Vietnam's new tax regulations reflect global tax trends

PwC Vietnam has witnessed some major tax changes locally and globally, which may permanently alter how business works. Within this single year, a number of new regulations and drafts resolutions have been proposed or passed.

The 2023 tax and legal year-end conferences in Hanoi and Ho Chi Minh City were held in November – an annual event by PwC to help businesses keep up with the latest legal and tax developments in Vietnam, as well with as any relevant international practices.

|

| Nguyen Thanh Trung, tax leader, PwC Vietnam |

The most important tax development this year is the introduction of 'Pillar 2', which establishes a minimum effective tax rate to be applied to profits of large multinational corporations worldwide. Emerging economies like Vietnam will face a difficult challenge in meeting this demand while at the same time maintaining its attractiveness to foreign investors, as tax incentives may no longer be the advantage they once were. This issue, and other difficulties and possible solutions, were also discussed during the conferences.

Shortly after, the National Assembly approved a resolution on November 29 related to corporate income taxes under Pillar 2. Under the resolution, the global minimum tax will be applied in Vietnam from January 1 next year.

This year also saw many important customs, legal, and corporate tax updates. Notably, the in-country export and import model in Vietnam is propose to be abolished. The introduction of personal data protection, alongside the update on foreign loans and environmental policy applied to manufacturers, are among the critical developments of 2023. Additionally, the proposed amendments to several tax laws including corporate income tax, VAT and SST, together with the draft regulations on invoicing, attracted a lot of attention from the business world.

“These updates demonstrate policies that promote transparency and broaden the tax bases, especially from new sources of revenue, which are in accordance with international practices,” said Nguyen Thanh Trung, tax leader of PwC Vietnam.

“These are also in accordance with current global tax trends, which ensure a fairer distribution of profits and taxing rights among countries, re-allocating tax rights to the markets," Trung added.

Vietnam is an ever-changing compliance and regulatory environment. PwC Vietnam aims to ensure that businesses are well-informed of the latest tax and legal developments, which is vital for their management and daily operations.

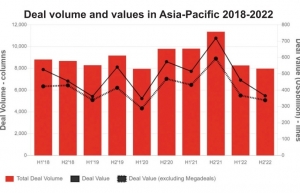

| Global CEOs resolute in M&As Global merger and acquisition (M&A) activities will likely rise later in 2023 as investors and executives look to balance short-term risks with their long-term business transformation strategies, according to PwC’s 2023 Global M&A Industry Trends Outlook. |

| Asia-Pacific Capital Projects & Infrastructure Summit spotlights sustainability The Asia-Pacific Capital Projects and Infrastructure Summit, organised by PwC Vietnam, took place on April 27 in Hanoi. The theme, Delivering infrastructure for tomorrow, today, focused on the country's development journey towards sustainable infrastructure. |

| PwC: Family businesses in Vietnam need to transform to build trust Family businesses not only need to make transformative changes to build trust, they have also got to make their efforts visible and communicate them clearly to their stakeholders, according to the Family Business Survey 2023 - Transform to Build Trust by PwC Vietnam. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- PwC 2025 Family Business Survey: navigating a new era of agility and purpose (December 10, 2025 | 11:59)

- Vietnam advances ESG in finance while critical data gaps remain (December 02, 2025 | 17:10)

- VCCI and PwC Vietnam launch 'Doing Business in Vietnam' to empower investors (October 14, 2025 | 11:41)

- Vietnamese consumers express concern about climate change (October 11, 2025 | 14:06)

- ESG seen as key to Vietnam’s business credibility and capital attraction (September 29, 2025 | 18:38)

- From compliance to strategy: ESG criteria gaining ground (September 29, 2025 | 15:47)

- Vietnamese firms step up ESG game (September 23, 2025 | 15:26)

- Vietnam tax and legal changes set to shape foreign investment landscape (September 16, 2025 | 13:46)

- Vietnamese businesses navigate US tariffs (June 25, 2025 | 12:14)

- The impact of cloud, AI, and data on financial services (April 14, 2025 | 11:20)

Mobile Version

Mobile Version