Asian markets steady as US takes a break

|

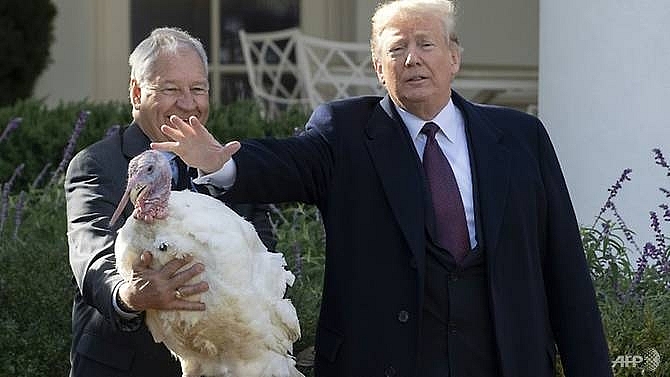

| US President Donald Trump pardons the turkey "Peas" during the annual ceremony at the White House, ahead of the Thanksgiving holiday. (Photo: AFP/Jim Watson) |

But analysts cautioned the tepid uplift in New York on Wednesday should not be interpreted as a sign of the start of a recovery from the recent carnage on global stock markets.

Investor sentiment remains fragile following the volatility that has swept markets since October, while the OECD has warned that the world economy has peaked and faces a slowdown as it confronts the Trump administration's trade war and tighter monetary conditions.

The dollar slipped against the euro, the pound and the yen amid reports the Federal Reserve may pause future interest-rate hikes.

Crude prices resumed their downward trajectory Thursday, after a brief recovery on Wednesday.

The commodity has fallen by almost 30 per cent from four-year highs touched at the start of October. Oil analysts attribute the pullback to high supply as well as a weakening global growth outlook.

"This half-hearted recovery effort should not be confused with anything other than pre-holiday scramble doing little more than what amounted to chasing oil prices," said Stephen Innes, head of Asia-Pacific trade at OANDA.

"Markets have been remarkably muted, even by holiday standards."

He added the post-Thanksgiving Black Friday shopping spree would be "the ultimate litmus test of US consumer confidence heading into the holiday season".

Ahead of a Friday holiday in Japan, the Nikkei rose 0.65 per cent as investors took heart from the weakening yen.

However, fresh data suggested the world's third-largest economy is continuing to struggle in its years-long battle with deflation.

BITTER ROW

Inflation in Japan stood at one percent in October, unchanged from the previous month, according to government data.

Japan has battled deflation for many years and the central bank's ultra-loose monetary policy appears to have had limited impact.

Late last month, the Bank of Japan again revised down inflation forecasts, in the latest sign it had failed to make headway towards its two-percent target despite years of massive monetary easing.

Shares in Nissan rose 0.77 per cent ahead of its board meeting that will propose the sacking of disgraced chairman Carlos Ghosn, after his spectacular arrest for financial misconduct sent shockwaves through the car industry and the business world.

The scandal has sparked questions over whether the alliance of Nissan, Renault and Mitsubishi Motors can survive without Ghosn, seen as the glue holding together his fractious creation, which globally employs around 450,000 people.

Elsewhere, Hong Kong ended the day with modest gains and Shanghai closed slightly down, while Sydney was the standout regional performer, gaining 0.9 per cent. Shares in Singapore were up even as the trade-reliant city-state braces for slower economic growth next year as demand in key markets in Asia weakens.

In early trade in Europe Thursday, London dropped 0.s2 per cent while both Paris and Frankfurt slid 0.3 per cent. Bourses had staged a sharp recovery Wednesday even as the EU, as expected, officially rejected Italy's big-spending budget, clearing the path for unprecedented sanctions and deepening a bitter row with Rome's populist government.

However, reports said Italy's government may be open to budget revisions as the European Union took a first step toward imposing fines on the country.

- Key figures around 0820 GMT -

Tokyo - Nikkei 225: UP 0.7 per cent at 21,646.55 (close)

Hong Kong - Hang Seng: UP 0.2 per cent 26,019.41 (close)

Shanghai - Composite: DOWN 0.2 per cent at 2,645.43 (close)

Euro/dollar: UP at US$1.1405 from US$1.1385 at 2200 GMT

Pound/dollar: UP at US$1.2788 from US$1.2777

Dollar/yen: DOWN at ¥112.97 from ¥113.04

Oil - West Texas Intermediate: DOWN 42 cents at US$54.21 per barrel

Oil - Brent Crude: DOWN 55 cents at US$62.93 per barrel

New York - Dow: FLAT at 24,464.69 (close)

London - FTSE 100: DOWN 0.2 per cent at 7,031.49

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- New rules ease foreign access to Vietnam equities (February 05, 2026 | 17:29)

- 0.1 per cent tax proposed on each transfer of digital assets (February 05, 2026 | 17:27)

- Ministry of Finance tightens policy delivery at start of year (February 05, 2026 | 17:26)

- Vietnam steps up market reforms as FTSE Russell reviews upgrade progress (February 05, 2026 | 17:20)

- 2025 profits mixed amid strong energy and farming results (February 05, 2026 | 17:18)

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

Tag:

Tag:

Mobile Version

Mobile Version