PwC study: $24 billion trapped in net working capital in 2018

The study analyses the working capital performance of the 500 largest listed companies by revenue across 15 sectors over the past four years.

The companies analysed have been listed on both the Ho Chi Minh City Stock Exchange (HSX) and the Hanoi Stock Exchange (HNX) for at least the past four years.

As a booming economy, the business environment in Vietnam is becoming increasingly competitive, especially in this time of emerging opportunities and potential trade shift from China owing to the US-China Trade War. As a result, in addition to growing the top line of its business, working capital management is essential for every company as it enables a faster cash conversion and reduced dependency on external financing sources.

| According to PwC Vietnam’s assessment, the working capital performance of Vietnamese businesses deteriorated last year while continuing to trail behind Asian and global peers. |

On the current status of working capital performance in Vietnam, Mohammad Mudasser, Practice lead, Working Capital Management of PwC Vietnam said, “We continue to see cash flows being sacrificed to attain top-line targets in Vietnam which is not sustainable for businesses in the long run. Managing operating working capital is a cross-functional responsibility, hence the role of CFOs must graduate from a pure accounting and controlling to a more active business partner in achieving the company's strategic objectives.”

Effective working capital management would additionally support companies’ liquidity needs, the lifeblood of any business. In recent years, while corporate debts have been constantly on the rise, the amount of trapped cash has also adopted on an upward trend. It is important for businesses to remain cognisant of internal cash release opportunities as it is the cheapest source of liquidity and, in many cases, may be the only source of cash in a harsh credit climate.

According to PwC Vietnam’s assessment, the working capital performance of Vietnamese businesses deteriorated last year while continuing to trail behind Asian and global peers.

ROCE down, margins flat

The report by PwC witnessed rapid top-line growth of Vietnamese businesses in fiscal year 2017-2018, with revenue growth of over 15 per cent for the companies analysed. However, margins contracted owing to higher cost of sales and other expenses. As a result, the Return on Capital Employed (ROCE) of the companies continued its downward trend, showing a 6.7 percentage point decrease in the 2018 fiscal year.

Cash release opportunities of up to $11.3 billion in the 2018 financial year

Companies in Vietnam left $24.1 billion on the table as cash trapped in their net working capital in the 2018 financial year which accounted for roughly 50 per cent of total net working capital (NWC) and 7 per cent of total annual sales of the companies analysed, respectively.

Remarkably, one-third of this amount can be realised for the engineering and constructions and consumer products industries alone. In terms of working capital elements, inventory days (DIO) was the most important element for the companies to focus on for cash release, followed by receivable days (DSO).

Deterioration in the C2C

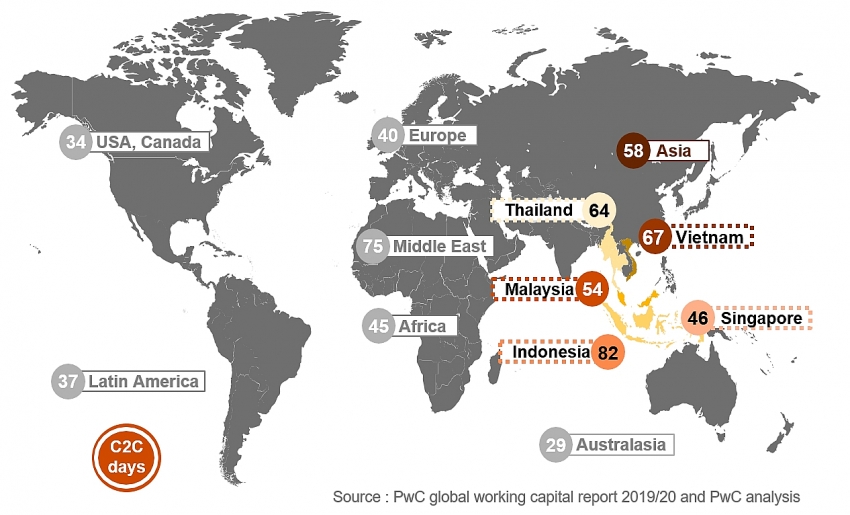

Working capital performance deteriorated in the fiscal years of 2017-2018 by two days reaching 67 days, mainly due to the shortening payable cycles. The findings also reveal that working capital needs were mostly financed through short-term borrowings rather than companies looking at opportunities for internal cash release.

