Special consumption tax needs supportive roadmap

|

| The seminar giving comments on the amended Law on SCT |

In the morning today, The Investor organised the seminar on building the Law on SCT (amended), including looking at the addition of sugary soft drinks, barley drinks, non-alcoholic beverages, new tobacco, and online video game services; supplementing regulations on tax bases and tax calculation methods; adjusting SCT for tobacco, beer, and alcohol.

Numerous opinions and discussions related to this proposal were raised. Nguyen Anh Tuan, editor-in-chief of The Investor said that most businesses agreed with the proposal of the Ministry of Finance on keeping the current relative tax calculation method for beer and alcohol.

The reason is that the current change of tax calculation method would have a great impact on the production and business of the alcohol and beer industry, which is struggling with many burdens due to the heavy impact of the pandemic, and a number of related regulations and policies.

"This will lose the competitiveness of Vietnamese branded popular beers, which currently account for up to 80 per cent of market share, affecting State budget revenue," said Nguyen Van Viet, chairman of the Vietnam Beer-Alcohol-Beverage Association (VBA).

"We should stabilise the current tax policy to help businesses overcome difficulties and recover," Viet added.

Lawyer Nguyen Thi Quynh Anh, vice chairwoman of the Vietnam Bar Federation, said that policymakers should consider carefully several objectives: regulating consumption, reducing the negative impact of alcoholic beverages on human health; ensuring a stable and sustainable revenue of the state budget; ensuring the fairness of tax policy for society and businesses; and protecting the domestic beverage industry.

However, the alcohol industry has been facing many woes, so the production output and beer consumption have been dropping, and the industry has seen declines.

"We should continue to maintain the current method of SCT calculation and consider a reasonable roadmap to increase tax rates based on the socioeconomic situation in each period to ensure a stable budget revenue, regulate consumption, and maintain the competitiveness of Vietnamese alcohol brands, which have taken several decades of building their names in the domestic market, and gradually reaching out to the world market," Quynh Anh said.

|

| SCT needs a supportive roadmap for adjustment |

SABECO CEO Bennett Neo said the proposal to amend the Law on SCT was of great importance as it directly impacted domestic beer producers and almost all Vietnamese beer brands, including SABECO and its Bia Saigon, Bia 333 brands.

Given the challenges posed by post-COVID recovery and lower-than-expected economic growth, and increases in input costs, SABECO recommended maintaining the current SCT rate for beer and alcoholic products for at least the next three to five years.

"Vietnam should continue to maintain the relative taxation method for the SCT and adjust the relative tax rates according to a suitable roadmap based on the socioeconomic situation, at least in the next 10 years," Neo said. "For the proposal of changing to the hybrid tax, SABECO does not recommend it because the relative taxes method regulates consumer demand based on product prices and is, therefore, more effective in resource allocation and redistributing income for individuals with high incomes."

He added that the current method was also demonstrating its effectiveness in adjusting inflation to stabilise consumer prices for alcohol beverages without increasing state management costs.

Nguyen Van Phung, former director of Tax Administration Department of Large Enterprises said that Vietnam had regulations on hybrid tax calculation methods, percentage tax calculation methods, and absolute tax calculation methods in the Law on Import and Export Tax.

Moreover, the contribution of the beverage industry to the state budget recently was relatively high and stable at $2.1-2.8 billion per year, despite the pandemic.

"If the tax calculation method is changed without a thorough impact assessment, it will affect the production and business ability of Vietnamese-branded beer enterprises and will greatly affect the budget revenue of the state and localities. If the prices are pushed up by the impact of taxes, production and consumption output will decrease, and the contribution to the state budget will also drop," he said. "In the current reality of Vietnam, this is not the right time to apply the hybrid method or the absolute method, even in terms of state budget revenue and tax administration costs."

| Support to continue in form of VAT cut Many types of goods and services currently subject to a 10 per cent VAT rate are to continue being eligible for a 2 per cent reduction in this type of tax, which is scheduled to get the official thumbs-up from the legislature in late June. |

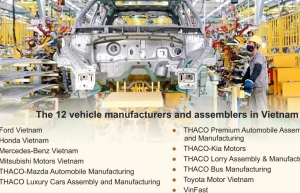

| Carmakers keen on extension of SCT pay The Ministry of Finance has sent to the Ministry of Justice a dossier on the extension of special consumption tax for domestically manufactured cars incurred from June-September 2023, until November 20. |

| Petrol suffers too many taxes: experts Each litre of petroleum is subject to too many taxes, with burdens on businesses and consumers are increasing, according to industry experts. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version