Mixed bag for pharma distribution

|

| Some domestic giants can gain from playing the role of local wholesaler, Photo: Le Toan |

|

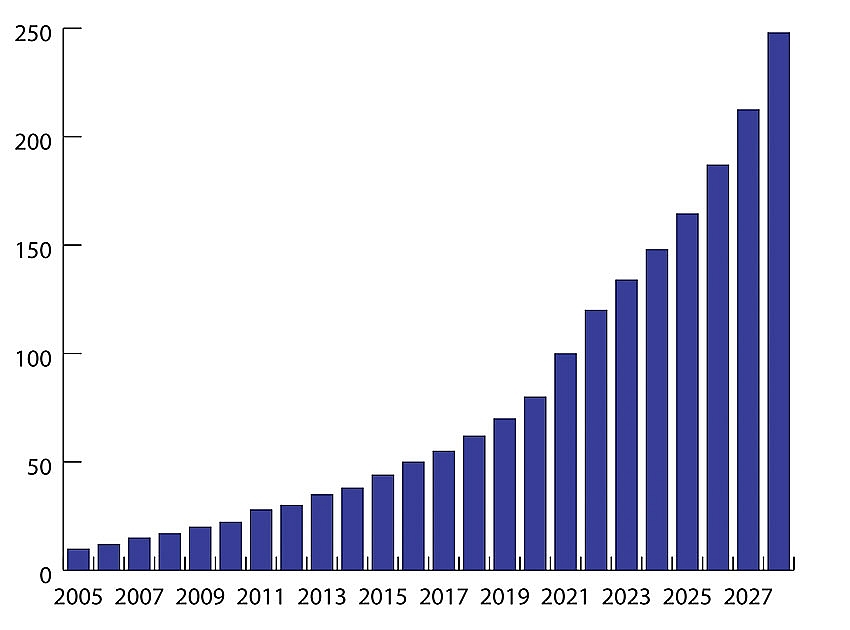

| Drug spending per capita in Vietnam 2005-2027 |

Penetrating into the Vietnamese healthcare market in 2014, Reckitt Benckiser Group Plc. – a British multinational in health, hygiene, and home products – made its latest move a few days ago to delve further into the country by signing a memorandum with the Ministry of Health (MoH) to launch a neonatal jaundice prevention scheme.

Present in over 60 countries with more than 40,000 partners, Reckitt Benckiser, with major brands in Vietnam including Enfa, Strepsils, Durex, and Gaviscon, is among the multinational corporations (MNCs) joining the race to meet the growing demand of local healthcare, together with famous brands like Sanofi, Zuellig Pharma, Novartis, and MSD.

“Lots of MNCs are interested in taking the opportunity to import all products. We will be looking at that chance too in the near future,” Bech Soren, general manager of Reckitt Benckiser Vietnam, told VIR. “We are now reviewing the conditions and will comply with the regulations. If we are going to import, we need to be in alignment. It needs about 12 to 18 months to review the requirements and what we need to do with investment to be able to carry out import.”

The interest of the group’s Vietnam branch is in intensifying the trend in which imports are around 55 per cent of total pharmaceuticals demands and has a more favourable legal framework for drug imports.

In spite of this legal corridor, groups which have or will receive certificates of eligibility for import in pharmaceuticals are said to face an obstacle to access the market as a wholesaler or join in other related activities such as tenders. This is due to restrictions to other activities related to distribution of drugs and medicinal ingredients in Vietnam under Decree No.54/2017/ND-CP issued in 2017 guiding implementation of the Law on Pharmacy 2016.

Distribution challenges

According to lawyers, the reason for restrictions is flowing from regulations pertaining to commitments to the World Trade Organization on goods trading and directly related activities for foreign-invested enterprises (FIEs) in Vietnam. The right to distribute pharmaceutical products is not granted to FIEs in Vietnam.

Therefore, in order to distribute the drugs, companies such as Sanofi Vietnam are required to work with a local wholesaler that distributes the drugs or medicinal ingredients into the local market. In other words, if FIEs working in importing drugs desire to distribute them, they normally enter into contracts with local wholesalers which are capable of distributing drugs and medicinal ingredients to health facilities and other drug-trading establishments in Vietnam.

According to Vaibhav Saxena, lawyer at Vietnam International Law Firm, the challenge comes as wholesalers of drugs and medicinal ingredients imported can distribute such items directly to the health facilities and drug-trading establishments without being controlled by the importing entity, which is not entitled to distribute them in Vietnam.

