Generali achieves record operating results with strong capital position

|

| Generali Group CEO Philippe Donnet |

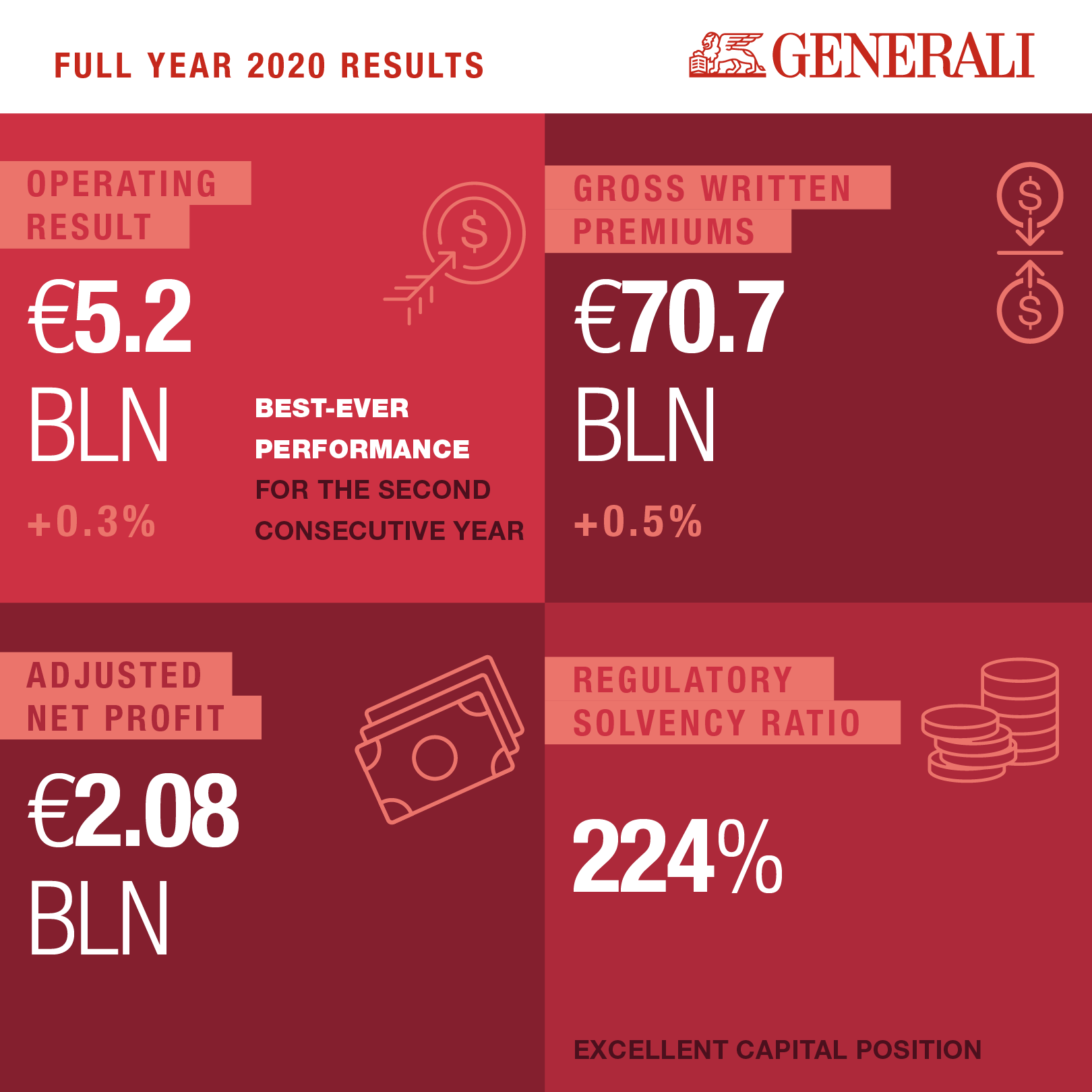

According to the consolidated statements, Generali Group's operating result saw, for the second consecutive year, its best-ever performance, touching €5,208 million ($6.21 billion) against €5,192 million ($6.19 billion) in fiscal year 2019.

The growth of the operating results from the Property, Casualty (P&C) and Asset Management segments, as well as the contribution of recent acquisitions, and the Holding and other activities more than compensated for the lower contribution of the Life segment, which was mainly due to the continued acceleration of provisions for guarantees to policyholders in Switzerland.

|

| A member of Italian-based Generali Group, after a decade of operation, Generali Vietnam has posted robust growth with an expansive network of more than 70 GenCasa and customer service centres |

The Life and P&C segments confirmed excellent technical profitability, demonstrated by the New Business Margin at 3.94 per cent and the improvement of the Combined Ratio to 89.1 per cent.

|

| Generali, one of the largest global insurance and asset management providers, posted the best-ever performance for the second consecutive year and confirmed a very strong capital position |

The significant increase of the operating result in the Asset Management segment was underpinned by the development of the multi-boutique platform and higher performance fees generated by the strong investment performance.

