Stock market eases off

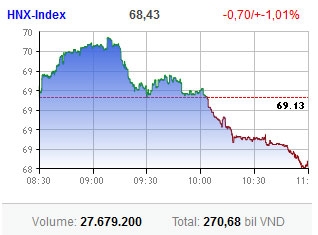

The Hanoi Stock Exchange (HNX)’s HNX-Index meanwhile lost 0.7 points or 1.01 per cent to 68.43 points, although the benchmark had gained throughout half of the session.

The Hanoi Stock Exchange (HNX)’s HNX-Index meanwhile lost 0.7 points or 1.01 per cent to 68.43 points, although the benchmark had gained throughout half of the session.

Liquidity sunk on both bourses. Total volume stood at 21.5 million shares worth VND346.81 billion ($16.9 million) on HoSE, while sunk to 27.7 million shares worth VND271 billion ($13.2 million) on HNX.

At the end of last week, the market temporarily jumped on easing inflation with the consumer price index at its lowest level for more than a year. Investors, however, remained concerned with ongoing volatile macroeconomics.

“Just a few positive sessions with weak liquidity is not a strong foundation to conclude that the market downtrend will turn around,” said Saigon-Hanoi Securities.

Demand for shares continued focused on a number of major stocks and driving stocks. Blue-chip Masan Group (MSN) hit the ceiling strongly raising HoSE. Bao Viet Holdings (BVH) and Eximbank (EIB) significantly gained.

Several speculative stocks, particularly the ones in real-estate shares, strongly outperformed the market. Binh Duong Trade and Development (TDC) added 3.3 per cent, Becamex Infrastructure Development (IJC) 4.08 per cent and Petrovietnam - Idico Long Son Industrial Park Investment (PXL) up 3.7 per cent with nearly one million units matched each.

Meanwhile, Hoang Quan Consulting – Trading – Service Real Estate Corp (HQC) was active the most on HoSE with 1.3 million shares matched. Decliners outran advancers 117 to 90 on the southern bourse. Some 94 stocks ended flat.

Driving stocks like Kim Long Securities (KLS), VnDirect Securities (VND), PetroVietnam Construction (PVX), Wall Street Securities (WSS), Vietnam Construction and Import - Export (VCG) also top the active stocks on HNX. However, those stocks mostly ended lower or flat.

Decliners and advancers ran nearly even 121 to 115.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version