Cool CPI figures fail to heat up market

Hanoi announced its CPI figures for June today with 1.21 per cent growth, significantly lower than May. Ho Chi Minh City posted 0.69 per cent growth against last month – the lowest growth in eight months.

Hanoi announced its CPI figures for June today with 1.21 per cent growth, significantly lower than May. Ho Chi Minh City posted 0.69 per cent growth against last month – the lowest growth in eight months.

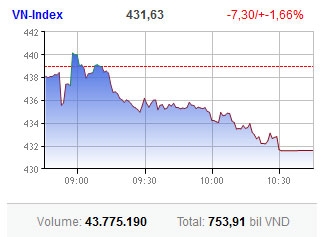

However, the stock market continued its downward trend today with VN-Index off 7.3 points or 1.66 per cent to 431.63 points. The HNX-Index lost 1.3 points or 1.7 per cent to 75.33 points.

Vincom Corp. (VIC) and Bao Viet Holdings (BVH) led the losers, off 4.44 per cent and 3.11 per cent respectively.

Saigon Securities Inc. (SSI) hit the floor after outperforming the market with more than three million shares traded.

Speculative stocks Tan Tao Investment Industry Corp. (ITA), Refrigeration Electrical Engineering Corp. (REE), PetroVietnam Transportation Corp. (PVT) and Investment and Trading Of Real Estate JSC (ITC) all hit the floor or nearly hit the floor.

Major stocks Hoang Anh Gia Lai (HAG), PetroVietnam Fertilisers (DPM) and Hoa Phat Group (HPG) significantly fell.

Financial shares, including Vietcombank (VCB), Vietinbank (CTG), Eximbank (EIB) and PetroVietnam Finance (PVF), slightly ended lower.

More than half the market declined, namely 167 stocks off and 54 advanced on the southern bourse.

Liquidity fell to 43.77 million shares, with values reaching VND754 billion ($36.4 million). A number of speculative stocks were being high demanded still, among them SSI, Vinh Son-Song Hinh Hydropower JSC (VSH) and Mirae JSC (KMR).

With the government poised last week to continue tightening the local economy in its effort to curb inflation until 2012, market sentiment is being hurt.

“A lot of investors are pessimistic,” said Vietnam International Securities.

“Inflation pressure remains at high-level,” said Saigon-Hanoi Securities.

The Hanoi Stock Exchange sunk in red with 234 stocks declining and 59 gaining.

Major stocks Bao Viet Securities (BVS) and VnDirect (VND) both hit the floor, while PetroVietnam Construction (PVX) and Vinaconex (VCG) sharply off.

Low-price stocks were being massively sold at floor prices after being strongly bought previously.

Trading volumes sharply fell to 36.5 million shares, worth VND417 billion ($20.14 million).

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version