Stock Market maintains bright form

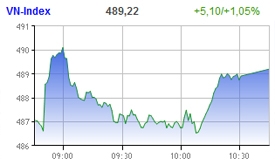

The VN-Index at the Ho Chi Minh Stock Exchange (HoSE) gained 5.1 points, or 1.05 per cent, to reach 489.22 points.

The VN-Index at the Ho Chi Minh Stock Exchange (HoSE) gained 5.1 points, or 1.05 per cent, to reach 489.22 points.

Advancers continued to outrun the decliners on HoSE, where 159 stocks rose, 54 fell and 71 remained unchanged.

Liquidity rose approximately 43 per cent to 41.5 million shares worth VND1.06 trillion ($50 million) on the southern bourse.

Liquidity rose despite the cautious mood as analysts awaited a fresh index rebound. “There would hardly be a rising-wave until liquidity increased from its current low level,” FPT Securities said in a note to clients.

This skeptical view is also down to the fact that orders were largely focused on major stocks and not penny ones. Analysts, therefore, considered HNX-Index as reflecting the market more accurately than VN-Index did.

Bao Viet Holding (BVH), the stock that is strongly driving the market up, advanced again to VND82,000, contributing 2.26 points to VN-Index.

The insurance stock has risen for nine consecutive sessions and as much as 95 per cent of its trading volume action today came from foreigners.

However, other blue-chips including Vincom Corp. (VIC), Vinpearl JSC (VPL), Masan Group (MSN) and PetroVietnam Fertilisers (DPM) all dipped.

On the Hanoi Exchange, the HNX-Index modestly rose 0.63 points, or 0.59 per cent, to reach 108.5 points. Liquidity remained low at VND464.73 billion ($23.24 million), up 20.78 per cent, while volume was 25.9 million shares, up 22.75 per cent.

Overall, 131 stocks went up, 119 fell and 126 finished unchanged.

Major stocks led the gainers on HNX like on the HoSE, however, banking stocks were mostly unchanged except Habubank (HBB).

Foreigners strongly contributed to market gains today when purchasing more than 7 million shares, worth VND223 billion ($11.15 million), on the northern bourse, taking it to the highest level since December 21, 2010.

The selling volume stood at 2.62 million shares, worth VND86.91 billion ($4.35 million), accounting for net purchase of 4.5 million units or VND136.15 billlion ($6.8 million), up VND57.6 billion ($2.88 million).

The most popular major stocks were PVD, SJS, PPC, KBC, ITA and VCB.

On HNX they continued to be net buyers. Net buying reached more than VND12.2 billion ($6.1 million) with purchases focusing on PVX, PVS, KLS, HBS and VCG.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version