A clear path for Vietnam’s robust growth

Despite the concerted efforts of central banks to raise interest rates, curbing peak inflation to 5.3 per cent by mid-2023, and a notable dip in global deal volumes, Asia-Pacific economies have showcased resilience, contributing a substantial 70 per cent to global growth. Forecasts predict the region will experience a robust growth rate of 4.8 per cent in 2024, the highest globally.

|

| Nguyen Luong Hien, partner of Deals Strategy at PwC Vietnam |

However, looking ahead to the medium term, it is imperative for Asia-Pacific countries, including Vietnam, to address profitability risks while simultaneously undergoing transformation. Key priorities encompass optimising supply chains, scaling new technologies, managing escalating costs and wavering confidence, prioritising the climate agenda, leveraging regional innovation, and rebuilding trust with stakeholders.

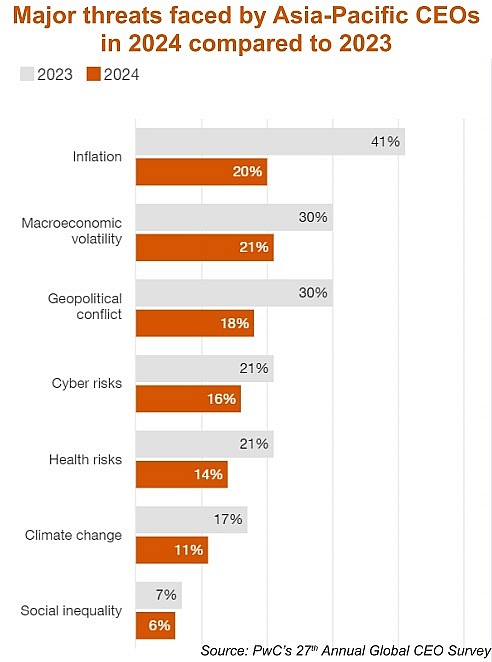

To facilitate these efforts and ensure viability, companies in the region are strongly advised to embrace reinvention, given a significant 63 per cent of CEOs do not think their companies will be economically viable within a decade if they continue on their current path, as highlighted in PwC’s 27th annual CEO survey for Asia-Pacific.

The report also reveals that 41 per cent of Asia-Pacific CEOs have not yet adopted generative AI across their companies in the last 12 months, even though they anticipate it to have remarkable impacts. Additionally, 20 per cent are not actively pursuing climate initiatives. Therefore, it is essential for CEOs to ensure the adoption and integration of initiatives related to GenAI and climate change into their strategies, while capitalising on opportunities for reinvention.

Further into the long term, the megatrends of technological disruption, demographic shifts, a fracturing world, and social instability loom large on the global horizon. These trends are not isolated challenges but existential questions that demand collective and proactive responses from businesses, governments, and societies.

Amid this global and regional dynamism, Vietnam emerges as a standout, poised for a strong economic rebound in the coming years. Thus, this article will delve into the key facets of Vietnam’s economic outlook, unravelling the factors steering its recovery.

|

Improved sentiments

In the trajectory of global economic development, emerging markets, including the Asia-Pacific region, are anticipated to play a pivotal role as more mature markets stabilise towards lower growth and inflation targets. Also in 2024, it is estimated that 40 per cent of Asian-based manufacturing companies will adopt multi-shoring sourcing strategies to enhance supply reliability. ASEAN will be a key beneficiary of trade shifts, with over 99 per cent of intra-ASEAN trade being tariff-free.

Vietnam is expected to witness GDP growth of 6-6.5 per cent in 2024, aiming for a return to pre-pandemic levels by 2025. The manufacturing sector, particularly electronics, has exhibited signs of recovery, evident in increased exports. This growth driver played a significant role in shaping Vietnam’s economic landscape in 2023, instilling confidence in the sector’s potential for further expansion.

The global demand for Vietnamese-made products is expected to increase as inventories of US retailers and consumer-facing firms decrease. Besides this, the robust inflow of foreign funding is expected to persist in 2024, providing essential support to Vietnam’s manufacturing sector.

Parallel to the resurgence in the manufacturing sector, Vietnam has seen a noteworthy rebound in domestic consumption. This rebound is expected to strengthen as factories rehire workers and the government addresses issues in the real estate market. Additionally, successful sales launches of residential projects indicate a thawing in the real estate market, which will further support consumer spending.

