Hot CPI spooks the market

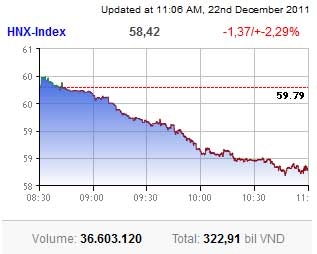

Ho Chi Minh Stock Exchange’s (HoSE) VN-Index lost up to 7.35 points or 2 per cent, while Hanoi Stock Exchange’s (HNX) HNX-Index was off 1.37 points or 2.29 per cent. The two benchmarks ended at 360.37 and 58.42 points respectively.

Ho Chi Minh Stock Exchange’s (HoSE) VN-Index lost up to 7.35 points or 2 per cent, while Hanoi Stock Exchange’s (HNX) HNX-Index was off 1.37 points or 2.29 per cent. The two benchmarks ended at 360.37 and 58.42 points respectively.

The government this morning reported December’s CPI growth was 0.53 per cent, is significantly higher than the November’s 0.36 per cent and October’s 0.39 per cent. Meanwhile, recent price hike of electricity and airline tickets had not even been accounted into the December’s CPI.

The figure pushed the CPI for the whole year 2011 to 18.12 per cent, significantly higher than the most recent target of 17 per cent and strongly surpassing the initial target in early this year of 7 per cent.

Investors bailed out most major stocks on both the two bourses. Blue-chips Bao Viet Holdings (BVH), Masan Group (MSN), PetroVietnam Drilling and Well Services (PVD), PetroVietnam Fertiliser and Chemical Corp. (DPM) along with financial stocks Vietinbank (CTG), Vietcombank (VCB), Saigon Securities Inc. (SSI) and PetroVietnam Finance (PVF) massively hit the floor on the HoSE.

Leading northern bourse stocks Kim Long Securities (KLS), VNDirect Securities (VND), Bao Viet Securities (BVS), Sacomreal (SCR) also hit the floor thanks to a strong bailing pressures. Other major stocks and most-active stocks largely lost 3-4 per cent. Real estate stocks like Ocean Group (OGC), Hoang Quan Consulting-Trading-Service Real Estate Corp (HQC) and Becamex Infrastructure Development (IJC) had tumbled to the prices of far below the par value.

However, liquidity significantly improved thanks to a number of investors picking the bottom prices. IJC, OGC, VIC, SSI, CTG all saw matching volumes rising to 1.2 – 1.7 million shares each on HoSE.

Put-through volumes still kept high at 14.7 million shares worth VND261.7 billion ($12.6 million) on the southern bourse, led by Sacombank (STB) and HAG. Total volume was of 46 million shares worth VND787.6 billion ($38 million).

The HNX also saw liquidity increasing to 36.3 million shares worth VND322.9 billion ($15.6 million), among them put-through volume was as high as 10.6 million shares worth VND112 billion ($5.4 million).

At the close, 187 stocks ended off and 48 ended up on the HoSE, while the figures on HNX were of 188 and 45, respectively.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version