Brand development and more on agenda for SABECO

On the whole, it has been a successful 12 months for Saigon Beer-Alcohol-Beverage Corporation (SABECO).

Chairman Koh Poh Tiong acknowledged that last year was a challenging one, for both Vietnam and SABECO in particular, as global economies have been rocked on many fronts, such as geopolitical uncertainties, the impact of soaring inflation and interest rates, and supply chain disruptions.

But general director Bennett Neo added that despite these challenges, SABECO has strengthened its market position, continued to grow market share, and drove consumer consumption.

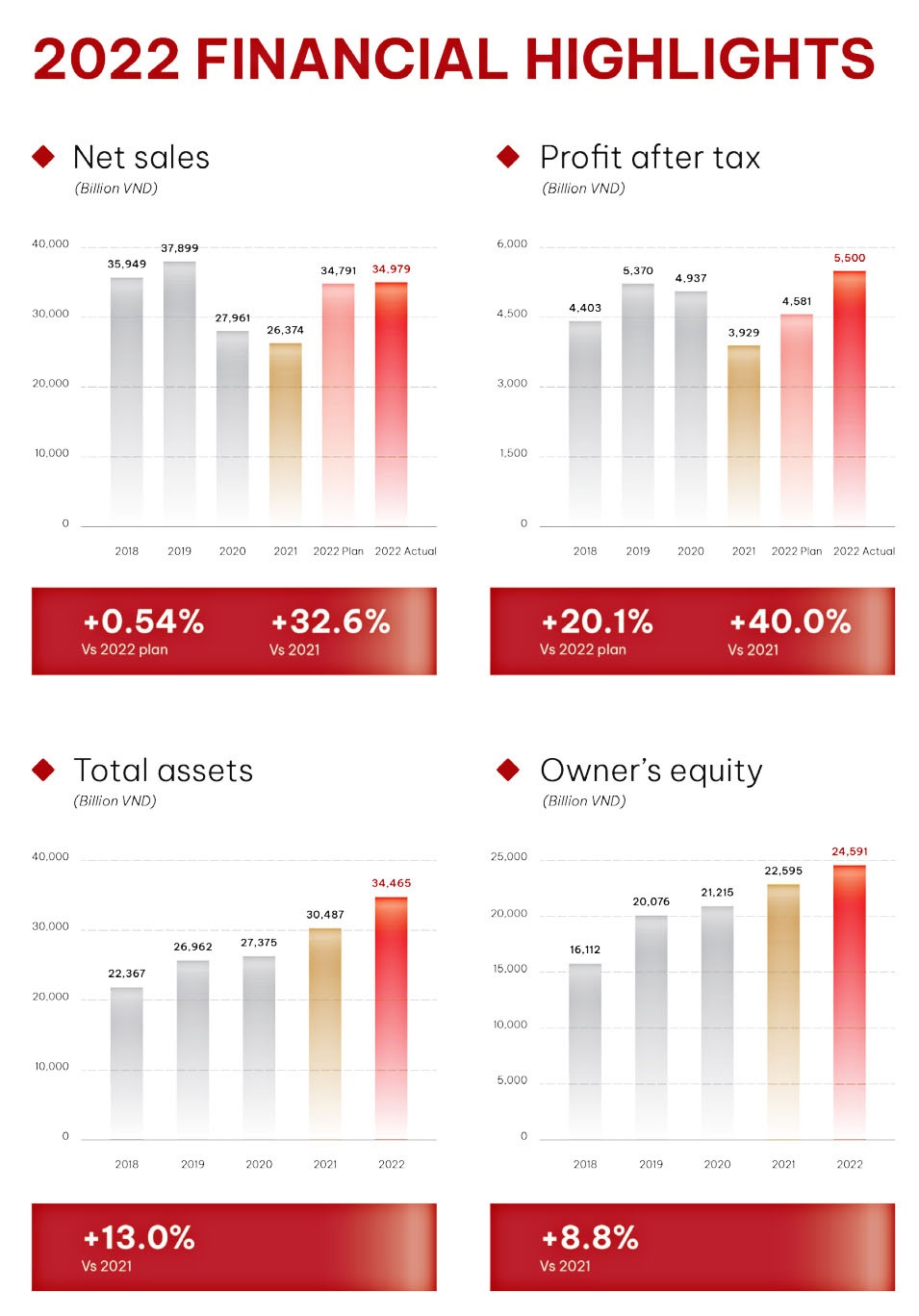

“Our performance for the year was respectable, and we managed to surpass last year’s revenue and profit after tax by 33 per cent and 40 per cent respectively,” Neo noted ahead of the company’s AGM. “This was the highest profit after tax in the history of SABECO despite the impact of higher input costs. I am proud to say that this outstanding performance would not have been achieved without the hard work and dedication from everyone involved with SABECO.”

|

Delivering value

After dealing with challenges caused by the prolonged pandemic these past few years, SABECO’s business has generated a healthy recovery since Vietnam fully emerged from lockdowns and markets across the country were reopened. In order to strengthen competitive advantages, the corporation embarked on Phase 2 of its transformation journey, covering six strategic pillars.

