PM’s comforting words fail to convince market

The VN-Index slightly fell by 0.04 points or 0.01 per cent to 383.31 points.

The VN-Index slightly fell by 0.04 points or 0.01 per cent to 383.31 points.

Last week, Prime Minister Nguyen Tan Dung told the National Assembly on Friday that the government would have measures to recover the securities market, while the central bank declared that interest rates would be pushed down.

Despite the good news, investors still dumped stocks. Several blue-chips ended lower, among them Bao Viet Holdings (BVH), Vinamilk (VNM) and Masan Group (MSN) all shed VND1,000.

Vietcombank (VCB) and Vietinbank (CTG) both slightly fell, while Sacombank (STB) significantly off 2.5 per cent to VND14,300. Eximbank (EIB) sharply dropped. Besides, FPT Corp. (FPT) and PetroVietnam Drilling and Well Services (PVD) ended lower.

In contrast, penny stocks strongly rallied. A mass of micro-cap stocks hit the ceiling with large trading volumes, among them Viky Plastic (VKP), Dream House Investment Corp (DRH), Cadovimex Seafood Import-Export And Processing (CAD), Bentre Aquaproduct Import and Export (ABT).

Speculative stocks PetroVietnam-Idico Long Son Industrial Park Investment (PXL) and Hoang Quan Consulting-Trading-Service Real Estate Corp (HQC) even saw nearly 600,000 units matched each. Both the real estate stocks hit the ceiling.

Also, Saigon Securities Inc. (SSI), Military Bank (MBB) and real estate stocks Tan Tao Investment Industry Corp. (ITA), Ocean Group (OGC), Hoang Anh Gia Lai (HAG) saw significant gains.

At the close, 158 stocks advanced on the southern bourse with 54 hitting the ceiling. Some 75 stocks were off, while 42 wee unchanged.

Liquidity slightly improved to 32.6 million shares worth VND437.7 billion ($21.1 million), in which put-through volume was 8.7 million shares worth VND122.6 billion ($5.9 million). Trading volumes of ITA, SSI and MBB all jumped to more than one million shares.

In contrast with the HoSE’s decline, the Hanoi Stock Exchange (HNX) saw strong rallies of speculative stocks Kim Long Securities (KLS), VNDirect Securities (VND), Wall Street Securities (WSS), Vietnam Construction and Import-Export (VCG) and Hanoi Investment General Corp. (SHN). Those stocks massively hit the ceiling with millions shares matched each.

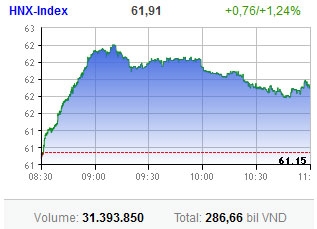

Overall, the HNX-Index gained 0.76 points or 1.24 per cent to 61.91 points. Liquidity also jumped from a low level to 31.4 million shares worth VND286.7 billion ($13.9 million).

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version