Indian hotel network OYO on red alert

|

| OYO jumped into the Vietnamese market last July, pledging to invest $50 million next years. Photo: OYO financials (TechCrunch) |

Recently in a Facebook group for startups, the account named Binh Thai Nguyen complained about OYO’s unprofessional business manner.

Accordingly, Binh Thai Nguyen– who claims to be OYO’s partner in Vietnam – encountered a number of problems where he continuously emailed and dispatched documents to both OYO's country head for Vietnam, Dushyant Dwibedy, and OYO Vietnam director Dao Thi Bich Tram. However, responses were a long time coming, sometimes even taking more than a month.

Previously, another hotelier in Ho Chi Minh City’s District 1, Dung, also complained of similar issues. As contracted, the hotelier was charged by OYO 25 per cent commission on each transaction made. However, Dung's hotel currently had four rooms for long-term lease which had been occupied before his contract with OYO, but the franchiser included these rooms in its calculations. The hotel owner repeatedly complained but to no avail.

Dung also noted that though OYO committed to provide free management training courses for employees during the co-operation, there was nothing done. After a few months, Dung decided to terminate the contract with OYO.

OYO has drawn its partners' ire not only in Vietnam but in the startup’s other markets, too. Reuters has also interviewed a number of hotel owners in 10 cities in India to find that there are more and more hoteliers who are not satisfied with the company's fee policy.

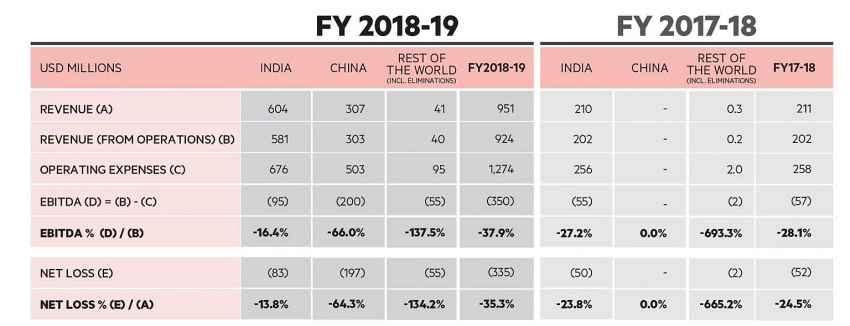

Eager to be a real rising star with sky-high growth and the wild valuation of $10 billion, the technology hotel franchise company has reached out to more than 800 cities, with more than 23,000 hotels worldwide, seizing the title “the third-largest and fastest-growing hospitality chain by room count”. On the other hand, during the 2018-2019 fiscal year, its net loss mounted to $335 million, a nearly seven-fold jump on-year, while its profit reported a fourfold increaseto reach $951 million. Most of the punches came from China, OYO’s main and biggest market where it is diverting 40 per cent of the funds.

In addition, OYO welcomed 2020 with a global downsizing campaign, cutting down thousands of employees in China, the US, and its home market – India.

The thunder-paced expansion – pressure from being a unicorn – has led to OYO’s inadequate operation, management, and personnel systems with dramatic losses.

As OYO is very much threatened to become the next unicorn to pass into oblivion, after Uber and WeWork, SoftBank Vision Fund is starting to look like a bad streak, with all three of these companies and other startups like CloudMinds, Bird, or Lyft turning out to be pyres for its cash and contributed to dragging down SoftBank Group's profitability by a whopping 99 per cent in the last quarter.

This also raises questions about the fortune of VNLIFE, the first Vietnamese firm to make it into Softbank Vision Fund’s portfolio with a $200 million deal. VNLIFE is the parent company of fintech VNPAY, the leading Vietnamese digital payment firm established in 2007. After receiving this historic investment, VNPAY officially made it into the select group of unicorns.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Sheraton Phu Quoc rolls out Lunar New Year 2026 cultural and dining programme (February 11, 2026 | 09:00)

- Fairmont opens first Vietnam property in Hanoi (February 04, 2026 | 16:09)

- Marriott signs major deal to expand luxury hotel footprint in Vietnam (February 04, 2026 | 15:58)

- Welcome Year of the Horse at Four Seasons Resort The Nam Hai (January 30, 2026 | 16:18)

- The Grand Ho Tram to host the first-ever IBF convention in Southeast Asia (January 29, 2026 | 12:18)

- Danang Marriott ushers in Lunar New Year by the sea (January 28, 2026 | 11:42)

- Angsana and Dhawa Ho Tram offer a serene Lunar New Year retreat (January 23, 2026 | 23:38)

- Tides of Heritage: A Tet speciality at InterContinental Phu Quoc Long Beach (January 20, 2026 | 12:08)

- Muong Thanh launches Lunar New Year gifts inspired by tradition (January 16, 2026 | 16:41)

- The Grand Ho Tram seeks responsible entertainment with pilot casino access (January 16, 2026 | 10:56)

Mobile Version

Mobile Version