Golden streak darkens on Friday

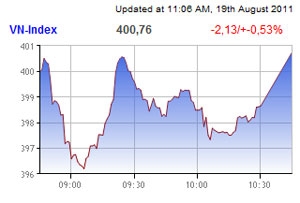

The VN-Index of Ho Chi Minh Stock Exchange (HoSE) shed 2.13 points or 0.53 per cent to 400.76 points.

The VN-Index of Ho Chi Minh Stock Exchange (HoSE) shed 2.13 points or 0.53 per cent to 400.76 points.

The benchmark rose on doubtful sentiment for the previous four trading days, in which market participants largely considered the rise as driven by exchange-trade funds.

“It’s exactly what securities companies had expected previously - market risks still loom and investors remain cautious,” said FPT Securities.

Besides, domestic gold hitting an all-time high in line with global gold price movements to VND46.79 million per tael this morning also added to the stock market’s falling momentum.

Blue-chips largely declined on the southern bourse. Vietinbank (CTG), PetroVietnam Fertilisers (DPM) and PetroVietnam Finance (PVF) strongly dropped, while Saigon Securities Inc. (SSI), Vietcombank (VCB), FPT Corp. (FPT) were off.

In contrast, pillar stock Masan Group (MSN) hit the ceiling to VND101,000 and Vinpearl Tourism and Trading (VPL) jumped 2.99 per cent to VND86,000.

HoSE’s liquidity strongly reduced, of which matching volume hit 21.5 million shares worth VND321 billion ($15.7 million) and put-through volume reached 5.4 million shares worth VND111.4 billion ($5.4 million).

At the close, 162 stocks ended lower on the southern bourse, compared with 56 up and 81 unchanged.

Hanoi Stock Exchange’s HNX-Index lost 0.78 points or 1.14 per cent to 67.53 points, dragged by a strong selling pressures at the session end. Some 213 stocks declined, while just 54 were up and 120 flat.

More than 39 million shares worth VND410 billion ($20 million), changed hands on the bourse. The liquidity of a number of major shares still kept high, in which Kim Long Securities’ (KLS) matching volume hit 7.3 million shares, VnDirect Securities (VND) six million shares and PetroVietnam Construction’s (PVX) reached 2.9 million units.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version