Consumer electronics retail losing its appeal

|

Consumer electronics retail going down

MWG made its name through the Thegioididong store chain, but now consumer electronics (which include smart phones, tablets, computers and other personal devices) retail has been relegated to the backseat in the company’s growth plan.

At the annual shareholders’ meeting on March 31, Nguyen Duc Tai, MWG’s chairman cum CEO, said that the main driver of growth in 2017 will be the company’s new passion, grocery retail, while consumer electronics will play a smaller part.

Bach Hoa Xanh, the grocery store chain that MWG founded in October 2015, is going to receive a lot of investment, Tai said. Moreover, the board of directors is considering acquiring other retailers, either in the same or in different fields, with a possibility of expanding to over the counter drug retailing.

In 2016, the MWG’s consolidated revenue rose from VND25.4 trillion ($1.11 billion) to VND45.6 trillion ($2 billion) or 80 per cent, while pre-tax profit rose from VND1.38 trillion ($60.8million) to VND2 trillion ($88.1 million), a much lower 58 per cent. Meanwhile, inventory almost doubled over the course of 2016 from VND5 trillion ($220 million) to VND9.5 trillion ($419 million). This represented decreasing margins from 5.4 to 4.4 per cent.

There are no separate figures for the Thegioididong chain. However, given that Bach hoa XANH contributed a negligible amount to revenue, while household appliance division Dien may XANH contributed 20-25 per cent of the revenue but had a margin of 12 per cent at the end of 2016, the margin of the consumer electronics retail operation could be even lower.

Number-wise, FPT’s distribution and retail division (represented by subsidiaries FPT Trading, which distributes consumer electronics, and FPT Retail, operator of the FPT Shop chain) is not in a better situation, with revenue down 9 per cent on-year to VND23 trillion ($1.01 billion) and pre-tax profit down 25 per cent to VND544 billion ($24 million).

One of the reasons of this poor performance is that starting from the fourth quarter of 2015, FPT Trading was no longer the sole company allowed to import iPhone devices. Apple now allows big retailers, such as FPT Shop and MWG, to share this market. Therefore, the revenue from distributing iPhone devices decreased by VND3 trillion ($132 million).

On the other hand, Microsoft stopped selling Lumia phones. FPT Trading then offered a big discount on these phones to get rid of them, sharply cutting profit. FPT Trading made VND300 billion ($13.2 million) a year in profit during 2013-2015, but in 2016 the number was only VND34 billion ($1.5 million).

The retail and distribution division dragged down the performance of the company as a whole, as all other divisions saw double-digit growth. FPT mentioned plans of selling this division in 2015, but the plan has yet to materialise. The board of directors said that there was interest from investors but the company “is still negotiating and thus cannot provide details.” Shareholders are worried if FPT has already missed the window of opportunity for negotiation because of the division’s decline.

Fighting headwinds

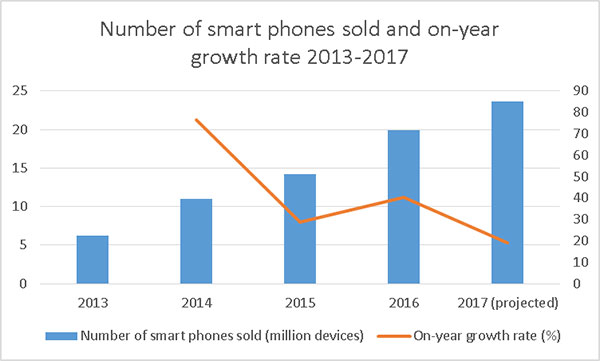

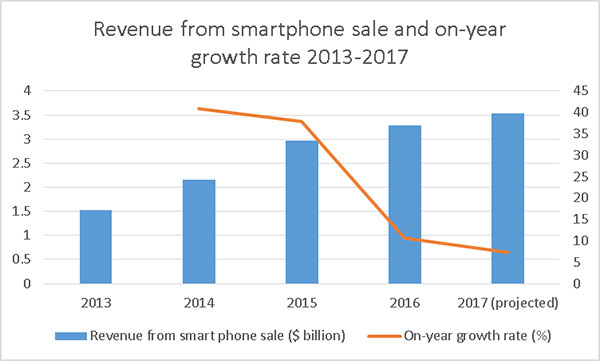

Local media quoted a report by market research firm GfK as saying that smartphone sales have slowed down.

|

|

| (Source: GfK) |

GfK expects the number of smart phones sold to increase by 19 per cent in 2017, to 23.6 million devices but revenue is going to increase only by 7 per cent to VND78.6 trillion ($3.46 billion). The average spending on smartphones is decreasing. It was VND5.5 million ($242) per device in 2013, but is expected to be only VND3.3 million this year.

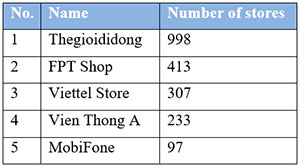

With each smartphone, retailers are bringing in less revenue, so in order to maintain revenue growth, they keep increasing the number of stores. As calculated by news site cafebiz.vn, revenue per Thegioididong store decreased by 30 per cent from VND45.8 billion ($2 million) in 2014 to VND32.5 billion ($1.43 million) in 2016.

In its report to shareholders at the recent meeting, MWG did not target to open a specific number of additional Thegioididong stores but only said that it would improve management and service quality.

In the second half of 2016, the store chain opened remarkably fewer new stores than before. Between March and July there were an average of 50 new Thegioididong stores each month, but afterwards the figure decreased to only 10.

At the end of last month, the first Thegioididong store in Cambodia opened with the trademark black and yellow colours, but under a different name: BigPhone. At the end of the second quarter, the company expects to have about 10-15 stores in the neighbouring country. This is part of the company’s expansion plan in Southeast Asia, which at the latest update included Cambodia, Laos, and Myanmar.

Major electronics retailers and coverage as of the end of March 2017 |

To improve customer experience when shopping at its stores, MWG plans to establish a subsidiary specialised in information technology in the second quarter of this year, to provide services and solutions for its three retail chains, such as enterprise resource planning (ERP), website management, and security. “Information technology will help the chains operate more effectively,” a representative told newswire ICTnews.

Besides selling groceries, MWG also plans to sell lottery tickets. Nguyen Duc Tai, chairman of Mobile World, said that the company has no detailed implementation plan yet. However, in the next few months, the trial run may take place in three or four stores. “We will work with authorised dealers instead of Vietlott. This plan is aimed to diversify the company’s products, as well as benefit customers,” Tai said.

Meanwhile, FPT Retail caught the market by surprise in October 2016 when it entered into cooperation with Vinamilk, the largest diary producer, to open a chain of stores to sell Vinamilk products. Both parties have started test runs in a few stores and they anticipate to expand the business upon seeing positive results.

According to FPT Retail’s leaders, this cooperation is aimed to diversify business lines. This is a new model based on FPT Retail's advantage in retail management as well as Vinamilk’s advantage in production and distribution. However, the main target is that FPT wants to find a potential and less risky investment besides its core business.

CEO of FPT Retail Nguyen Bach Diep said in a recent interview with ICTnews that all retail chains will eventually expand to multiple types of products, and FPT retail is not an exception. She said that while the number of FPT Shop stores will increase in the next two years, the company is considering some new paths in order to grow its revenue.

| RELATED CONTENTS: | |

| Transport, retail firms make unexpected business moves | |

| Thai investment fund buys MWG shares for $11m | |

| MWG 2017 growth prospects uncertain | |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Mobile Version

Mobile Version