Solar power attracting billions of dollars investments

Solar energy attracting investment

After years of waiting, the solar power market has just received exciting news: the prime minister has signed Decision No.11/2017/QD-TTg on the mechanism for encouraging the development of solar power projects in Vietnam.

Decision 11 is exciting news for domestic and foreign investors interested in the Vietnamese electricity market, especially since it requires Electricity of Vietnam (EVN) to purchase all electricity produced by grid-connected projects at 9.35 cent per kWh.

Many solar power investors were said to start spending billions of dollars on theỉ projects in Vietnam

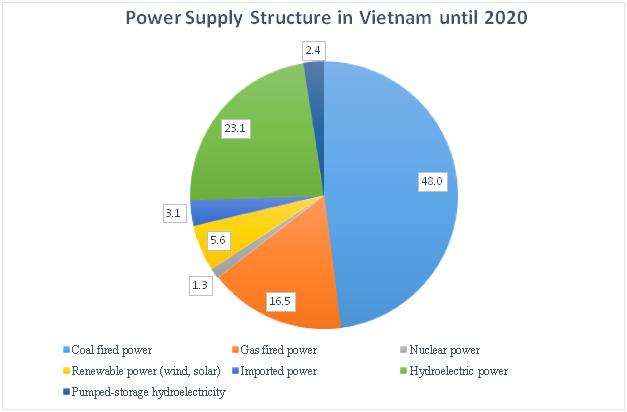

|

| Source: Institute of Energy Vietnam |

Thanh Thanh Cong Corporation (TTC) has just officially announced it would spend around $1 billion to build and operate 20 solar PV plants in Vietnam.

TTC also mentioned the decision at the corporation’s conference for customers in the energy sector in Ho Chi Minh City, in front of strategic partners, including the International Financial Corporation (IFC), Armstrong Asset Management (AAM), Sharp Corporation, and many large domestic banks. Among these, IFC and AAM own 15.95 and 20.05 per cent of Gia Lai Electricity JSC (GEC), and will continue to cooperate with TTC in future solar power projects.

Thai Van Chuyen, CEO of TTC, said that the corporation plans to deploy 20 solar power projects in Tay Ninh (324MW), Binh Thuan (300MW), Ninh Thuan (300MW), Thua Thien-Hue (30MW), and Gia Lai (49MW), among others, with a maximum production cost of VND20 billion ($880,000) per MW, IRR of more than 15 per cent, and payback period of less than 12 years. These projects will start construction in the fourth quarter of 2017. TTC will contribute 30 per cent of the capital, while the remainder will be mobilised from banks and financial institutions.

TTC has previously invested in solar power, but only at an experimental scale, such as rooftop PV systems over 1.2MW for offices, restaurants, and hotels belonging to member companies. Additionally, TTC has also implemented solar power in agriculture, with the Solar Pump for agricultural irrigation at Nuoc Trong Sugarcane Farm and the solar-powered irrigation system at Bien Hoa-Phan Giang Sugar JSC.

Besides TTC, there are over 30 domestic and foreign investors starting to develop solar power projects with capacity ranging from 20MW to 300MW, mostly located in the central region.

Thien Tan Investment and Construction JSC is currently developing two solar power plants in the central provinces of Quang Ngai and Ninh Thuan. DooSung Vina Company Ltd. (South Korea) also invested $66 million in a 30MW solar power plant in the central province of Binh Thuan.

A number of South Korean, French, and Indian investors have registered investments to construct solar power projects in Thua Thien-Hue, Ha Tinh, and Hau Giang provinces. Additionally, German and Thai investors are considering the possibility of investments in Quang Tri and Binh Dinh provinces.

EVN also proposed to the Ninh Thuan People’s Committee to invest in a 200-MW solar power project covering 400 hectares in the province, with an expected total investment sum of VND8 trillion ($351.9 million). According to the proposal, the project would start construction in 2018 and go into operation in 2019.

Recently, the committe has signed a memorandum of understanding with Sinenergy Holdings Ltd., a subsidiary of SHS Holdings Singapore, on the development of a 300-MW solar power plant in combination with hi-tech agriculture in the province Phuoc Huu on a designated area of 832 hectares. The project’s total investment is about VND7,920 billion ($348.4 million) and is expected to be finished in July 2019.