The group non-operating result amounted to negative €1,848 million ($2.2 billion) against negative €1,581 million ($1.88 billion) in the 2019 financial year, impacted by impairments on available for sale financial assets resulting from the negative performance of the financial markets, particularly in the first half of the year, as well as a €93 million ($110.9 million) impairment on goodwill related to the Life business in Switzerland.

It was also impacted by one-off effects such as the €100 million ($119 million) cost for the Extraordinary International Fund for COVID-19, the €94 million ($112 million) expense from the liability management transaction and, in France, the extraordinary obligatory contribution to the healthcare system, requested to the insurance sector, for €64 million ($76 million).

The lower incidence of interest expense on financial debt was positive, thanks to the debt optimisation strategy, which continued in 2020.

The group’s net profit was €1,744 million ($2.07 billion) compared to €2,670 million ($3.18 billion) in the previous fiscal year, impacted by €332 million ($396 million) deriving from the aforementioned liability management transaction, from the contribution of the Extraordinary International Fund for COVID-19 and from disposals, as well as €287 million ($342 million) of impairments on investments mainly in the first half of the year.

Excluding also the expenses of the COVID-19 fund and the liability management transaction, the adjusted net profit shed 12.7 per cent to € 2,076 million ($2.47 billion).

Gross written premiums of the group amounted to €70,704 million ($84.32 billion), a slight increase (0.5 per cent) compared to last year, thanks to the contribution of the Life segment.