There was also limited use of payables or receivables financing which can be easier to source financing avenues compared to traditional bank borrowings.

The fast-growing companies (companies with a sales growth exceeding the median in the past four years) had significantly higher short-term debt growth (CAGR of 13.5 per cent), indicating risks to the sustainable growth of these companies.

Significant improvement opportunities for Vietnamese businesses in shortening working capital cycle

|

Vietnam’s working capital performance continues to lag behind that of most Asian countries, as well as developed markets such as Europe, the US, and Australasia. PwC’s study shows that Vietnam’s C2C was nine days higher than the Asian median and 13 days higher than that of Malaysia. Malaysia, the second-best managed working capital economy in Asia, performed significantly better in inventory (ten days lower DIO) and receivables management (eight days lower DSO) when compared to Vietnam.

A widening gap between top and bottom working capital performers

The study also observed stark differences between top and bottom working capital performers’ performance over the last year. Whilst top performers managed to improve their performance, the bottom performers deteriorated further to result in an overall deterioration of the C2C of all the companies analysed.

The upper quartile of companies also achieved better financial performance in profitability, solvency, and liquidity ratios, as well as having the ability to self-finance instead of relying on external financing sources as the worst performers do.

Unlocking business potential with working capital management

Effective working capital management has an important role to play in gaining control over and releasing business’ trapped capital, a valuable resource that is often overlooked. This especially applies to fast-growing companies in Vietnam whose dependency on short-term debts is increasing by the year.

Along a similar vein, regarding growing concerns for sustainability, the study acknowledges that top working capital performers are best at reducing their C2C cycles, leaving companies in the bottom group far behind.

Beside a significant amount of trapped cash, as well as a stretching C2C cycle, the stark gap between revenue growth (15 per cent) and increase in operating profits (3 per cent) further signifies the growing burden of expenses and also implies significant opportunities for working capital improvement in Vietnam.

Different metrics of working capital performance in the 2018 financial year universally showcase certain limitations of working capital management in Vietnam despite the country’s economic growth. To stay ahead, businesses in Vietnam need to actively manage and maintain their working capital elements to optimise business efficiency and ultimately increase cost savings.

Established offices in Hanoi and Ho Chi Minh City in 1994, PwC Vietnam is proud of its team of more than 1,000 local and expatriate staff with a thorough understanding of the business environment in Vietnam and a wide knowledge of policies and procedures covering investment, tax, and legal, accounting, and consulting matters.

The company consists of different divisions including PwC Legal Vietnam, PwC Consulting Vietnam, and PwC Vietnam Cybersecurity for services diversification.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnamese consumers express concern about climate change (October 11, 2025 | 14:06)

- ESG seen as key to Vietnam’s business credibility and capital attraction (September 29, 2025 | 18:38)

- From compliance to strategy: ESG criteria gaining ground (September 29, 2025 | 15:47)

- Vietnamese firms step up ESG game (September 23, 2025 | 15:26)

- Vietnam tax and legal changes set to shape foreign investment landscape (September 16, 2025 | 13:46)

- Vietnamese businesses navigate US tariffs (June 25, 2025 | 12:14)

- The impact of cloud, AI, and data on financial services (April 14, 2025 | 11:20)

- Vietnam 2025 M&A outlook: trends, deals, and opportunities (March 21, 2025 | 08:54)

- Vietnam's M&A landscape mirrors global trends (February 18, 2025 | 17:13)

- Asia-Pacific CEOs enter 2025 with optimism and caution (February 06, 2025 | 17:16)

Tag:

Tag:

Mobile Version

Mobile Version