PwC surveys how financial and tech firms navigate fintech landscape

|

The FS and TMT industries are using fintech to sharpen operational efficiency, lower costs, improve customer experience, and heighten the appeal of their products and services. They are also carving out new commercial possibilities. Digital-only banks are offering redesigned client propositions and cost profiles while investment managers are deploying fully customised robo-advisory.

Insurers are using sensors to monitor people’s health and drive illness prevention and according to a recent PwC survey, consumers are ready for the digital shake-up. The question is no longer whether fintech will transform FS, but which firms will apply it best and emerge as the leaders.

Key findings and insights

Adopting a fintech-centred strategy is paramount – The survey found that 47 per cent of TMT and 48 per cent of FS organisations have embedded fintech fully into their strategic operating model. Also, 44 per cent of TMT and 37 per cent of FS organisations have incorporated emerging technologies into the products and services they sell.

“The really big changes have to be top-down. They have to be strategic. They have to be something that leadership, the board, and the executives are closely involved in and have decided the organisation needs to pursue,” said John Garvey, Global Financial Services leader, PwC.

FS should look to TMT for ideas about how best to use fintech – FS executives surveyed think that using fintech to improve the ease and speed of their service will be key to retaining customers. However, people expect ease and speed, so firms that focus their fintech efforts on these attributes might only meet customers’ expectations and not differentiate themselves, especially when competing with digitally sharp, intuitive TMT businesses.

|

| Vo Tan Long, technology consulting partner at PwC Consulting Vietnam |

Vo Tan Long, Technology Consulting partner at PwC Consulting Vietnam, said, “Customer satisfaction through customer experience is the ultimate goal for companies. Everywhere in the world, technology is helping to bridge the gap between the virtual world and the real world by aligning the customer experience in both worlds, thus creating customer satisfaction. This is also the best way to attract and retain customers.”

FS and TMT should look to each other and retrain to fill skills gaps – PwC's survey showed that 80 per cent of TMT and 75 per cent of FS organisations are creating jobs related to fintech. Yet 42 per cent of both TMT and FS organisations are struggling to fill these roles. While 73 per cent of FS organisations are hiring from the technology sector, only 52 per cent of TMT firms are looking to recruit from FS. Finding ways to attract people from TMT to FS and vice versa will be important to future success because each sector needs the other’s expertise. Upskilling will also be important.

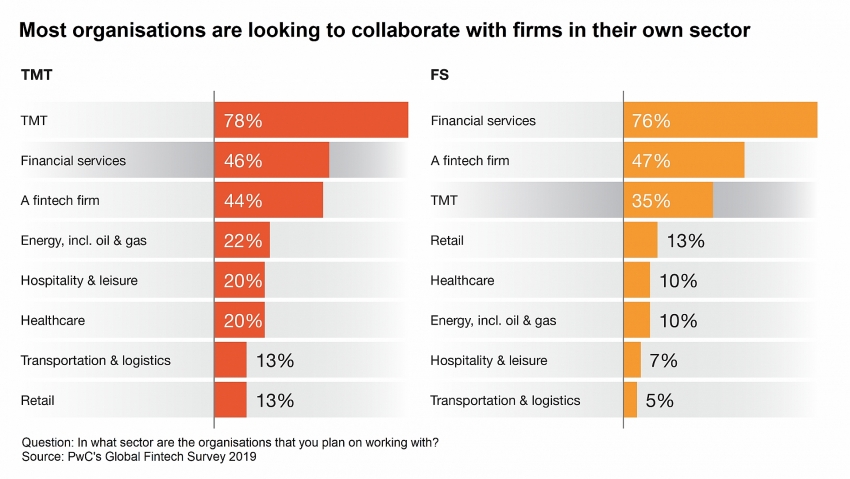

Firms should push cross-sector fusion – Among organisations that are planning to pursue an acquisition, strategic alliance or joint venture to drive growth via fintech, 78 per cent of TMT and 76 per cent of FS firms are targeting businesses within their own sectors. Less than half (44 per cent of TMT and 47 per cent of FS organisations) are targeting a company specialising in fintech.

At a time when FS firms are striving to sharpen their technology capabilities and TMT needs product and regulatory expertise to compete in the FS market, firms will miss opportunities if they do not pursue more cross-sector cross-over.

“Cross-sector collaboration will help to create a complete set of services that cater to customers’ daily life. Such ecosystems might require inter-organisational integration of business processes and technologies. In Vietnam, a number of large and medium-sized commercial banks, telecommunications corporations, and leading fintech companies have been at the forefront of this process,” Vo Tan Long said.

