VBSP: a helping hand to employees in COVID-19 times

|

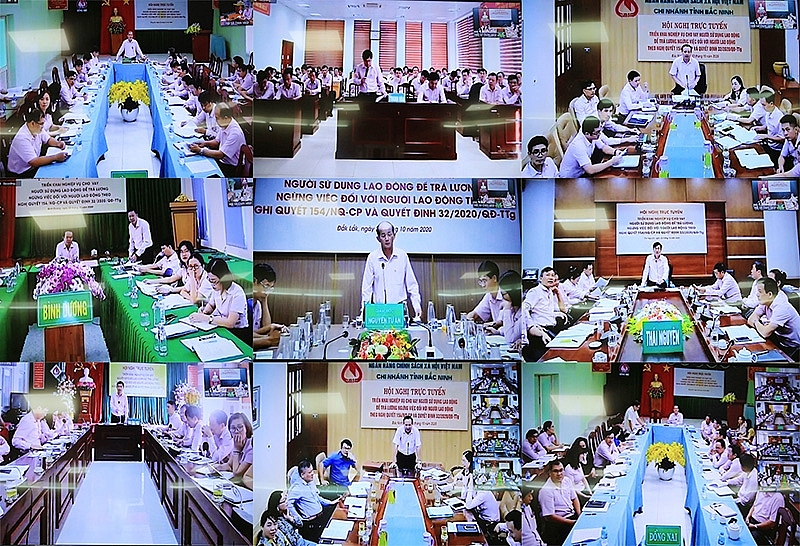

| VBSP's recent online conference on the deployment of payments for work suspension |

This year, to timely resolve difficulties for people hit by the coronavirus pandemic, the government and the prime minister have enacted Resolution No.42/NQ-CP dated April 9, 2020 and Decision No.15/2020/QD-TTg dated April 24, 2020 presenting measures and policies to support people and businesses in COVID-19 times.

In light of these documents, the Vietnam Bank for Social Policies (VBSP) was tasked with lending to businesses facing financial difficulties to make work suspension payments to their employees.

Based on implementation practice, the government continued enacting Resolution No.154/NQ-CP dated October 19, 2020 amending and supplementing Resolution 42, and Decision No.32/2020/QD-TTg dated October 19, 2020 amending and supplementing Decision 15 to remove further difficulties for people and businesses.

|

| Participants joining and exchanging remarks at VBSP’s online meeting in different locations |

To ensure the effective enforcement of these legal documents, VBSP has presented professional guidance helping business leaders carry out suspension payments for their employees during the pandemic.

At the online conference, Deputy Minister of Labour, Invalids and Social Affairs Le Van Thanh lauded VBSP for quickly bringing the government and the prime minister’s respective resolutions and decisions into life.

| To ensure the effective enforcement of these legal documents, VBSP has presented professional guidance helping business leaders carry out suspension payments for their employees during the pandemic. |

To bolster the efficiency of these supporting policies, Thanh asked the VBSP to keep communicating about the state support policies to management agencies from the central to local levels, keeping them and businesses well-informed about these support measures. Simultaneously, Thanh asked the Vietnam Fatherland Front Central Committee, the Vietnam General Confederation of Labour, and diverse social and political organisations to effectively handle communication and supervisory activities to ensure that the right people benefit from the policies, avoiding negative phenomena and ensuring publicity and transparency during implementation.

Following the spirit of “lending to the right people with the utmost efficiency”, general director Duong Quyet Thang required the bank’s branch offices in different localities in the country to host training courses about this kind of lending to ensure its timely and effective implementation, making this task a top priority in the upcoming months.

VBSP’s top leader proposed local management agencies to continue paying attention to policy credit activities and lending to employers suspending payments to ensure the effectiveness of state policies, thus pushing back the pandemic threat while pushing up local socioeconomic development.

| Lending conditions Business leaders (hereafter called the customers) will be eligible for taking up this kind of loan if they meet the following requirements: 1. Employing labourers who have taken part in social insurance payments but were forced to stop working for at least one month between April 1 and December 31, 2020; 2. Having their revenue drop by at least 20 per cent in the first quarter of 2020 or in the quarter prior to the lending approval compared to the corresponding period in 2019; 3. Not having bad debts at credit institutions and foreign bank branches as of December 31, 2019. Lending objective: The customers will use the loan to fund work suspension payments for their labourers due to the impact of COVID-19. Lending volume, interest rate, and duration 1. Lending volume is maximally one month per customer equalling 50 per cent of the regional minimum wage times the number of labourers facing work suspension. Each customer can take up a loan for at most three months during the period of April 1-December 31, 2020; 2. Lending interest rate: zero per cent per year. Overdue debt interest rate: 12 per cent per annum; 3. Lending duration: Negotiable but not exceeding 12 months since the date of disbursing the first loan; 4. The customers do not need to present collateral; 5. VBSP and its branch offices directly provide the loans to customers. Loan approval and disbursement 1. No later than the fifth day every month, customers need to submit their lending record to VBSP or its member units. In the next five working days, VBSP or member units must evaluate the lending records and inform customers of the results. In case the document is rejected, VBSP or member units need to inform the customers as to the reason. 2. Disbursement a. Based on contract, VBSP or member units disburse loans to customers through account transfer; b. If the customers require loans to fund suspension payments for their employees for the months from April to October 2020 in one time, VBSP or member units will use the customers’ lending records as a basis to approve the applications, sign credit contracts, and carry out capital disbursement one time only; 3. VBSP and member units shall carry out capital disbursement until January 31, 2021. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Vietnam Television launches third 'Song Sau Lu' project for 2025 (December 15, 2025 | 08:00)

- Closing workshop highlights five-year impact of Fair for All project (December 12, 2025 | 16:22)

- Stakeholders mobilised before new child safety rules take effect (December 10, 2025 | 09:00)

- Vietnam receives emergency international relief as regional flooding intensifies (December 04, 2025 | 15:11)

- AmCham scholarships awarded to students (December 02, 2025 | 16:46)

- Vietjet flights carry love to devastated central region (November 28, 2025 | 11:35)

- SCG Sharing the Dream supports Vietnam’s youth and sustainable development goals (November 28, 2025 | 10:55)

- Siemens Caring Hands donates $34,700 for disaster relief in Vietnam (November 26, 2025 | 20:25)

- Ireland extends support for the Resilience First initiative (November 26, 2025 | 15:24)

- South Korea funds IOM relief for Vietnam’s typhoon-affected communities (November 24, 2025 | 15:33)

Mobile Version

Mobile Version