Strategies sought by insurers after mixed bag in growth

|

| Strategies sought by insurers after mixed bag in growth |

Data compiled by BIDV Securities Company (BSC) showed that foreign companies are prevailing in the Vietnamese life insurance market, even though the pandemic is out of their control.

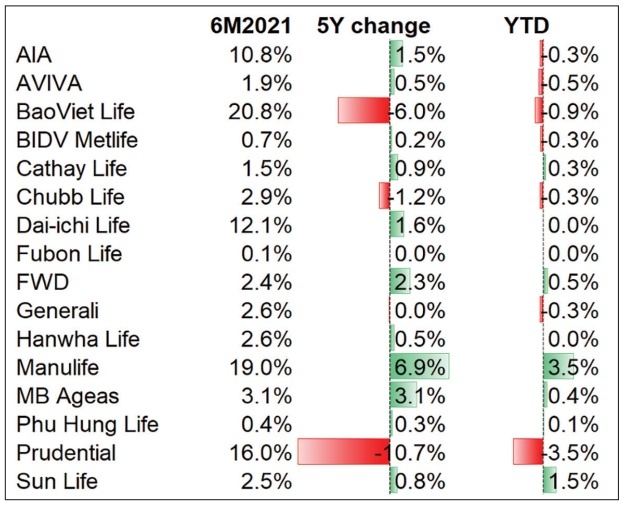

Bao Viet Life, the only Vietnamese insurer on the list, still holds the largest market share, with 20.8 per cent. However, other foreign enterprises such as Manulife, Prudential, Dai-ichi Life, and AIA have accelerated their initiatives and international expertise to improve operational efficiency and gain customer appetite.

The five largest companies accounted for 78.7 per cent of the whole life insurance market share, with foreign insurers enhancing their position, while a number of major Vietnamese insurers have diminished.

|

In the past five years, BaoViet Life’s market share has decreased by 6 per cent. On the contrary, Canadian insurer Manulife has increased their segment from 6.9 to 19 per cent. AIA rose from 1.5 to 10.8 per cent, while Dai-ichi Life from 1.6 to 12.1 per cent.

Other insurance companies have also ramped up their presence in the past few years, such as FWD, MB Ageas, and Sun Life. UK-backed Prudential also now boasts 16 per cent of the life insurance business segment.

“The vibrant domestic stock market has bolstered the financial investment activities of insurance companies. However, low interest rates reduce financial income of deposit-focused insurance companies,” BSC commented.

“Most insurers have set low or even negative growth targets in 2021 due to the low interest rate environment as a result of loose monetary policy.”

Notwithstanding, BSC added, the forthcoming amended Law on Insurance Business is expected to lift the foreign ownership cap, which would lay the concrete foundation for foreign investors to penetrate the domestic market.

Elsewhere, the ongoing pandemic and its resulting economic crisis are hitting the non-life insurance industry hard.

In this sector there are six leading insurers, accounting for about 60 per cent of the market share. However, in the past three years, Bao Viet has gradually lost its market share, from over 20 per cent in 2018 to 15 per cent by the end of June 2021, which is equivalent to PVI. Some other insurers have raised their rankings, such as MIC, surpassing Pjico.

According to preliminary data from the Insurance Association of Vietnam, in the first eight months of this year, non-life insurance revenues were estimated at VND37.28 trillion ($1.62 billion), up 3.61 per cent. However, this figure is the lowest growth rate in nearly 10 years.

Meanwhile, compensation reached VND11.74 trillion ($510 million) with the rate at 31.5 per cent, not including compensation provision.

In which, motor vehicle insurance revenues reached VND10.28 trillion ($445 million), accounting for 27.6 per cent of total market revenue, down 7.7 per cent over the same period; with a compensation rate of 48 per cent.

Health insurance revenues hit VND11.05 trillion ($480.7 million) and occupied 29.7 per cent, up 3.39 per cent on-year, with a claim rate of 29.6 per cent, not including compensation provision.

Property damage liability insurance revenue stood at VND5.4 trillion ($234.7 million), accounting for 14.5 per cent, up 10.26 per cent. Fire and explosion insurance revenues sat at VND4.9 trillion ($212.4 million), occupying 13.1 per cent, up 10.4 per cent; cargo insurance revenues hit VND1.8 trillion ($79.1 million), making up 4.9 per cent and up nearly 23 per cent; and hull insurance and shipowner’s civil liability attained over VND1.6 trillion ($71.5 million), accounting for 4.4 per cent and up 18 per cent.

Other insurance services include liability insurance at VND899 billion ($39.1 million), up 24 per cent; aviation insurance at VND544 billion ($23.7 million), up 26 per cent; credit and financial risk insurance touched VND540 billion ($23.5 million), down nearly 7 per cent; and business damage insurance hit VND157 billion ($6.8 million), down 2 per cent over the same period.

Thus, the revenue growth of the non-life insurance market in the first eight months of 2021 was roughly equivalent to 50 per cent of last year’s period.

“This segment is forecasted to encounter a bumpy road as the automobile industry is stuck in the mud due to the economic downturn. Under pandemic pressure, customers tend to cancel insurance policies or fail to renew them,” BVSC said.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- QBE Vietnam: 20-year journey of building trust and enabling resilience (November 20, 2025 | 14:25)

- Hanwha Life hosts training course in South Korea for Vietnamese fintech talents (November 20, 2025 | 09:51)

- Insurers accelerate post-typhoon recovery (October 28, 2025 | 15:31)

- Shinhan Life Vietnam builds growth on people strategy (October 07, 2025 | 09:45)

- Insurance sector initiates rapid response after Typhoon Bualoi devastation (October 03, 2025 | 18:25)

- Non-life insurers face mounting pressure after typhoon hits motor sector (October 02, 2025 | 18:59)

- Prudential Vietnam delivers responsible investment package (September 25, 2025 | 10:37)

- Insurers struggle to keep pace with EV rapid adoption (August 29, 2025 | 17:12)

- Non-life insurance market in sees bright spots in H1 despite rising challenges (August 28, 2025 | 16:21)

- Life insurance rebounds with renewed growth and trust (August 06, 2025 | 18:04)

Tag:

Tag:

Mobile Version

Mobile Version