What Vietnamese businesses can expect from the EU's CSRD

|

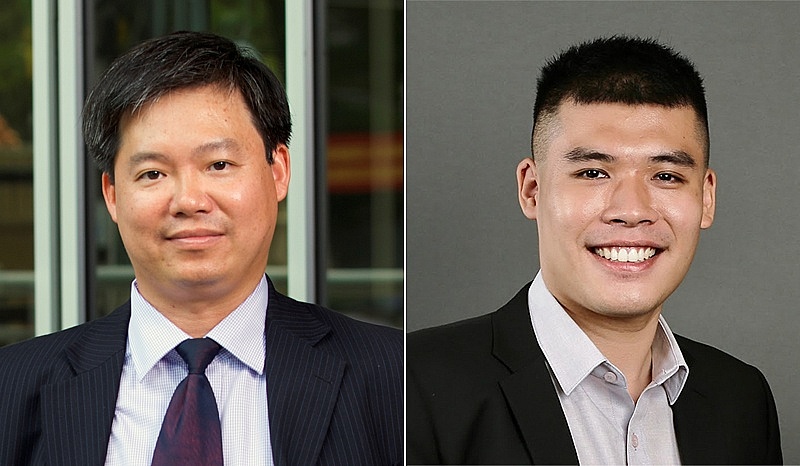

| Nguyen Hoang Nam, ESG leader and partner of Assurance Services (left) and Luong The Cuong, ESG manager of Assurance Services |

The CSRD extends sustainability reporting beyond traditional corporate borders, affecting all large companies and listed entities operating within the EU. However, its influence stretches further, impacting any global business connected to the European market, whether through supply chains or direct operations. This includes a significant number of subsidiaries and partners in countries like Vietnam, where European investment is substantial.

In our assessment, the CSRD is catalysing a significant transformation, reshaping the value-creation agenda for businesses globally. Alarmingly, according to PwC research, 45 per cent of global CEOs lack confidence in their companies’ ability to survive beyond a decade if they continue on their current trajectories.

The CSRD is set to impact around 50,000 businesses, pushing them towards greater sustainability and transparency. Supply chain disruptions are a considerable concern, with 43 per cent of global CEOs acknowledging their major or moderate impact on operations.

In response to these challenges, 75 per cent per cent of companies in Europe have already implemented carbon reduction initiatives, while 71 per cent are actively developing new climate-friendly products or processes, reflecting a strong commitment to sustainability and innovation in the region.

The CSRD broadens the scope of sustainability reporting beyond traditional frameworks. It mandates detailed disclosures on direct and indirect emissions: Scope 1 (direct emissions from owned or controlled sources), Scope 2 (indirect emissions from the generation of purchased electricity, steam, heating, and cooling consumed by the reporting company), and notably Scope 3 (all other indirect emissions that occur in a company’s value chain). The inclusion of Scope 3 emissions is particularly challenging due to the complexity of tracking emissions across extensive and diverse supply chains.

The timeline for compliance varies by entity type, starting as early as 2024 for some, while others have until 2026. All disclosures must be part of the management or sustainability reports, prepared in a single electronic format, and digitally tagged to ensure consistency and ease of access.

A significant aspect of the CSRD is its requirement for companies to report on their resource use and the adoption of circular economy principles. This is not just about recycling or waste management; it involves a fundamental shift in how resources are used and reused in business operations, aiming to minimise environmental impact while maximising economic efficiency. Companies are now required to disclose their initiatives and the financial impacts of these practices, pushing them to integrate sustainability deeply into their strategic planning.

The CSRD also extends corporate reporting to cover impacts on biodiversity and ecosystems. This is a critical area of focus that has gained prominence as businesses recognise their role in preserving natural habitats and species. For instance, pharmaceutical companies must consider how the sourcing of raw materials from specific plant species might affect biodiversity. The directive encourages companies to analyse and report how their operations could potentially endanger species or degrade habitats, which could, in turn, impact their business operations.

Under CSRD, companies must also consider the social impacts of their operations, including how they affect local communities and environments. This involves reporting on the human rights practices within their supply chains, such as labour conditions, wages, and the avoidance of forced or child labour. Companies face potential legal repercussions if their activities negatively impact communities or the environment, highlighting the importance of thorough and transparent sustainability reporting.

For EU subsidiaries operating in Vietnam, complying with the CSRD is particularly challenging. These subsidiaries must navigate the local regulatory environment and cultural practices while meeting the stringent requirements of the CSRD. They must engage with and possibly support local suppliers to enhance their capabilities in meeting these standards. This involves educating them about CSRD requirements, helping them implement necessary changes, and ensuring consistent reporting and compliance practices.

On the other hand, PwC has also observed that a significant number of Vietnamese businesses have yet to report on Scope 3 emissions. This is crucial because Scope 3 encompasses all other indirect emissions that occur in a company's value chain, which are often the most substantial portion of a company's carbon footprint.

Furthermore, subsidiaries need to align their operations not only with the CSRD but also with local Vietnamese laws related to environmental protection, social governance, and labour laws. This dual compliance ensures they meet both local and international standards, avoid legal issues, and foster sustainable business practices.

Adopting CSRD standards can serve as a catalyst for companies in Vietnam to improve their sustainability practices, enhancing their global competitiveness and market positioning. By implementing the CSRD, companies comply with regulations and contribute to a more sustainable and responsible global economic system.

How PwC can help?

At PwC, we are dedicated to helping companies comply with the CSRD in a manner that aligns with their broader business and sustainability goals. Our approach is multifaceted, encompassing education, strategic planning, and technical support. We offer comprehensive training sessions and resources to help businesses grasp the full scope of CSRD requirements, with a particular emphasis on the complexities of GHG inventory processes.

Additionally, we assist companies in seamlessly integrating their GHG reporting with other sustainability initiatives, ensuring that their compliance efforts also advance broader corporate objectives, such as the United Nations' Sustainable Development Goals.

Our team provides essential technical support to establish effective systems and processes for data collection, management, and reporting, which is particularly critical for managing Scope 3 emissions that require extensive coordination across the supply chain.

| ESG poses challenges for Vietnamese businesses in global trade expansion According to the Corporate Global Trade Survey Report 2023 published by Reuters, 88 per cent of businesses require annual environmental, social, and governance (ESG) data collection from their suppliers. This poses a new challenge for Vietnamese businesses in the process of global supply chain integration. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- ESG seen as key to Vietnam’s business credibility and capital attraction (September 29, 2025 | 18:38)

- From compliance to strategy: ESG criteria gaining ground (September 29, 2025 | 15:47)

- Vietnamese firms step up ESG game (September 23, 2025 | 15:26)

- Vietnam tax and legal changes set to shape foreign investment landscape (September 16, 2025 | 13:46)

- Vietnamese businesses navigate US tariffs (June 25, 2025 | 12:14)

- The impact of cloud, AI, and data on financial services (April 14, 2025 | 11:20)

- Vietnam 2025 M&A outlook: trends, deals, and opportunities (March 21, 2025 | 08:54)

- Vietnam's M&A landscape mirrors global trends (February 18, 2025 | 17:13)

- Asia-Pacific CEOs enter 2025 with optimism and caution (February 06, 2025 | 17:16)

- Proposed changes to interest deductibility rules may be welcomed by taxpayers (January 22, 2025 | 09:23)

Tag:

Tag:

Mobile Version

Mobile Version