The company’s beer sales achieved a robust performance compared to 2021 due to stronger consumer demand, the return of on-premises consumption, and improvements in SABECO’s brand health and awareness. Despite the intensifying competition, it managed to gain market share thanks to effective consumer promotions for both on-trade and off-trade channels, as well as vibrant marketing campaigns being launched across the Bia Saigon and 333 brands.

Net sales reached VND34.98 trillion ($1.49 billion), increased by one-third on-year, coming from better volume performance with a higher proportion of mass premium that contributed to the better brand mix, and the favourable impact of price increases.

According to SABECO, 2023 boasts golden opportunities for Vietnam’s beer industry. The trend of consuming mass premium beer brands will continue to grow over the long run, company leaders say. However, potential consumer belt-tightening may impact sales due to their incomes still affected by restrictions in recent years.

In addition, strengthened competition and more robust alcohol-related legislation and tax rises could also continue to affect performance.

|

Setting a positive outlook

SABECO is projecting net revenues of VND40.28 trillion ($1.72 billion) for 2023, an increase of 15 per cent on-year, and an after-tax profit of VND5.78 trillion ($246 million), up 5 per cent on-year.

SABECO’s Board of Directors said that the company’s 2023 business plan is based on the goal of sustainable growth to create motivation for long-term development. Accordingly, to implement the business plan, the company will focus its resources on branding and market development activities; apply digitalisation; improve supply chain efficiency; and reform to improve investment efficiency.

The operating environment remains challenging and uncertain, Neo explained. “With the intensifying competition landscape coupled with the fear of economic slowdown, we are cautiously optimistic about our business growth and performance. Against this backdrop, we remain committed to delivering our short-term priorities and long-term goals,” he said.

“We will continue to defend and grow market share as well as sales volume, both sustainably and profitably, continue to drive productivity improvements, and mitigate input cost pressures. I am confident that with the relentless efforts across SABECO, we will be able to achieve the next level of success,” he said.

The agenda for the 2023 AGM, which will be conducted in Ho Chi Minh City on April 27, notes that the firm plans to announce a share issue at a ratio of 1:1, meaning shareholders will receive a new share for every share they already own. Following approval from the State Securities Commission of Vietnam, SABECO’s charter capital will increase to VND12.8 trillion ($546 billion). In addition, the company is set to increase its 2022 dividend payment from 35 per cent to 50 per cent.

SABECO will explain the accomplishments of its disciplined execution across all business areas, including relatively satisfactory earnings and sustainable dividend payouts. “Our relatively stable operational performance allowed a dividend payment of up to 35 per cent of par value to shareholders, meeting the plan approved at the 2022 AGM, and an additional special dividend payment of 15 per cent of par value pending for approval at the 2023 AGM,” the agenda document read.

The company is also set to offer a series of solutions to focus resources on branding and marketing activities, including developing brand positioning, production, and distribution to meet market needs, professional distribution network restructuring, and effective supporting channels and product segment control, as well as maintaining the domestic market and reaching out to the international market.

It is set to promote research and development initiatives to improve product quality and new product offerings, and apply the SABECO 4.0 digital system in administrative and business activities for SABECO, its group of companies, and for the capability and efficiency of its supply chain system.

In 2023, the company will continue to commit to sustainable development around the themes of consumption, conservation, country, and culture, which will include social activities, community support, and environmental protection.

According to BIDV Securities Company, the investment thesis for shares of SABECO are its top share of the beer industry, with 34 per cent market share of output, a solid position in popular segment communication, and growth potential from the high-end segment. This is thanks to a variety of product structures aimed at young customers and a healthy financial structure supporting diverse sales and marketing activities, it added.

BIDV forecasts that SABECO’s net revenues and profit after tax-minority interest in 2023 will be up 8.9 per cent and 7 per cent on-year, respectively. Profit growth is being driven by proactively capturing market share thanks to the wide coverage of product lines in both the low-end and high-end segments, as well as diversified marketing campaigns.

| SABECO and Bia Saigon back Vietnamese athletes With a commitment to bring the best out of the country, SABECO and Bia Saigon, along with the Sports Administration, are working together to elevate sport in Vietnam and back its talented athletes. |

| 2023 to be lucrative for SABECO Saigon Beer-Alcohol-Beverage Corporation (SABECO) has just released the agenda for its 2023 AGM, which will be conducted in Ho Chi Minh City on April 27, where the firm plans to announce a share issue at a ratio of 1:1. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version