According to the Hau Giang Department of Investment and Planning, JinkoSolar is looking forward to developing a solar power plan in the province's Hoa Gian and Phuc Hiep. The project will focus on the production of commercial electricity with a designed capacity of 35MW, an area of 40 hectares, and a 50-year lease.

The project’s total investment is VND1,168 billion (approximately $52.5 million).

Emergence of M&A activities

According to Tran Vinh Du, deputy director in charge of M&A counselling at Ernst & Young Vietnam (EY Vietnam), there are many reasons for investors to take interest in the Vietnamese renewable energy sector.

Firstly, according to the reform roadmap of the Vietnamese electricity market, the market will no longer be a single buyer market (EVN) like at the present. The electricity sector will grow, and the price of electricity is expected to rise in accordance with the rule of supply and demand.

Secondly, regarding solar power, the government has issued Decision 11 requesting EVN to buy from solar power projects. For many years investors could not invest in these projects due to the fact that they would not be able to sell to EVN without government guidelines on electricity price. Since the decision was issued, EVN can sign contracts purchasing power from solar power plants, creating output for these projects.

Finally, there have been incredible advancements in solar production technology. The devices are growing more efficient, while production costs are going down. This make solar power go from a “vanity project” to a lucrative and sustainable investment opportunity. This is also the chance for M&A deals in the sector to emerge.

Du also shared that EY Vienam has been working with many investors in this field from North America, Asia, and Europe. Investors have many criteria when looking for M&A partner in this field, most importantly good radiation.

Projects must be placed at the area with the highest level of solar radiation. The northern region does not have this advantage, thus hardly receives investors’ attention. Most projects are located in the Central Highlands, or South Central and Southern Vietnam. Investors also require projects to be clean, with clear legality.

“Many of the projects we know are still just on paper at the preliminary stage, thus it is difficult to attract foreign investors,” said Du.

Additionally, foreign investors also wish to find reliable domestic partners. This is very important since foreign investors understand the crucial role of local partners in this field.

Du said that domestic companies with experience in the electricity sector, especially with projects already connected to the grid, are preferable compared to new companies in the field.

Du also added: “As with all investment projects, financial and legal review is always crucial. Therefore, investors prefer companies with the high level of transparency in financial records as well as management process.”

| Vietnam M&A Forum 2017, co-organised by Vietnam Investment Review and AVM Vietnam and sponsored by the Ministry of Planning and Investment, will take place in GEM Conference Centre in Ho Chi Minh City on August 10, 2017, with the topic “Seeking a big push.” This is the biggest annual event on M&A and investment connection, with over 500 participants, including policy makers, experts, and industry leaders. Aside from an in-depth conference on M&A in Vietnam with the topic “Seeking a big push,” the Gala Dinner and Ceremony to honour the M&A deals and advisory firms of 2016- 2017, the Forum will publish the Special Publication “Vietnam M&A Outlook 2017” and organise a Master Class on M&A strategy. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Partnerships drive sustainable finance (January 07, 2026 | 09:23)

- FDI inflows reach $38.42 billion in 2025 (January 06, 2026 | 17:55)

- $2.1 billion Nghi Son LNG-fired thermal power plant waits for investor (January 06, 2026 | 17:51)

- GE Vernova powers up Vietnam with first 9HA gas power plant in the country (January 06, 2026 | 16:54)

- Solid finish for manufacturing after volatile year (January 06, 2026 | 08:50)

- Meiko strengthens Vietnam operations with new PCB plants (January 06, 2026 | 08:49)

- Ho Chi Minh City backs $2 billion AI data centre with dedicated task force (January 06, 2026 | 08:43)

- PM sets January deadline for high-speed rail consultant (January 06, 2026 | 08:40)

- New decree spurs on PPP implementation (December 31, 2025 | 19:01)

- Global alliance develops $1 billion AI data centre network in Vietnam (December 30, 2025 | 10:08)

Mobile Version

Mobile Version