Banks swim against the tide

VCB hit the ceiling for two straight sessions after it got approval from the State Securities Commission to list more than 1.6 billion additional shares, likely to become the fourth largest-cap stock.

VCB hit the ceiling for two straight sessions after it got approval from the State Securities Commission to list more than 1.6 billion additional shares, likely to become the fourth largest-cap stock.

Also, CTG gained 1.2 per cent and PetroVietnam Finance (PVF) was significantly up 2.18 per cent.

In contrast, blue-chips Masan Group (MSN) and Vincom Corp. (VIC) both hit the floor. Saigon Securities Inc. (SSI) lost 2.02 per cent.

Vinpearl Tourism and Trading JSC (VPL), Hoang Anh Gia Lai JSC (HAG) and Song Da Urban & Industrial Zone Investment and Development JSC (SJS) all hit the floor. Almost all large-cap stocks dropped or ended flat.

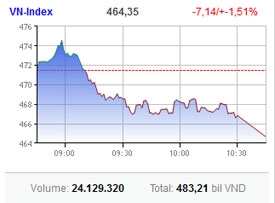

At the close, the Ho Chi Minh Stock Exchange’s (HoSE) VN-Index tumbled 7.14 points or 1.51 per cent to 465.35 points. Just 44 stocks gained while 182 fell and 82 unchanged.

On the local stock market, investors were under heavy selling pressures as inflation and interest rates hikes continue looming. Liquidity kept low at 24 million shares, with value reached VND483 billion ($23.33 million).

On the Hanoi Stock Exchange (HNX), the HNX-Index lost 1.42 points to 79.56 points. Almost the whole market sunk in red when 256 stocks declined, with 30 advancing. Some 77 hit the floor.

However, trading volumes slightly gained on the northern bourse, with more than 24.8 million shares worth VND301 billion ($14.54 million) changing hands.

VnDirect Securities (VND) was active the most with more than 1.7 million shares traded, followed by Habubank (HBB), Thai Hoa Vietnam Group (TVH), PVX and Kim Long Securities (KLS) with approximately 1.4 million units traded each.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version