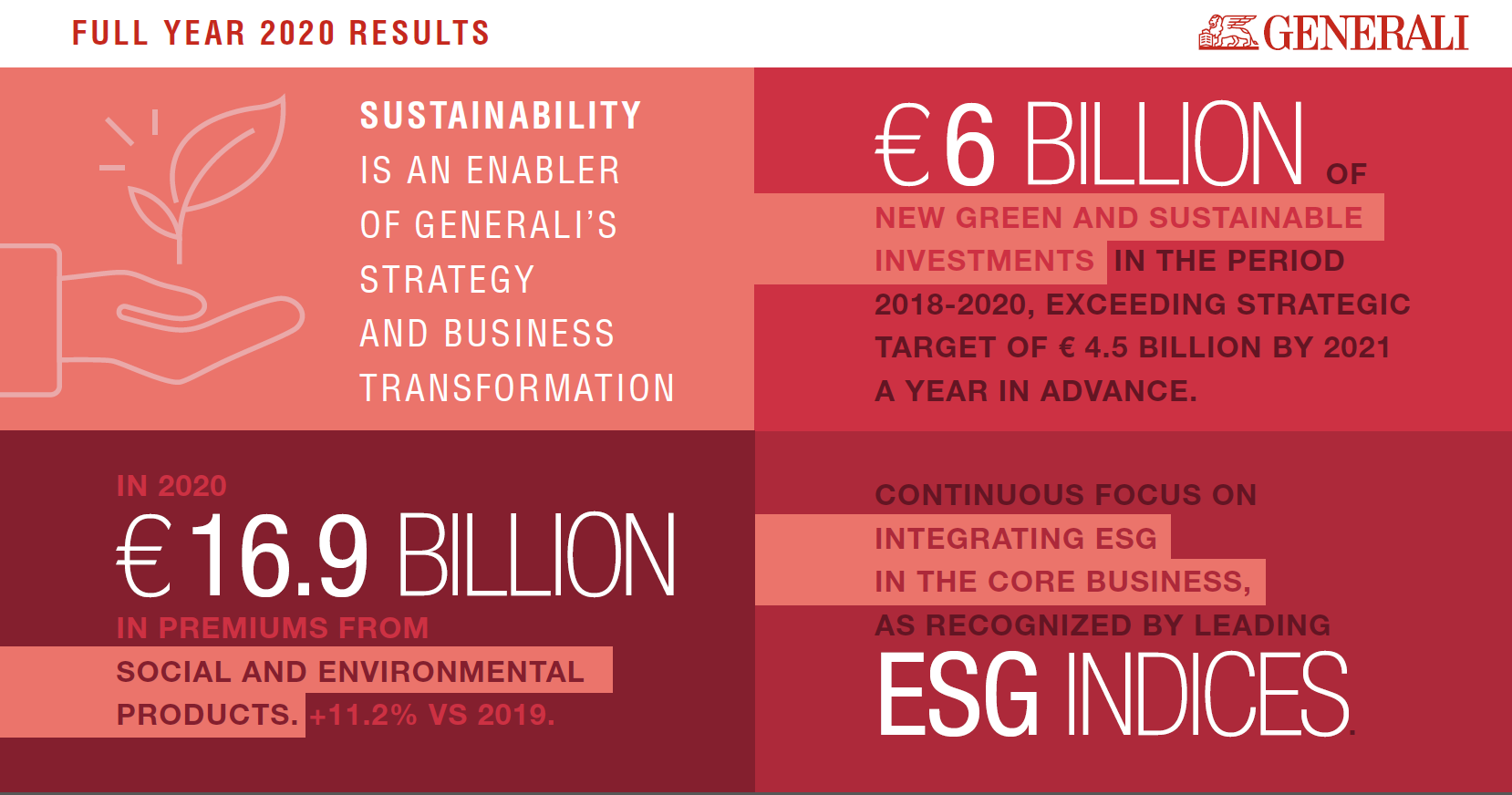

Premiums in the P&C segment remained stable on equivalent terms. In line with the objectives of the "Generali 2021" strategy, social and environmental products counted for €16.9 billion ($20.15 billion) of total premiums, signifying a 11.2 per cent jump.

The group had Total Assets Under Management equal to €664 billion ($791 billion), up 5.4 per cent.

|

| With the commitment to sustainability being one of the enablers of Generali’s strategy, the group has achieved outstanding sustainability performance in 2020 |

The group shareholders’ equity rose 5.9 per cent to €30,029 million ($35.81 billion). The change is mainly due to the result of the period attributable to the group, the distribution of the dividend, and the change in other profits or losses recognised to shareholders’ equity.

Significantly, the group confirmed an excellent capital position, with the Solvency Ratio stable at 224 per cent. The strong recovery compared to the first nine months of 2020 was mainly due to the positive impact deriving from the extension of the internal model for operational risks, the upswing in financial markets, and the very positive contribution of normalised capital generation.

The latter applies to the whole of 2020 and reached a record level of €4 billion ($4.7 billion).

Similarly, the group’s net Holding cash flows grew to a record level of approximately €3.7 billion ($4.41 billion), benefitting from solid remittances from subsidiaries, the successful implementation of capital management initiatives, lower incidence of interest expenses, and a number of favourable tax impacts.

The dividend per share that will be proposed at the next shareholders’ meeting is €1.47 ($1.75), split into two tranches of €1.01 ($1.20) and €0.46 ($0.55), respectively. The dividend proposal represents a total maximum pay-out of €2.315 billion ($2.76 billion).

“For the second consecutive year, we have achieved the group’s best-ever operating result and, also thanks to the further growth of the dividend, we continue to create value for all of our stakeholders. We have entered the final year of our strategic plan and are well-positioned to achieve all of the objectives of ‘Generali 2021’,” said Generali Group CEO Philippe Donnet. “We have defined and implemented a new organisational structure to ensure, not only the success of this plan but to also prepare for the next strategic cycle.”

Sustainability is an enabler of ‘Generali 2021’, driving the transformation of the business and the strategy in the long term.

The group made €6 billion ($7.16 billion) of new green and sustainable investments, in the period 2018-2020, exceeding the strategic target of €4.5 billion ($5.37 billion) by 2021 a year in advance. In 2020, Generali also collected over €16.9 billion ($20.15 billion) in premiums from social and environmental products, an increase of 11.2 per cent compared to 2019.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Shinhan Life Vietnam builds growth on people strategy (October 07, 2025 | 09:45)

- Insurance sector initiates rapid response after Typhoon Bualoi devastation (October 03, 2025 | 18:25)

- Non-life insurers face mounting pressure after typhoon hits motor sector (October 02, 2025 | 18:59)

- Prudential Vietnam delivers responsible investment package (September 25, 2025 | 10:37)

- Insurers struggle to keep pace with EV rapid adoption (August 29, 2025 | 17:12)

- Non-life insurance market in sees bright spots in H1 despite rising challenges (August 28, 2025 | 16:21)

- Life insurance rebounds with renewed growth and trust (August 06, 2025 | 18:04)

- Global Care launches Vietnam’s first insurance KOL platform (July 25, 2025 | 09:42)

- Liberty Insurance leaves mark at 2025 Insurance Asia Awards with dual wins (July 14, 2025 | 07:27)

- New CEO takes helm at Prudential Vietnam (July 07, 2025 | 17:51)

Tag:

Tag:

Mobile Version

Mobile Version