Banking stocks lead the charge

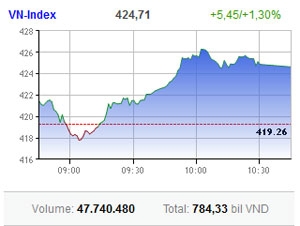

Ho Chi Minh Stock Exchange’s (HoSE) VN-Index soared 10.58 points or 2.49 per cent to 435.29 points. Liquidity hit more than 50 million shares worth VND805 billion ($39.3 million).

Ho Chi Minh Stock Exchange’s (HoSE) VN-Index soared 10.58 points or 2.49 per cent to 435.29 points. Liquidity hit more than 50 million shares worth VND805 billion ($39.3 million).

Hanoi Stock Exchange’s (HNX) HNX-Index gained 2.17 points or 2.97 per cent to 75.36 points. Volume was high at 53 million shares worth VND612 billion ($29.9 million).

That rise was fueled by central bank moves to lower interest rates last week. The market had strongly jumped in Monday and Tuesday, somewhat reduced the rising momentum in Wednesday and ended the week in dramatic fashion today.

“Major investors are putting their confidence in the market’s recover after a series of central bank measures to reduce interest rates,” said FPT Securities.

Banking stocks led the gainers with Eximbank (EIB), Vietinbank (CTG), Vietcombank (VCB) all hitting the ceiling and Sacombank (STB) up 2.86 points on the HoSE. Matching volumes of these stocks hit millions of units each.

Habubank (HBB), Asia Commercial Bank (ACB) and Saigon-Hanoi Bank (SHB) also massively hit ceiling on the HNX, with hundreds of thousand bid orders remaining at the session end.

Major stocks like Saigon Securities Inc. (SSI), PetroVietnam Finance (PVF) and real estate shares Tan Tao Investment Industry Corp. (ITA), Ocean Group Corp. (OGC), Investment and Trading of Real Estate (ITC) also sharply jumped.

In the contrast, Hoang Anh Gia Lai (HAG) fell after S&P lowering its credit rate yesterday. Hoang Quan Consulting-Trading-Service Real Estate Corp (HQC) also reduced after continuously jumping in previous sessions.

Securities shares also lowered their gains on the HNX. Bao Viet Securities (BVS) even ended lower.

Overall, 190 stocks gained on the HoSE, compared with 39 declining and 71 unchanged. The HNX closed with 216 stocks up, 54 off and 115 ending flat.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Mobile Version

Mobile Version