Usual suspect drags market down

Inflation come back to frighten investors, while European debt woes weighed on global market, strongly discouraged investors’ sentiment.

Inflation come back to frighten investors, while European debt woes weighed on global market, strongly discouraged investors’ sentiment.

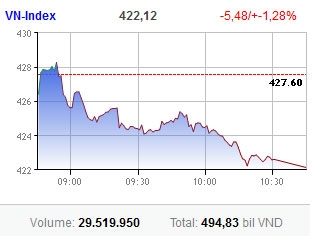

The Ho Chi Minh Stock Exchange’s (HoSE) VN-Index sharply shed 5.48 points or 1.28 per cent to 422.12 points. The main bourse sunk into the red with 184 stocks off, compared with just 48 up and 68 unchanged. Among the, up to 76 stocks hit the floor.

The Hanoi Stock Exchange (HNX) also lost 0.96 points or 1.35 per cent to 70.38 points. Decliners amounted to 211 stocks, overwhelming 59 up and 122 flat.

Cash continued withdrawing from the stock market despite a fall in gold prices. Trading value reduced nearly 40 per cent to VND495 billion ($24.1 million) on the main bourse. The figure was also low at VND363.5 billion ($17.7 million) on the HNX.

On the HoSE, investors strongly sold out mid-cap and small-cap stocks. Among them, Becamex Infrastructure Development (IJC) and PetroVietnam-Idico Long Son Industrial Park Investment (PXL) saw more than one million offering orders outstanding at the session’s end.

PetroVietnam-family shares Petro Capital Infrastructure Investment (PTL), PetroVietnam Transportation Corporation (PVT), Petroleum Industrial and Civil Construction (PXI), Mientrung Petroleum Construction (PXM) also had no bidding orders remaining at the session’s end.

On the HNX, Petro Vietnam Power Land (PVL) was also among the stocks being sold the most.

Blue-chips continued shedding on the HoSE, with Bao Viet Holdings (BVH), Masan Group (MSN) and Vincom Corp. (VIC) off VND2,000-VND3,000 each.

In contrast, Sacombank (STB) gained 1.4 per cent to VND14,500. The banking stock also outperformed the market with 1.4 million units matched.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version