Investors still taking cautious approach

In this session’s beginning, consumer price index (CPI) growth of March was posted at 2.17 per cent, not higher than the previous expectations. However, the CPI still weighed on investors’ minds, added up by gold and oil prices climbing.

In this session’s beginning, consumer price index (CPI) growth of March was posted at 2.17 per cent, not higher than the previous expectations. However, the CPI still weighed on investors’ minds, added up by gold and oil prices climbing.

“The rising trend [of the market] was strongly restrained by a big selling pressure, as investors tended to make short-term deals,” said Sacombank Securities (SBS).

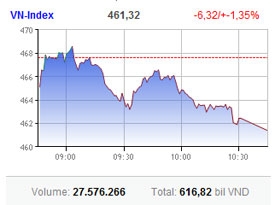

Trading values dropped nearly 24 per cent in Ho Chi Minh Stock Exchange (HoSE) to VND616.82 billion ($29.8 million), with a volume of just 27.58 million shares.

Foreigners’ buying volume on the HoSE even tumbled to as low as 1.48 million shares – the lowest level this month. Net selling value was of VND787 million ($38,000).

The benchmark VN-Index shed 6.32 points or 1.35 per cent to close at 461.32 points.

PetroVietnam Drilling (PVD) hit the floor leading the decliners.

Masan Group (MSN), PetroVietnam Finance (PVF) and Vietinbank (CTG) all sharply gave back while Bao Viet Holding (BVH) and Saigon Securities Inc. (SSI) significantly off.

Sacombank (STB) and Hoang Anh Gia Lai (HAG) slightly fell while Eximbank (EIB) ended flat.

Just a few blue-chips gained, among them Vincom Corp. (VIC) and Hoa Phat Group (HPG).

Mid-cap and small-cap stocks meanwhile saw just a modest declined. Among them several stocks even hit the ceiling.

At the close, 129 stocks declined on the southern bourse, compared with 83 advancing. Some 15 hit the ceiling and 15 hit the floor.

Hanoi Stock Exchange (HNX) lost 0.83 points (0.88 per cent) to end at 93.28 points, with decliners and advancers ran nearly even 123 to 140.

Investors’ sentiment was somewhat low on the northers bourse with as high as 107 stocks ended flat or had no transaction. Liquidity slightly rose 8.5 per cent to VND494 billion ($23.8 million) with 32.3 million shares changing hand.

VnDirect Securities (VND) outperformed the market with nearly three million shares traded, followed by Kim Long Securities (KLS) and PetroVietnam Construction (PVX) with more than two million units changing hand each.

The investors’ trade focused on a number of stocks, among them also PVGas North (PVG) and PVGas South (PGS).

Generally, major stocks almost unchanged or saw modest falls.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version