R&D comes to forefront for local pharma sector

|

According to Vietnam Report’s December 2017 survey of local pharmaceutical firms, 83 per cent of those surveyed ranked the research of new drugs as their predominant strategy in 2018.

“The trend will enable pharma firms to venture further into the profitable segment of ethical – or prescription – drugs, which is currently dominated by multinational corporations, to cash in on the favourable conditions created in the Law on Pharmacy 2016,” an analyst at BIDV Securities told VIR.

Recent moves by top Vietnamese drugmakers Hau Giang Pharmaceutical JSC (DHG), Traphaco, and Domesco have seemingly confirmed the trend.

“Research and development (R&D) is the decisive factor for the future growth of our company. We spend about 5 per cent of our annual revenue on R&D activities. In 2017, we started to focus on a new product – an eyedrop made at our new factory inaugurated in November 2017,” said Vu Thi Thuan, chairwoman of Traphaco. “We plan to produce functional foods such as digestive ferments for children, and upgrade some production assemblies to EU-GMP/PIC/S-GMP standards in 2018.”

With the new factory, Traphaco aims to become the number one drug producer in Vietnam by 2020, with market capitalisation of VND10 trillion ($454.5 million), revenue of VND4 trillion ($181.8 million), and a distribution network of 40 branches nationwide by 2020.

Traphaco’s major foreign shareholders are Vietnam Azalea Fund Ltd. under Mekong Capital with a 25 per cent stake, Vietnam Holding Ltd. (10.43 per cent), and Citigroup Global Markets Ltd. (4.75 per cent).

Vietnam’s third-biggest listed drugmaker Domesco and the country’s biggest publicly-traded drugmaker DHG have also already taken action. Abbott Laboratories is Domesco’s biggest foreign shareholder with a 51.7 per cent stake, Taisho Pharmaceutical Holdings (24.5 per cent) and FTIF Templeton Frontier Markets Fund (12.95 per cent).

Domesco launched a costly new drug factory in the southern province of Dong Thap in 2016. The new plant, the third of its kind developed by Domesco, meets European standards and is focused on research and production of medicines for cancer treatment.

Similarly, DHG has big future plans for production. It will develop a biological product segment, focusing on types made from herbs and supplements. It will also expand distribution of products to multinational corporations, while co-operating with them in the production stages.

DHG hopes to maintain an average growth of 15 per cent in its net revenue annually, to $300 million by 2020. In this way it aims to become Vietnam’s biggest generic drugmaker – its projections target 10 per cent of market share in locally-made drugs.

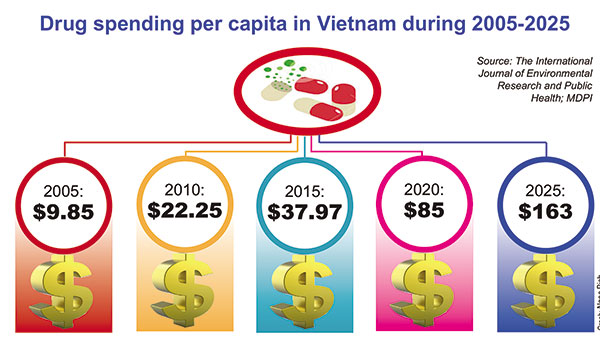

Vietnam’s pharmaceutical market is on track to grow on a steep curve. The 2017 turnover of the domestic market was estimated at $5.2 billion, according to data from Business Monitor International, up approximately 10 per cent on-year. The industry is expected to continue its double-digit growth over the next five years. Pharmaceutical enterprises in Vietnam are placing great hope on potential business growth this year, with nearly 75 per cent of businesses anticipating industry growth of 10 per cent.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Mobile Version

Mobile Version