Bank of Tokyo Mitsubishi to raise its stake in VietinBank

Under the agreement made in the shareholders’ extraordinary meeting last week, the Bank of Tokyo Mitsubishi (BTMU) will increase its stake in VietinBank to 19.73 per cent, representing the biggest ever merge and acquisition case in Vietnam’s financial and banking system sector. At an issuance price of VND24,000 ($1.15) per share, the deal will enable VietinBank to increase its chartered capital to VND32,661 billion ($1.57 billion) from VND26,217 billion ($1.26 billion), turning it into the largest bank in Vietnam in term of chartered capital.

VietinBank said it planned to use VND2,943 billion ($141 million) for loan increases. Especially, the bank will spend VND1,000 billion ($48 million) for network expansion, another VND1,000 billion ($48 million) for investment in infrastructure, technology, development of new services, and VND1,500 billion ($72 million) for investment expansion and investing in other companies.

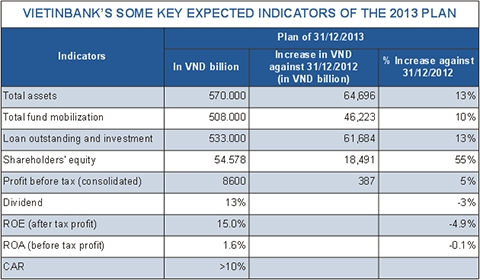

After the issuance, the government will hold 64.46 per cent of the bank’s stake, while the International Financial Corporation and related parties claiming 8.03 per cent. In 2013, VietinBank plans to earn VND8,177.6 billion ($392 million) in pre-tax profit.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Citi sharpens its focus on institutional banking (February 09, 2026 | 19:58)

- SSC steps up engagement with FTSE Russell on market reforms (February 09, 2026 | 17:33)

- IFC considers $50m trade finance guarantee facility for Nam A Bank (February 09, 2026 | 17:28)

- Hoa Phat Agricultural Development debuts shares on HSX (February 06, 2026 | 14:00)

- Vietcap’s VAD 2026 draws strong global investor turnout (February 06, 2026 | 13:30)

- New rules ease foreign access to Vietnam equities (February 05, 2026 | 17:29)

- 0.1 per cent tax proposed on each transfer of digital assets (February 05, 2026 | 17:27)

- Ministry of Finance tightens policy delivery at start of year (February 05, 2026 | 17:26)

- Vietnam steps up market reforms as FTSE Russell reviews upgrade progress (February 05, 2026 | 17:20)

- 2025 profits mixed amid strong energy and farming results (February 05, 2026 | 17:18)

Mobile Version

Mobile Version