Textile sector hemmed in by challenges

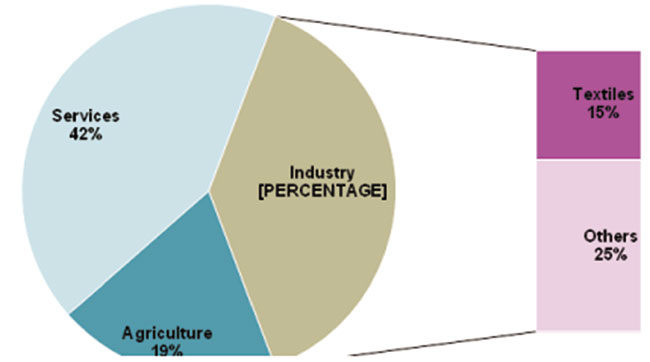

Share of Textile in the GDP of Vietnam (2014)

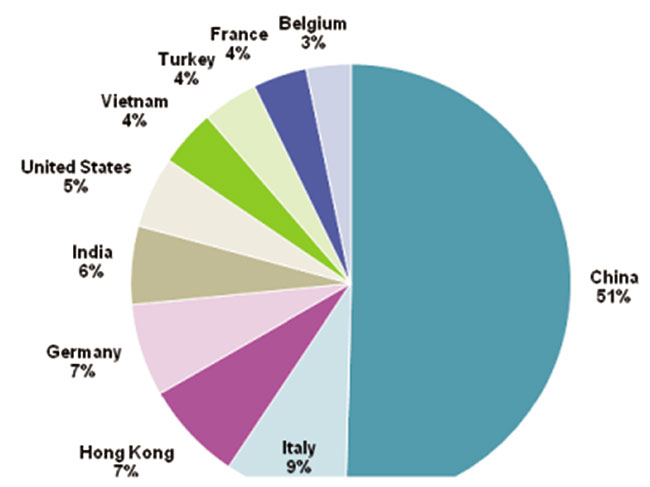

Vietnam’s share in Global Textile Trade (2014)

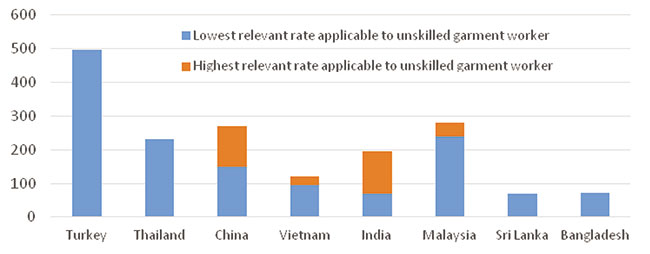

MINIMUM MOnTHLY WAGES IN THE CLOTHING INDUSTRY IN 2014, SELECTED COUNTRIES

The current state of flux in the global economy has created an interesting situation for global manufacturing and trade flow. The conclusion of the Trans-Pacific Partnership (TPP) negotiations in the US on October 4th, 2015 brought about a new turning point for Vietnam’s economy. While foreign direct investment (FDI) in the manufacturing sectors has steadily increased over the past few years – some in anticipation of this agreement – the TPP is expected to further surge investment interest in Vietnam in the coming years. This will not only be from TPP participant countries, such as the US and Japan where booming garment and shoe industries are poised to benefit from the elimination of tariffs, but from any country whose manufacturers are seeking easier and more secure access to some of the world’s most exciting consumer markets.

Keeping in mind the favourable prospects for the textile and garment industry, macro-economic indicators also pose fair warning to export dependent economies such as Vietnam whose key selling point is primarily cost arbitrage. As the TPP and other future free trade agreements (FTAs) bring opportunities to Vietnam for increasing production and export, they will also create challenges that need to be tackled in order to secure future economic prosperity. We look at Vietnam as a case in point to understand the possible way forward to maintain the growth story of the past decade in light of current opportunities and threats.

Vietnam’s textile industry

The past decade witnessed the Vietnamese GDP growing at 6 per cent plus CAGR. The conducive economic environment has helped Vietnam grow its economy from $57 billion in 2006 to $187 billion in 2014. Investors have been bullish about this growth story and have pumped $4 billion into the economy annually between 2001 and 2015. The textile industry has been a primary growth engine in a manufacturing-driven economy contributing 15 per cent to the overall GDP, 18 per cent to overall exports, and 4 per cent to the global textile industry. The textile industry, being an important driver of the Vietnamese economy, necessitates a focus in strategy formulation to maintain robust and sustainable performance in the evolving economic scenario.

The primary driver for the growth of the Vietnamese textile industry came about with the completion of the Multi Fibre Agreement (MFA) in 2005, which resulted in the abolition of quotas for first-world exports. The post-MFA era growth trajectory has not been too different for Vietnam’s peers like China, India, Pakistan, Bangladesh, and Sri Lanka. The growth across all these countries has been significantly driven by outsourced manufacturing work from the developed world for obvious reasons of labour cost arbitrage. The labour arbitrage remains the single biggest driver for order inflow especially in the ready-made garments segment. The abundance of orders from the developed world resulted in a spurt in manufacturing with a mushrooming of small to medium players across these countries with turnover between $50 million to $200 million per annum.

With Vietnam’s share of the global textile trade at 4 per cent, and being one of the top exporters of textiles and garments to the US, there is still a lot of scope in the short- to medium-term for accommodating more companies, or for the existing ones to add significantly to their current volume and revenue. The FTAs being signed with the Eurasian Customs Union, and South Korea, as well as the TPP (which is estimated to increase exports to the US from $9.8 billion in 2014 to $30 billion in 2020) will certainly provide this impulse.