Marc Franck, chief executive at Zuellig Pharma Vietnam (ZPV) added, “It is correct that an integrated supply-chain model, whereby one company handles products from import until selling to healthcare facilities, typically ensures better control over the quality of the pharmaceutical products. This probably explains why this is the current operating model in most countries.”

“Yet, under the Vietnamese laws, ZPV only sells products imported by itself to local wholesalers who have been notified and registered with the MoH,” he continued. “These local wholesalers must meet stringent quality standards of the pharmaceutical industry and must obtain the GDP which is granted by the MoH.”

Currently not all local pharma companies have qualified distribution infrastructure, but leaders like Traphaco JSC, Imexpharm Pharmaceutical JSC (IMP), Domesco Medical Import-Export JSC, and Hau Giang Pharmaceutical JSC (DHG) have nationwide distribution networks with qualified warehouses and storages. This will put pressure on MNCs in ensuring their distribution network in Vietnam, and guaranteeing high standards from local wholesalers. Sanofi is not an exception, although its representative insists that “we believe we have strong enough capacity to ensure the quality of the drug import process.”

In one case, Sandoz – the world’s second-biggest generic pharmaceutical company and the generics division of Novartis – and Traphaco stopped distribution co-operation after entering the agreement in 2015.

“We decided to end the co-operation because of disagreements on the discount. We were the sole distributor of Sandoz drugs on the over-the-counter channel but we received fewer discounts for this, which is unacceptable,” said a representative of Vietnam’s second-largest publicly-traded drugmaker Traphaco.

Who will gain benefits?

While being predicted to suffer from competition in manufacturing from imports, Vietnam’s biggest drugmakers such as Traphaco and IMP are expected to benefit from distribution as local wholesalers thanks to their strong distribution networks.

“Local wholesalers may have more contracts with FIEs to distribute imported products to hospital, pharmacies, and retailers. The local wholesalers can also lease the warehouse to the FIE for them to carry out import activities,” said Le Net, lawyer at LNT& Partners.

Traphaco and fourth-largest drug maker IMP have the upper hand among major distributors of imports from MNCs, after Domesco and DHG, Vietnam’s biggest publicly-traded drugmaker, were deprived from distribution rights by scrapping the foreign ownership limit (FOL) thus enabling Abbott Laboratories to acquire 51.7 per cent of Domesco, and Taisho Pharmaceutical Holdings, one of Japan’s largest drug producers, to raise ownership in DHG to over 50 per cent.

Traphaco now has one distribution subsidiary, 28 distribution branches, and 40 agents nationwide, with partners from the likes of Canada, Japan, and South Korea.

Similarly, IMP owns 23 such branches in 63 cities and provinces, distributing products for a number of leading drug manufacturers worldwide, including Sandoz, Sanofi, Galien France, DP Pharma, Robinson Pharma, and INC.

Distribution is a profitable business channel for pharma companies. For example, IMP earned over VND40.8 billion ($1.77 million) in revenue from sales of other brands last year, according to IMP’s 2018 audited financial statement, making up 3.68 per cent of the firm’s total revenue from sales of products.

Traphaco’s sales of other brands make up 5-6 per cent of total sales revenues. “We aim to increase the percentage further in the upcoming time,” said the Traphaco representative.

On the contrary DHG suffered from a hard 2018 with consolidated net revenues falling 4.43 per cent on-year after it gave up the distribution business to serve the lifting of the FOL. Doan Dinh Duy Khuong, acting CEO of DHG, blamed the slight fall for a halt in distribution of MSD and Eugica products.

According to the MoH, together with Sanofi Vietnam, Zuellig Pharma, and DKSH, many MNCs in Vietnam are now applying for a licence to import drugs to Vietnam directly, which is expected to bring about more business opportunities for local distributors. Seeing potential ahead, Traphaco will focus on business with imported products in the second half of the year.

The drugmaker is also co-operating with South Korea’s Daewoong in sole distribution of its products in Vietnam, and technology transfer to help Traphaco produce Daewoong items at Traphaco’s Hung Yen factory, as well as in research and development activities.

According to statistics from the MoH, Vietnam’s drug imports increased 8.8 per cent on-year in 2018 to $3.7 billion, reflecting the growing local demands. The growth momentum is forecast to continue in the months to come.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version