Same old story for market

Domestic gold strongly dropped in line with global price movements. The metal lost VND1 million ($48,780) per tael this morning and narrowed the gap with global prices.

Domestic gold strongly dropped in line with global price movements. The metal lost VND1 million ($48,780) per tael this morning and narrowed the gap with global prices.

At the same time, Ministry of Finance proposed the government further tighten the local economy to rein in inflation, raising investors’ concerns about a possible falling stock market.

“The market trend is unclear at the moment and there remain quite a few risks. The market can only rise with firmer support, particularly a more positive macroeconomics news,” said Vietcombank Securities.

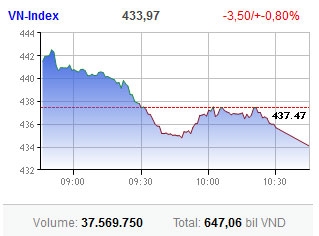

The VN-Index of Ho Chi Minh Stock Exchange (HoSE) shed 3.5 points or 0.8 per cent to 433.97 points, after rising nearly six points during the session.

Investors continued focusing on small-cap and mid-cap stocks, which usually saw strong fluctuations. Among them, Lao Cai Mineral Exploitation & Processing (LCM) hit the ceiling for the eighth straight session, while Binh Duong Trade and Development (TDC) hit ceiling for the sixth straight session.

Hoang Quan Consulting-Trading-Service Real Estate Corp (HQC) outperformed the market with 2 million shares traded, hitting ceiling as well.

Lower-than-par-value stocks Urban Development and Construction Corp. (UDC), Vietnam Electricity Construction (VNE) and PetroVietnam Transportation Corp. (PVT) were also among top rallying stocks today.

Whereas, blue-chips kept lackluster with Bao Viet Holdings (BVH), Masan Group (MSN) and Vincom Corp. (VIC) all fell. Several major stocks like Hoang Anh Gia Lai (HAG), Ocean Group (OGC), PetroVietnam Fertilisers were off.

Vietcombank (VCB) hit the ceiling after the lender got approval to sell a 15 per cent stake to Japanese partner Mizuho. Other banking shares like Sacombank (STB), Asia Commercial Bank (ACB) and Eximbank (EIB) slightly rose.

Some 143 stocks advanced on the southern bourse, compared with 82 off and 75 unchanged. Liquidity kept low at 37.6 million shares worth VND647 billion ($31.6 million), with put-through volume making up VND135 billion ($6.6 million).

In contrast to HoSE’s movements, the Hanoi Stock Exchange (HNX) added 0.24 points or 0.33 per cent to 73.58 points. Advancers outran decliners 142 to 116 on the bourse, with cheap stocks like IDJ International Financial Investment and Enterprise Development (IDJ), Petro Vietnam Power Land (PVL) largely rallying.

Total volume sharply reduced to 35.8 million shares worth VND386 billion ($18.8 million).

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version