Amid the global economic challenges, Vietnam’s macroeconomic indicators stand resolute and stable. The State Bank of Vietnam’s strategic implementation of controlled inflation and interest rate cuts has been instrumental in providing stability during challenging times, setting the stage for future growth.

The stability offered by a resilient macroeconomic environment becomes integral in mitigating external shocks and fostering investor confidence. As Vietnam continues to attract foreign investment, a stable macroeconomic environment ensures a secure and predictable landscape for financial activities and business operations.

Although Vietnam’s trade has faced a slowdown, particularly with key partners like the US and China, the country’s ability to draw in over $39 billion in foreign direct investment in 2023 showcases resilience and gradual recovery from the impact of the pandemic. This influx of investment is anticipated to bolster Vietnam’s economic revival.

|

Dynamic chances

Vietnam’s retail sector is actively narrowing the income gap with other countries, witnessing varied spending patterns across different income brackets and contributing to economic vibrancy and inclusivity. Higher-income households tend to allocate more funds towards transportation and education, reflecting the evolving consumer landscape. This trend signifies socioeconomic progress and presents diverse opportunities for businesses to cater to the varying needs of consumers.

The narrowing income gap indicates a more equitable distribution of wealth, fostering social cohesion and creating a larger consumer base. For businesses, this trend opens up new avenues for market expansion and product diversification, aligning with the changing dynamics of consumer behaviour.

Meanwhile, the number of listed firms in Vietnam has remained stable at about 1,500, portraying a resilient business climate. Despite profitability challenges in most sectors over the past four years, primarily due to the lingering pandemic effects, the stability of listed firms forms a solid foundation for future growth and recovery.

Elsewhere, the global merger and acquisition market is poised for a surge in 2024. Noteworthy sectors expected to be particularly active include green energy, technology, real estate, and healthcare. Additionally, investors may explore opportunities in sectors that present favourable valuations during market declines, such as real estate and construction, industrial production, and logistics.

Successful dealmakers will prioritise strategy, assess the impact of megatrends (such as technological disruption, climate change, and demographic shifts) on their business models, and leverage transactions for transformative purposes. Key drivers for value creation in 2024 include the need for speed, a focus on talent, and the willingness to make bold moves.

The economic outlook for Vietnam in 2024 and beyond is one of promise and potential, despite global trade slowdowns and the ongoing impacts of the pandemic. The short-term positivity is grounded in tangible economic indicators and recovery trends, while the long-term trajectory depends on the strategic decisions and transformative actions taken by businesses and policymakers.

As the global and regional landscapes evolve, Vietnam’s journey towards recovery and growth stands as a testament to adaptability, resilience, and the pursuit of a sustainable future.

| PwC Vietnam appoints Mai Viet Hung Tran as general director PwC Vietnam today announced Mai Viet Hung Tran as its next general director, with effect from July 1. Tran succeeds Dinh Thi Quynh Van, who has served as in the position for 12 years. |

| PwC: Family businesses in Vietnam need to transform to build trust Family businesses not only need to make transformative changes to build trust, they have also got to make their efforts visible and communicate them clearly to their stakeholders, according to the Family Business Survey 2023 - Transform to Build Trust by PwC Vietnam. |

| VNU and PwC hold workshop on ESG practices On September 19, the Vietnam National University Hanoi Industry Collaboration Hub and PwC Vietnam organised a workshop to bridge the environmental, social, and governance (ESG) gap between academic institutions and businesses. The workshop drew more than 50 invitees, including experts, scientists, and representatives from various firms. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnamese consumers express concern about climate change (October 11, 2025 | 14:06)

- ESG seen as key to Vietnam’s business credibility and capital attraction (September 29, 2025 | 18:38)

- From compliance to strategy: ESG criteria gaining ground (September 29, 2025 | 15:47)

- Vietnamese firms step up ESG game (September 23, 2025 | 15:26)

- Vietnam tax and legal changes set to shape foreign investment landscape (September 16, 2025 | 13:46)

- Vietnamese businesses navigate US tariffs (June 25, 2025 | 12:14)

- The impact of cloud, AI, and data on financial services (April 14, 2025 | 11:20)

- Vietnam 2025 M&A outlook: trends, deals, and opportunities (March 21, 2025 | 08:54)

- Vietnam's M&A landscape mirrors global trends (February 18, 2025 | 17:13)

- Asia-Pacific CEOs enter 2025 with optimism and caution (February 06, 2025 | 17:16)

Tag:

Tag:

Mobile Version

Mobile Version