While the macro situation seemingly assures sustained topline growth potential, the challenge of comparative cost inefficiencies will be even more significant with general price reductions by competing countries. Statistics show that while trade has expanded, the prices from exporting nations have actually reduced. Average import prices for the US in 2013 from China were lower than the 2008 prices. Garment prices from Bangladesh fell by 40 per cent in the mid 2000s and similar price reductions have been reported from other countries as well. The global price reduction trends put immediate pressure on the suppliers. The former International Textile, Garment, and Leather Workers’ Federation (ITGLWF) reported that around 8,000 textile, clothing, and footwear production units were closed following 2008. This resulted in the loss of 11 million full-time jobs and three million part-time jobs around the world. As such, it is imperative for the Vietnamese textile industry to look deeply into its operating models and to tackle possible cost disadvantages in order to remain competitive globally.

Challenges - opportunities

The opportunities for the Vietnamese textile industry to improve its operating structure to continue its globally favoured position can be found in the supply chain and depends on elements in labour productivity, supply lead time reduction, maintaining delivery quality, and improving labour practices to meet the standards of delivery in the global demand centres (primarily Europe and the US).

Labour productivity

Labour, the single biggest driver behind cost arbitrage and the prime reason behind businesses thriving in these countries will become a progressively scarce commodity. Wages will rise and gradual erosion of this cost arbitrage would remove the differentiating advantage. China is a case in point, where former growth tailwinds took the exports and the capacities to several multiples. Labour wages in China rose to close to $200 per month as compared to Vietnam where these hover around $100-110 per month. Numbers in India are closer to Vietnam, and in Bangladesh they are lower still. With stagnation and in select categories contraction, the Chinese industry shifted its focus towards increasing labour productivity. In fact, labour productivity in China has moved forward in leaps and bounds, and has been the reason why business has remained there – although times are changing of late with decreasing arbitrage.

Studies have shown that once the TPP comes into effect the new trade relationships would create an additional six million jobs in Vietnam’s textile and garment industry. However, it will also increase the labour wage by 12 to 15 per cent. As a consequence, Vietnam needs to invest in techniques of modern floor management and industrial engineering practices to further enforce the advantage. Industrial engineering, lean manufacturing practices – especially in the cut and make departments – can help the organisations increase labour productivity substantially. Such techniques have produced significant improvements globally with labour productivity rising by as much as 20-25 per cent.

Supply lead time

Supply lead time is the other major differentiator: Players having control on upstream activities would be the first choice for customers sourcing in Vietnam. Gaining control can be done either by backward integration (a challenging task depending on the proximity to developed procurement hubs) or putting appropriate demand management, planning, and procurement processes in place. With cost arbitrages often becoming a secondary factor, lead times and the ability to deliver on time becomes the lynchpin of orders. There have been several cases where individual big players in India and China have taken orders on premium and cashed in their ability to manage supply lead times. For Vietnam, a key aspect of the infrastructure, apart from the plant and machinery, is the logistics infrastructure. The current state of Vietnam’s logistics infrastructure is sub-optimal, leading to higher procurement and delivery lead times with the sourcing to free on board shipping point) time often as high as 80 days. Players in other countries are operating with lead times of between 40-50 days. The situation can be remedied through the development of local sourcing options, which can cut the sourcing time of 20 days considerably. There are also further opportunities to slash manufacturing lead times to further improve overall order to delivery cycles. Leading companies in India and China have been able to bring down the manufacturing lead times by 30-40 per cent through integrated planning processes and industrial engineering practices. Other aspects such as custom clearance (which takes five days as against one day in China) can also be streamlined to increase competitiveness .

CSR and labour practices

Corporate social responsibility (CSR) and clean labour practice concerns have become major issues over the last number of years. The recent occurrence in Bangladesh of labour deaths as a result of building collapses and fires have moved global retail leaders to scrutinise industrial standards.

Investment in employee welfare, the formulation of appropriate labour regulations, and due emphasis on CSR would become business necessities going forward. The Vietnamese textile industry has the potential for varied growth in the years to come. However, to realise this, long-term product and market strategies need to be formulated. Processes and systems need to be put in place along with the requisite infrastructure to enable high quality delivery to customers with shorter lead times. The industry needs to move towards effective labour utilisation, and shift from the common global perception of running low labour cost factories. A comprehensive re-examination of supply chain principles along with modern floor management principles like lean manufacturing, have the potential to take the performance of organisations to the next level and make Vietnam a global textile powerhouse.

The views expressed by the authors here do not necessarily represent the views and opinions of KPMG Vietnam.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- KPMG launches tariff modeller in Vietnam to navigate US tariff risks (July 29, 2025 | 12:11)

- Removing hidden barriers to unlock ASEAN trade (June 29, 2025 | 11:31)

- New report charts path for Vietnam’s clinical trial growth (May 21, 2025 | 08:58)

- TTC Agris strengthens market position with investment in Bien Hoa Consumer JSC (May 19, 2025 | 10:14)

- World Bank to help SBV build shared database for banking industry (April 09, 2025 | 08:55)

- New trade alliances and investment hubs are redefining global power dynamics (April 03, 2025 | 17:00)

- ACCA and KPMG forge path for business leaders to pioneer ESG excellence (March 07, 2025 | 10:09)

- VietBank signs MoU with KPMG (February 26, 2025 | 18:47)

- Warrick Cleine MBE: an honour for services to British trade and investment in Vietnam (December 31, 2024 | 20:16)

- KPMG report offers fresh insight into leveraging AI (December 24, 2024 | 09:23)

Mobile Version

Mobile Version