Startup guide to fledgling enterpreneurs

This article was written as a rudimentary introduction to the startup process, of what to keep an eye for, and a short glossary of the obscure terms and stages involved.

Stages of funding

Setting up a startup can be best broken down to the stages of the so-called funding process, the timeline denoting the milestones of growth and increased funding, as well as the emergence of new partners and co-owners.

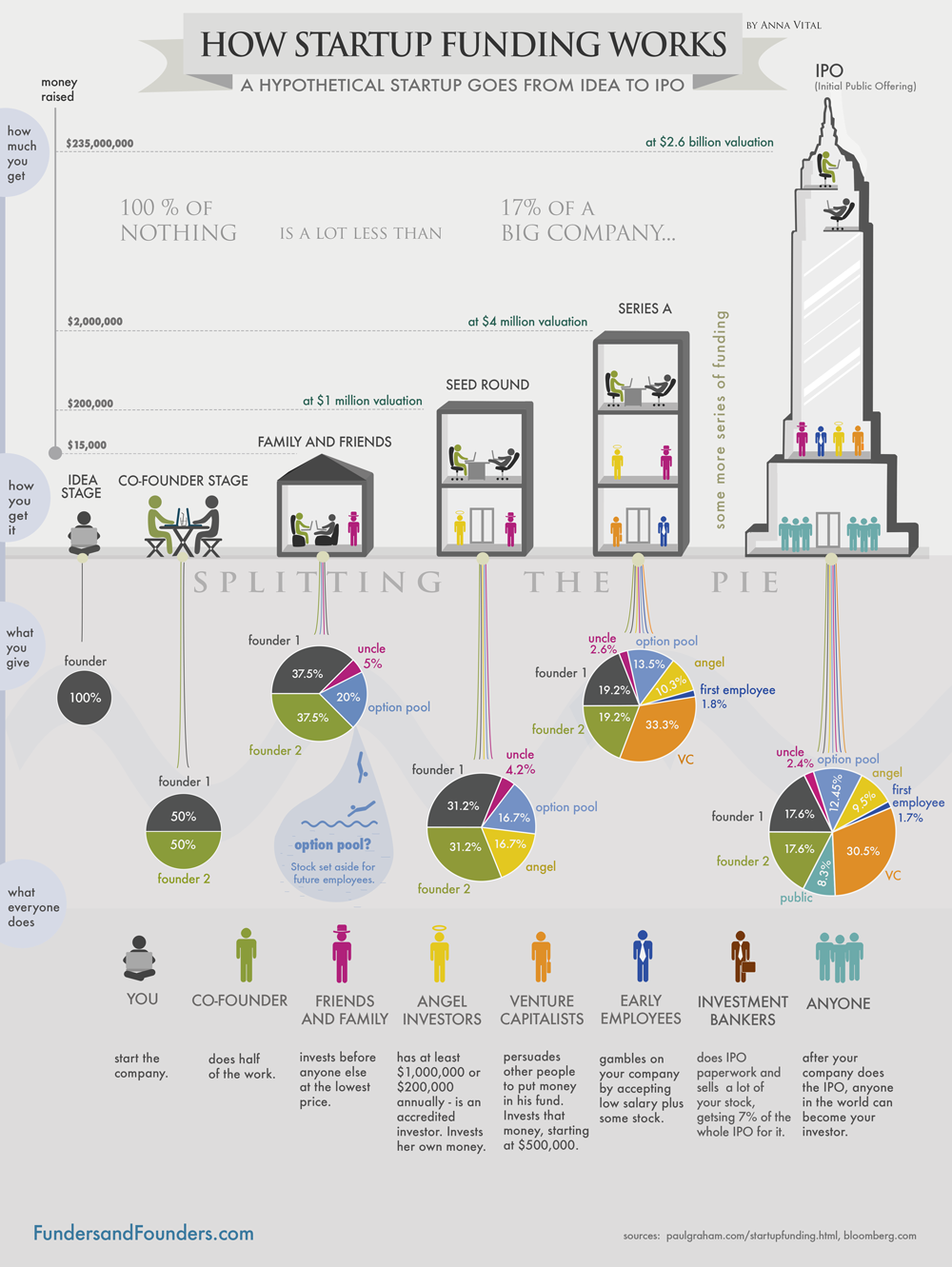

Probably the best (and simplest) run-down on the process was compiled by information designer and infographic author Anna Vital, whose chart is widely used as the best introductory tool to the stages of start-ups, running from the idea stage to the eventual IPO.

|

| Anna Vital's handy infographic on the startup funding process (Source: http://fundersandfounders.com) |

Idea stage: It all starts with a single person who decides on realising an idea, to bring out a product or service, and build an enterprise around it. During this preparatory stage, this single person is working on the idea alone, drawing up plans, crystallising the rough outline of the actual product, and while he/she is nowhere close to the end product yet, actual value is already being created, 100 per cent of which belongs to him/her.

Co-founder stage: After a while comes the time when a single person has to admit that his limited resources, be it product-specific knowledge or finances, may not be enough to go ahead. While it is possible to bootstrap an enterprise from the get-go, aspiring entrepreneurs usually look for a trustworthy partner to share the workload and help with networking—a large number of startups went bust because the founders spent way too much time tinkering with the product in the backyard, while ignoring looking for customers or further funding.

