Replaced regulation to hit global drugmakers

|

| Branded drugs are expensive but popular in Vietnam |

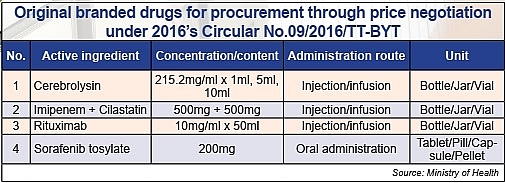

According to a VIR source, the Drug Administration of Vietnam (DAV) is going to issue a replacement for 2016’s Circular No.09/2016/TT-BYT, which governs the list of drugs for procurement through bidding, for concentrated procurement, and for procurement through price negotiation, towards expanding a third list to drop the price of brand-name drugs.

“The issuance of the new circular will be made within the month and will take effect in 45 days as ruled. Accordingly, most brand-name drugs will be added to the third list for procurement through price negotiation,” a DAV official told VIR.

There are two schemes for procurement of branded products: price negotiation, and open bidding in Group 1 under Circular No.15/2019/TT-BYT dated July 2019 regulating drug tenders at public hospitals. Specifically, off-patent pharmaceuticals (OPP) with many generic drugs in replacement in Group 1 will be included in open bidding for Group 1 drugs, while OPPs failing in procurement via price negotiation will be also included in tender of Group 1.

As shown in Circular No.15, tenders of generic drugs are divided into five groups. Group 1 includes drugs manufactured entirely by a manufacturing line satisfying EU-GMP requirements or equivalent requirements in a country that is considered a stringent regulatory authority.

The new issuance is in line with the government’s direction to increase local access to quality medicines and to reduce medicine prices, focusing on brand-name drugs. According to statistics from the DAV, such drugs make up an average of 26 per cent of total health insurance spending. Remarkably, the rate is 47 per cent at central hospitals, and 26 per cent at provincial ones.

|

The new regulation is expected to be a blow to multinational corporations like Pfizer, GSK, Novartis, and others, possibly forcing them to cut prices if they want to be more competitive. At present, in-patient pharmaceuticals and OPPs are still included in tenders for brand-name drugs or equivalent drugs, which cost 10-20 times more than generic products.

Branded drugs are costly because mutinationals have to spend billions of US dollars researching and developing them. Thus, patents offer them exclusive rights to produce and set prices for drugs, treatments, and tests that they develop. Brand-name pharmaceuticals go to the hospital system, or the ethical drugs channel (ETC), which is the most profitable segment.

At present, the ETC is the main distribution channel in the local pharma market, accounting for around 70 per cent, while the remainder of the market comprises over-the-counter, or non-description, drugs. Foreign players hold the majority of the ETC market due to ownership of brand-name drugs, which operate in a monopolistic manner and sell at high prices.

According to EuroCham’s Pharma Group, the innovative pharmaceutical industry should be seen in the context of it being one of the most innovative sectors, with approximately $140 billion being invested in research and development annually. The Pharma Group represents the voice of the international research-based pharmaceutical industry in Vietnam and has 22 members from Europe, Switzerland, the US, and Japan.

According to a Pugatch Consilium Bio-Competitiveness Index analysis, around 60 per cent of the $140 billion invested in such development is directed at clinical research. Vietnam’s share of global research-related foreign direct investment is miniscule: It accounts for $23 million, or 0.04 per cent. However, if Vietnam were to improve its index performance indicators, this could lead to an additional $32-55 million of such investment in clinical trial activity and associated monetary transfers alone.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VIFC in Ho Chi Minh City officially launches (February 12, 2026 | 09:00)

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

Tag:

Tag:

Mobile Version

Mobile Version