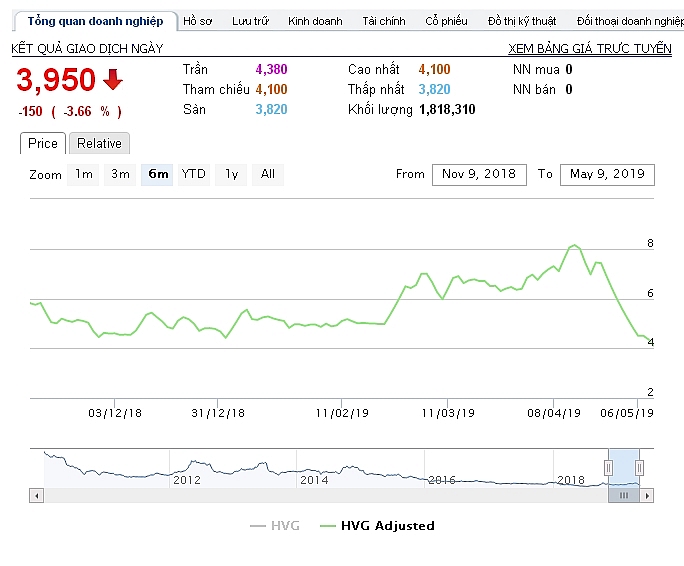

Hung Vuong Corporation stock price continue to drop half of value

|

| The stock of Hung Vuong Corporation has dropped to half its value over-month |

Hung Vuong Corporation (HSX: HVG) has just released announcement No.030519/CV-HVG on its website about fully divesting Hung Vuong Song Doc JSC.

This is the result of the May 2 meeting of the HVG board of directors. HVG owns 32.13 million shares at Hung Vuong Song Doc JSC, equivalent to 51 per cent.

By the last day of March 2019, HVG’s subsidiaries included:

| No | Company names | Percentage of ownership |

| 1 | Angiang Fisheries Import Export JSC (AGIFISH Co) | 79.58 |

| 2 | An Lac Real Estate JSC | 76 |

| 3 | HVBT Seafood Processing Co.,Ltd | 90 |

| 4 | Eroupe JSC (EUR) | 80 |

| 5 | Asia Co.,Ltd | 96 |

| 6 | Tac Van Seafoods Co | 66.78 |

| 7 | Hung Vuong Song Doc JSC | 51 |

| Associated companies | ||

| 8 | Hung Vuong – An Giang Football JSC | 48 |

| 9 | Viet Thang Feed JSC (VTF) | 31.16 |

| 10 | Hung Vuong Mien Tay Aquaculture JSC | 48 |

| 11 | Hung Vuong – Sa Dec Co.,Ltd | 40 |

| 12 | Hung Vuong – Vinh Long Aquatic Food Processing JSC | 38.75 |

| Joint Venture | ||

| 13 | Hung Vuong Mascato Co.,Ltd | 60 |

HVG decided to liquidate its real estate holdings and dissolve An Lac Real Estate where it held 76 per cent, while also divesting Sao Ta Foods JSC (FMC) (more than 21 million shares), reducing its ownership from 90.36 to 33.16 per cent in Viet Thang Feed JSC (VTF), and sold Cold Storage 2 to ABA Business Solution Inc., collecting nearly VND151 billion ($6.56 million).

Accordingly, HVG liquidated more than 39 per cent of its assets, reducing its holdings from VND13.9 trillion ($604.35 million) to only VND8.434 trillion ($366.7 million).

However, HVG finance is still unbalanced and auditors emphasise that the company’s ability depend largely on its ability to arrange cashflows and turn a profit in the future, as well as the restructuring of its bank debts.

| POR14 result causes difficulties to Hung Vuong Corporation Prominent entrepreneurs planning to retire Hung Vuong Corporation reports loss of $12 million in second quarter |

By the end of March 2019, the total debts of HVG stood at VND5.84 trillion ($253.9 million). The table below shows HVG’s short-term bank loans:

| Banks | Loan value (unit: million dollars) |

| BIDV | 84.13 |

| Vietcombank | 26.17 |

| HDBank | 7.39 |

| PG Bank | 4.32 |

| Agribank | 3.02 |

| Vietinbank | 1.7 |

| Total | 126.75 |

HVG’s due debts payable:

| Banks | Loan value(unit: million dollars) |

| BIDV | 1.42 |

| PG Bank | 0.17 |

| HDBank | 0.77 |

| Total | 2.37 |

On the stock market, after a period of breakthrough at the beginning of the year (going from VND5,000 to VND8,000 [$1.22-0.35]) HVG dropped without slowing in the past month to VND3,950 ($0.17) after the anti-dumping tax under POR14 was announced.

|

| HVG stock on May 9 |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Temporary relief for food imports as businesses urge overhaul of regulations (February 07, 2026 | 09:00)

- Opella and Long Chau join forces to enhance digestive and bone health (February 06, 2026 | 18:00)

- Vietnam-South Africa strategic partnership boosts business links (February 06, 2026 | 13:28)

- Sun PhuQuoc Airways secures AJW Group support for fleet operations (February 06, 2026 | 13:23)

- Pegasus Tech Ventures steps up Vietnam focus (February 05, 2026 | 17:25)

- The generics industry: unlocking new growth drivers (February 04, 2026 | 17:39)

- Vietnam ready to increase purchases of US goods (February 04, 2026 | 15:55)

- Steel industry faces challenges in 2026 (February 03, 2026 | 17:20)

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

Tag:

Tag:

Mobile Version

Mobile Version