Markets finish week with a bang

Some 225 stocks hit the ceiling on the two bourses, 10-times greater than the usual amount of each session during a few past weeks.

Some 225 stocks hit the ceiling on the two bourses, 10-times greater than the usual amount of each session during a few past weeks.

Advancers overwhelmed the decliners. Some 209 stocks rose on Ho Chi Minh Stock Exchange (HoSE), 265 gained on Hanoi Stock Exchange (HNX), compared with 39 and 71 off respectively.

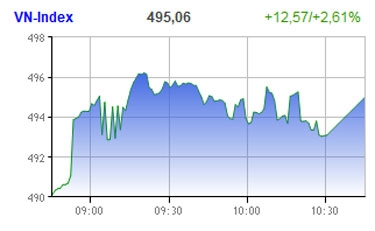

Helped by the rising trend on large-scale, The HoSE furthered its rising momentum after surprising investors with a sudden bound back yesterday. The benchmark VN-Index jumped 12.57 points (2.61 per cent) to 495.06 points.

Vincom Corp. (VIC), Bao Viet Holding (BVH) and PetroVietnam Finance (PVF) all hit the ceiling.

Hoang Anh Gia Lai Group (HAG) strongly rose, while Vietinbank (VCB), Eximbank (EIB) and Sacombank (STB) adding up a modest gain.

Of the drop, Vietcombank (VCB) and FPT Corp. (FPT) slightly gave back.

Investors continued cashing in on speculation of a short raising trend, maintaining the liquidity almost unchanged on the southern bourse at VND914.16 billion ($44.16 million).

Foreigners' buying volumes hit five million units while the selling volume was 5.7 million. Vietinbank (CTG) topped their favourite stocks, which saw the five consecutive net buying sessions with large trade volume.

On the northern bourse, HNX-Index added 2.54 points, or 2.75 per cent, to close at 94.85 points. Liquidity hit VND456.34 billion ($22 million).

Kim Long Securities (KLS) hit the ceiling again to close at VND10,400, while the stock still being in the centre of investors’ concerns as Kim Long is withdrawing from securities sector.

Moreover, brokerage sectors advanced the most today with almost all securities companies shares hit ceiling, despite the growing expectation about a difficult year for brokerage firms.

Banking shares saw just a slight gain.

However, both analysts and investors still keep a skeptical and cautious confidence.

“The recovery won’t last for long as the cash flow was restrained still and March’s inflation is expected at high level,” said Nguyen Viet Quang, analyst for VnDirect Securities.

Foreigners were cautious also as they net sold VND4.2 billion ($203,000) on the HNX and their net buying just VND3.8 billion ($184,000) on the HoSE.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version