Liquidity levels splutter as week gets off to a poor start

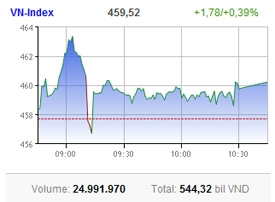

Trade values on the Ho Chi Minh Stock Exchange (HoSE) stood at VND544.32 billion ($26.3 million) – the lowest level within recent three weeks. Volume hit nearly 25 million shares.

Trade values on the Ho Chi Minh Stock Exchange (HoSE) stood at VND544.32 billion ($26.3 million) – the lowest level within recent three weeks. Volume hit nearly 25 million shares.

Foreigners’ buying volumes on the main bourse stood at as low as 1.58 million shares.

On the Hanoi Stock Exchange (HNX), as little as 28.2 million shares worth VND411.82 billion ($19.9 million) changed hands, down 25 per cent against the previous session.

“The majority of investors now have a negative sentiment about the market,” Vietnam International Securities said, considering the low sentiment as generating from the government’s tightening monetary policies and high interest rates.

Saigon-Hanoi Securities said “investors are waiting for Q1’s business reports and April’s inflation result in order to assess more exactly the impacts caused by government’s macroeconomic policies.”

The two benchmarks still slightly rose today. HoSE’s VN-Index added 1.78 points, or 0.39 per cent, to 459.52 points, helped much by the large-cap stocks.

Bao Viet Holding (BVH) was among the top gainers which advanced 3.55 per cent. Vincom Corp. (VIC) ended 1.67 per cent higher, while Vietinbank (CTG) climbed 3.16 per cent.

Hoang Anh Gia Lai (HAG) and Hoa Phat Group (HPG) also slightly rose.

Financial shares almost unchanged, among them Saigon Securities Inc. (SSI), Sacombank (STB), Vietcombank (VCB) and Eximbank (EIB).

At the close, 109 stocks fell down on the southern bourse while 90 up and 83 ended flat.

The HNX-Index climbed 0.25 points higher (0.27 per cent) to end at 93.07 points. Some 113 stocks were up, 152 giving back and 114 unchanging on the northern bourse.

Kim Long Securities (KLS), VnDirect Securities (VND), PetroVietnam Construction (PVX) and Vinaconex (VCG) led the gainers helping the market rise.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version