“In China, convergence is gathering pace. At the top of the market, we’ve even seen regulators seeking to match up the big four TMT firms with the big four banks and get them to work together – you could call it an arranged marriage. The TMT firm provides the tech-enablement and the FS firm delivers the end product,” said Wilson Chow, TMT Global leader, PwC.

|

The current landscape

Emerging technologies have given companies a low-cost way of creating convenient, personalised, data-intuitive products and services. Fintech has also lowered the barriers to entry for firms – from established FS groups to startups or TMT entrants – and has therefore created a complex web of co-operative competition, or “co-opetition,” and collision.

Winners and losers

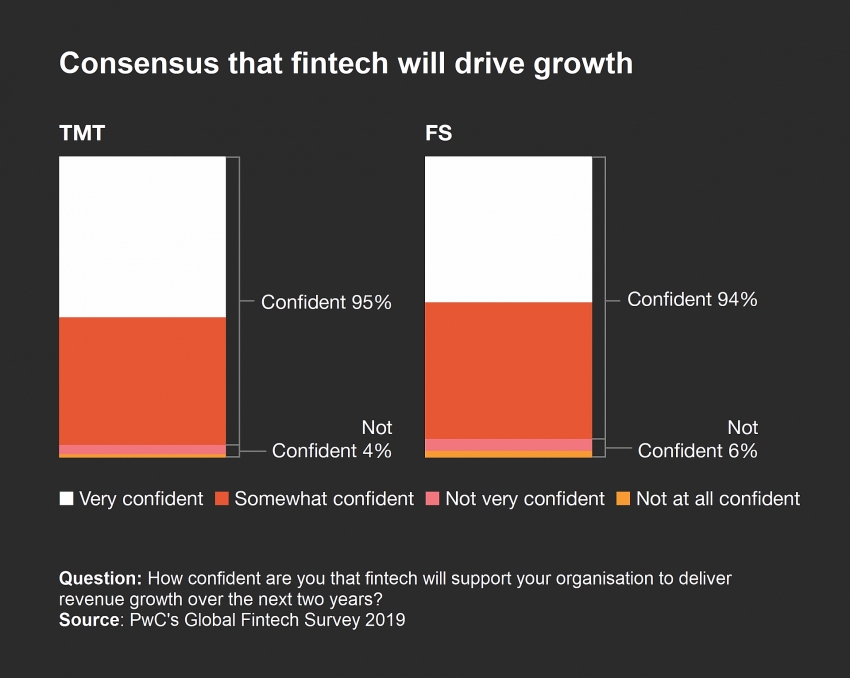

Companies that have embraced fintech are reshaping the marketplace, and those that have not are being left behind. Three-quarters of the FS and TMT executives surveyed said they are stepping up their fintech investment in the next two years. More than 90 per cent are very or somewhat confident that fintech will deliver revenue growth over the next two years. However, focus, maturity, and speed to market vary.

| This is PwC's third survey charting the rapid evolution of fintech. • PwC's 2016 Global Fintech Survey, Blurred lines: How fintech is shaping financial services, revealed established financial services (FS) organisations’ concerns about the threat to their market position as fintech set new benchmarks for agility, customer insight, and cost. • PwC's follow-up in 2017, Redrawing the lines: Fintech’s growing influence on financial services, highlighted the shift towards collaboration as startups realised they did not have the scale or customer trust to compete with long-established FS organisations head-on, while FS looked to fintech partnerships to help strengthen operational efficiency and boost innovation. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnamese consumers express concern about climate change (October 11, 2025 | 14:06)

- ESG seen as key to Vietnam’s business credibility and capital attraction (September 29, 2025 | 18:38)

- From compliance to strategy: ESG criteria gaining ground (September 29, 2025 | 15:47)

- Vietnamese firms step up ESG game (September 23, 2025 | 15:26)

- Vietnam tax and legal changes set to shape foreign investment landscape (September 16, 2025 | 13:46)

- Vietnamese businesses navigate US tariffs (June 25, 2025 | 12:14)

- The impact of cloud, AI, and data on financial services (April 14, 2025 | 11:20)

- Vietnam 2025 M&A outlook: trends, deals, and opportunities (March 21, 2025 | 08:54)

- Vietnam's M&A landscape mirrors global trends (February 18, 2025 | 17:13)

- Asia-Pacific CEOs enter 2025 with optimism and caution (February 06, 2025 | 17:16)

Tag:

Tag:

Mobile Version

Mobile Version