Only skin deep? Japan seeks deeper improvements

Engineer Nguyen Minh Son has his eyes glued to a computer screen. He is in the final stages of a new invention that will help save lives. It is a respiratory monitor used in surgery. His product may outperform some of its leading competitors in the market today.

“This monitor may become part of our Vietnamese production line,” said Son, who is working at Metran Company Limited – Japan’s top healthcare machinery and equipment firm.

Tran Ngoc Phuc, an overseas Vietnamese and president of 30-year-old Metran, said the company held the patents on 20 inventions, many of which they planned to manufacture in Vietnam in the near future.

Phuc has plans to “make a major investment” to expand Metran’s production line in Vietnam. $3 million is already slated for a factory in Binh Duong’s My Phuoc urban area. The factory is projected to open in 2014 and, besides domestic distribution, will also export to ASEAN markets, Europe, and the US.

The company currently has two production centres in Ho Chi Minh City, one making software used in producing medical equipment and the other making healthcare machines. The products are sold locally and exported to Japan.

“Compared to other ASEAN markets, Vietnam’s quality of labour for the cost is very competitive. I have also been approached by several Vietnamese partners,” Phuc said.

Hirota Nakanishi, assistant director of the ASEAN-Japan Centre’s Trade and Investment Division, said that many Japanese enterprises are looking to Vietnam as a potential manufacturing base.

“Vietnam offers the possibility of much greater growth, something much more difficult to achieve in Japan. Recently, Japanese companies have started entering the banking, insurance, and consumer goods sectors,” he explained.

Daisuke Hiratsuka, executive vice president of the Japan External Trade Organisation’s (JETRO), reported that between April 2012 and March this year, 6,800 Japanese enterprises inquired with the office in Hanoi about investing in Vietnam and another 5,700 in Ho Chi Minh City.

JETRO’s website shows that access to Vietnam tab has totaled 36,000 page views, ranked third after China and Thailand.

“Japanese investors are showing great interest in Vietnam, particularly those making automobiles, machines, and electronics. They are beginning to shift their production from China and Thailand to Vietnam,” Hiratsuka said.

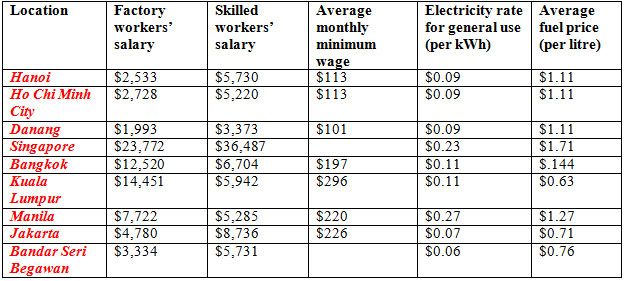

According to a recently released JETRO survey on investment cost in major cities around ASEAN, Vietnam is highly competitive.

Hiroshi Aimoto, director of the Japanese Ministry of Economy, Trade and Industry’s Trade Policy Bureau, shared the opinion that Japanese companies were strongly considering making Vietnam their manufacturing hub. “Investment costs in neighbouring nations are surging.”

According to JETRO, after China joined the World Trade Organization (WTO) in 2001, workers’ wages in the manufacturing sector have gone up nearly 200 per cent in US dollar terms whereas in Vietnam they only rose 9.7 per cent between 2006 and 2011.

The Richest, a Canadian website tracking the world’s wealthiest people, recently announced a top ten list of nations with the cheapest labour costs. Vietnam was fifth.

According to the list, Vietnam’s hourly labour cost is currently $0.39, which remains lower than that in Egypt ($0.80), Sri Lanka ($0.62), Senegal ($0.52), Kenya ($0.50) and India ($0.48).

The website calculated Vietnam’s hourly labour cost at $0.39, lower than Egypt ($0.80), Sri Lanka ($0.62), and Senegal ($0.52), as well as Kenya and India.

At the recent Vietnam-Japan Economic Summit in Hanoi, Minister of Planning and Investment (MPI) Bui Quang Vinh said Vietnam was well positioned to host Japanese enterprises looking to it as a production base.

“In the near future, Japan’s support for Vietnam in terms of building up supporting industries and the two countries’ ongoing joint initiative will lay a strong foundation for Japanese companies seeking a manufacturing hub,” he said.

As of July, Japanese investment capital in Vietnam totalled $32.8 billion, with more than 2,000 ongoing projects.

Being a good host

Although Vietnam has many competitive qualities, there are still difficulties with entering the country. The Vietnam Chamber of Commerce and Industry and the Japan Business Association in Vietnam (JBAV) recently agreed to develop a dialogue mechanism that supports improving the investment environment and remove obstacles faced by Japanese investments.

“The dialogues will be organised quarterly and cover topics such as infrastructure, human resources, supporting industries, tax, and so on. Comments, ideas, and opinions from the discussions will be submitted to the government and ministries, which can use them to eliminate challenges,” said MPI’s Vinh.

Vinh vowed to improve the investment environment for Japanese enterprises.

“We need their opinions, we want to solve their problems. We understand that is the only way to access their investment,” Vinh stressed. “Investor are like shoppers, if we don’t have good products and services, they will go to a different shop.”

His commitment followed Japanese enterprises and organisations’ demands for support in tackling major obstructions they currently faced in Vietnam.

Aimoto, from Japan’s Trade Policy Bureau, said infrastructure such as power, roads, logistics, and communications were insufficient and many enterprises lamented the fact that business and investment procedures continued to be bureaucratically inefficient. Also that supporting industries were damaging Japanese companies’ performance.

Eriko Tayama, head of the Japan Business Division at Singaporean investment consultancy Ascendas Vietnam, said one of the company’s Japanese customers had spent a great deal of time exploring Vietnam’s investment environment.

“They decided to invest in the Philippines instead as Vietnam did not fulfill its labour, land tax, and component supply requirements,” she explained.

Echoing this view, Japanese Ambassador to Vietnam Yasuaki Tanizaki underscored that Vietnam’s investment climate was not satisfying Japanese investors.

“One of the biggest concerns is the slow restructuring process of Vietnam’s state-run enterprises. We are also worried about slow institutional reform, which is preventing larger investments into the country,” he said.

Aimoto proposed that to solve these issues, Japan and Vietnam needed to boost implementation of the two countries’ joint initiative, now in its fifth phase, and develop an action plan on industrialisation that incorporates Vietnam-Japan Cooperation 2020/2030.

The initiative’s fifth phase, launched in July and moving through 2014, includes 13 issue groups that include law and policy, human resources, intellectual property, banking, infrastructure, and macro-economic stability.

“All these sectors need improvements,” Vinh said.

Kenji Itatani, executive director of Tokyo-based Sonkenzai Centre, which often works with Japanese agencies and delegations going to Vietnam, advised that the government establish a hotline or committed email for Japanese investors to seek advice and support when they run into difficulties doing business in Vietnam.

“And Vietnam needs to actively invite Japanese investors, rather than just issuing policies and hoping that they come,” he added.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Mobile Version

Mobile Version