HoSE still caught in the headlights

The benchmark VN-Index significantly slipped 6.8 points or 1.5 per cent to 447.57 points, after losing more than seven points yesterday. The fall came a wake of continuing rises in previous sessions.

The benchmark VN-Index significantly slipped 6.8 points or 1.5 per cent to 447.57 points, after losing more than seven points yesterday. The fall came a wake of continuing rises in previous sessions.

Analysts predicted the market to fall in a short-term adjustment tracking macroeconomic movements, with inflation expected to cool and interest rates likely lowered through the central bank’s help.

“It’s easy to see the similarities between market movements with that in early 2009,” said PetroVietnam Securities. “The macroeconomic situation is more positive.”

Phan Dung Khanh, head of Kim Eng Securities’ Analyst Department, said: “Although the market is in a short-term adjustment, it will probably rise in the mid-term, with support of strong cash flows.”

Half of the southern bourse fell today, with 134 stocks off and 81 up. Some 75 stocks ended flat.

Pillars Masan Group (MSN) and Bao Viet Holdings (BVH) led the losers, both hitting the floor.

Real estate stocks largely slipped, among them Licogi 16 (LCG), Hoang Anh Gia Lai (HAG), Quoc Cuong Gia Lai (QCG), Ocean Group (OGC) and Hoang Quan Consulting-Trading-Service Real Estate Corp (HQC).

In contrast, several major shares from the production sector rose, among them FPT Corp. (FPT), Vinamilk (VNM), PetroVietnam Drilling and Well Services (PVD). Financial shares Eximbank (EIB), Sacombank (STB) and Sacom Development and Investment Corp (SAM) also significantly gained.

Liquidity reduced to 44 million shares worth VND819 billion ($40 million) on the HoSE, with put-through volumes making up a remarkable part of 6.7 million shares worth VND279 billion ($13.6 million).

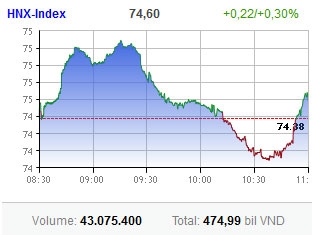

Meanwhile, the Hanoi Stock Exchange (HNX) slightly added 0.22 points or 0.3 per cent to 74.6 points, helped by a turnaround at the session’s end of driving stocks like Kim Long Securities (KLS), VnDirect Securities (VND), PetroVietnam Construction (PVX), Thai Hoa Vietnam Group (THV) and BaoViet Securities (BVS).

Decliners outran advancers 136 to 103, while 155 stocks were unchanged. Trading volume was quite low at 43 million shares worth VND475 billion ($23.2 million).

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version