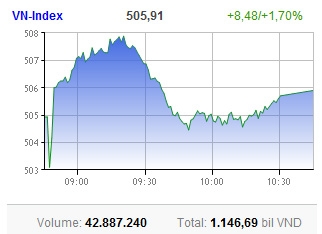

VN-Index over 500 points

The VN-Index at the Ho Chi Minh Stock Exchange (HoSE) soared to 505.91 points, up 8.48 points or 1.7 per cent, helped much by a series of blue-chips like Bao Viet Holding (BVH), Masan Group (MSN), Hoang Anh Gia Lai Group (HAG), PetroVietnam Fertilisers (DPM), PetroVietnam Finance (PVF). This was the first time in six months the index went over the 500 points level.

The VN-Index at the Ho Chi Minh Stock Exchange (HoSE) soared to 505.91 points, up 8.48 points or 1.7 per cent, helped much by a series of blue-chips like Bao Viet Holding (BVH), Masan Group (MSN), Hoang Anh Gia Lai Group (HAG), PetroVietnam Fertilisers (DPM), PetroVietnam Finance (PVF). This was the first time in six months the index went over the 500 points level.

Among these stocks, BVH and MSN hit the ceiling for the fourth and third straight sessions respectively, adding as much as 4.85 points in total to the benchmark. HAG, DPM and PVF followed contributing between 0.5 points to 1 point each.

Of the 8.48 points VN-Index gained, the 10 most-supportive stocks contributed 8.61 points. Almost all of those stocks were buoyed by interest from foreign investors.

Liquidity gained a little to 42.88 million shares worth VND1.15 trillion ($57.5 million) on the southern bourse, where 103 stocks gained compared with 111 falling and 80 remaining unchanged.

The not-as-high-yet liquidity along with the outrunning of the decliners seemingly made the analysts skeptical of the VN-Index’s achievement as they continue to believe that market sentiment is still low.

Sai Gon Securities Inc. (SSI), Sacombank (STB) and Vincom Corp. (VIC) were among the decliners. Meanwhile, most penny and mid-cap stocks had quite a lacklustre trading day.

The Hanoi exchange continued its weak performance with the HNX-Index falling again to 107.27 points, down 0.19 points or 0.18 per cent.

Overall, 174 stocks were down, compared with 95 going up and 104 remaining unchanged. Liquidity slumped to 22.9 million shares worth VND434 billion ($21.7 million), down more than 20 per cent.

Foreign investors suddenly boosted their trade today, focusing on blue-chips like HAG, DPM, KBC, PVD and VPL. They bought up to VND255 billion ($12.75 million) worth of shares on HoSE while selling VND123.8 billion ($6.19 million), accounting for net buying of 4 million shares worth VND131.4 billion ($6.75 million).

Also, foreign investors were net buyers on HNX with some VND9 billion ($450,000) of net buying value today.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version