Stock market wobbles

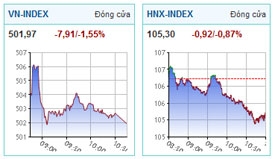

At the close, VN-Index had fallen to 9.62 points, or 1.85 per cent, to 509.88 points.

At the close, VN-Index had fallen to 9.62 points, or 1.85 per cent, to 509.88 points.

This surprising move came amid concern that both stocks would cause a market distortion. The benchmark of Ho Chi Minh Stock Exchange (HoSE) would hit a plateau or fall down without the support of BVH and MSN, said Vietnam International Securities.

This would significantly damage local investors’ confidence, “The fact that the VN-Index depends on foreign investors’ trading, as some major stocks like BVH, MSN and VIC are continuously driven up by exchange-traded funds (ETFs), make investors hesitant in jumping in the market,” said Saigon – Hanoi Securities.

The number of stocks hitting the floor suddenly was 28 on HoSE, among them DVD, CMT, TCM, VHG, CAD and DQC besides BVH and MSN.

Liquidity also fell more than 18 per cent to VND1.03 trillion ($51.5 million), with volume reaching 38.33 million shares on the southern bourse.

Major stocks largely fell: Hoang Anh Gia Lai (HAG) shed 1.82 per cent, PetroVietnam Fertilisers (DPM) fell 1.37 per cent and FPT Corp. (FPT) dropped 1.82 per cent.

Finance stocks also dipped. Vietinbank (CTG) fell 1.74 per cent, Eximbank (EIB), 1.31 per cent, Saigon Securities (SSI), 2.7 per cent while PetroVietnam Finance (PVF) nearly hit the floor. Overall, 42 stocks added (six hit ceiling), while 194 falling and 48 unchanged on HoSE.

On the Hanoi exchange, the benchmark HNX-Index lost 1.65 points or 1.53 per cent to close at 106.22 points. Liquidity remained unchanged with 26.6 million shares worth VND483.85 billion ($24.2 million) changing hands.

Up to 220 stock finished lower, 28 unchanged and 48 had no transaction while just 77 up.

Habubank (HBB) and Kim Long Securities (KLS) were among the decliners while Asia Commercial Bank (ACB) ended flat.

Foreign investors boosted major stocks today after focusing on BVH and MSN for long periods. On the HoSE they bought 3.66 million shares of 95 stocks, of which VCB, DPM and ITA were most commonly purchased.

On the HNX they bought 421,900 units while selling 274,800. VNC and PVX were the most popular stocks while BVS, VND and PVS led the most selling ones.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version