Having a second (or third) person on the team, while diluting ownership rights, provides an enterprise with much-needed expertise and access to larger audiences or funding opportunities. On the other hand, this setup is also rather limited in its resources and it usually does not stretch far enough to show a working product before more funding is needed.

Family and friends round: Further funding is only available by formalising the enterprise, registering it and securing the relevant documentation, after which it accept funds from the public (otherwise it would be “public solicitation,” which is largely against the law). In this round of funding, entrepreneurs have two options: either going around friends and family or hitting up accredited investors and making your pitch.

Either way, capital contribution means handing out equity, partial ownership of the company. While entrepreneurs are understandably against the idea of giving up ownership and control, there is a lot going in favour of this from a financial perspective, the primary argument being that there are no better alternatives to grow.

A significant amount of capital may be acquired without giving away controlling interest in the enterprise itself—as Anna Vital put it, “Your slice of the bigger pie will be bigger than your initial bite-size pie.”

| Simple maths of capital contribution An angel investor values the startup company at $1 million and offers to invest $200,000. By pre-money valuation, $200,000 should be worth 20 per cent of company ownership. However, by putting in $200,000, the angel investor would hold 20 per cent of a $1,200,000 company—higher than his share in the total company capital, which is only about 16.7 per cent. Thus, when angel investors make a capital contribution, startups need only give them ownership equity proportional to their share post-money valuation, which is in this case 16.7 per cent. |

Seed/Angel round: Startups need to be constantly on the lookout for funding, growing complacent after securing the first capital contribution usually spells doom for the company: founders need to be constantly planning for success, growth, and additional expenses.

After their initial contribution, friends and family might not have the resources to provide sufficiently large funds, especially not to a formal startup company. This is when incubators, accelerators, and excubators come into the question, along with angel investors—the time for the well-honed pitch to sway business professionals and force open their purses.

Venture capital round: After building the first version of the product and establishing some traction with users through (hopefully) working with incubators and accelerators, even angel investment might seem relatively small funding. The next step would be approaching venture capitalists, who are essentially bigger, financially more capable angel investors.

The first VC investment will be the company’s Series A, after which Series B, C, and the rest of the alphabet may follow in good order. In case everything is going well, the product sells like hotcakes, customers maintain heavy demand, and the enterprise itself remains financially viable, the company will reach its end-game fantasy: either acquisition by a larger firm or the long-aspired IPO.

Keep lean and clean

After clarifying the growth stages of a startup company and seizing up the long road ahead, aspiring entrepreneurs need to turn their attention to the essential business processes without which the enterprise cannot function. It cannot be stressed enough that without sufficient forethought and organisation even the best product idea may not find the appreciative target audience and that haphazard management can be the death of any company. This is especially true for startups that by their very nature attempt to build a castle out of thin air.

Business Insider provides a hefty list of the eight most crucial business processes to look out for, but first and foremost startup founders need to keep one thing in mind: a startup is all about innovation, even in the smallest nuances. There is no sure-fire sample to follow and the most successful companies have managed to tailor the smallest facets of business management to give them the edge. It is all about streamlining, keeping every process small and compact, monitored and customised at every turn of events—small businesses at their heart are all about efficiency.

|

| The success of a startup rides on efficient and innovative management (illustration, source: http://sujanpatel.com) |

Many of these points might seem obvious, yet a whole legion of startups went bust from not actually paying due attention to them. Most of them (save for the ones with the most inane management) started off doing them, but they failed to pay constant and unwavering focus on keeping and revising their processes, thinking the initial plan was good to go—losing a couple of dollars at each turn, expenses mount up and bury a company over time.

Managing financial and physical assets: A good idea alone hardly ever sells the product. A company needs to be financially viable to provide the optimum price, and simple accounting is a must to keep track of the company’s available funds, of where the money comes from and where it goes.

Developing a business plan: Jot down the key elements and keep the list updated. The first version of the plan may need to include critical processes, such as market opportunity, requirements, product definition, business model, sales process, organisation. Never forget to keep revising, expanding, and changing these points, they become obsolete surprisingly fast as the product gains shape, the market develops, and funds shift.

|

| Illustration, Source: http://www.spinachandyoga.com |

Funding process: Create a clear plan on what networking and documents are required to get to friends and family, angel investors, and institutional investors. Make sure all legal procedures are observed and keep track of your networking options and activities.

Product development process: Continuously document product requirements, features, metrics, and milestones in its development.

Manage human resources: Recruit, hire, pay, and train others, while ensuring effectiveness and consistency. In addition, keep track of legal obligations and tax considerations—startups and small enterprises are famous for being informal and lax workplaces, which promotes creativity and inclusion, but the legal foundations should be solid as stone.

Leverage IT: Prepare a plan well in advance on how to acquire, utilise, and implement IT solutions in your business. As the enterprise grows, teamwork and common working surfaces will become all the more important and a few handy features can go a long way towards making operations more effective. In case of technology startups, it is advisable to decide early on how the company will access the internet, what servers will be required, and how the databases will work. Additionally, do not ever forget the scheduled backup.

Billing and revenue collection: Companies need to explore their options on the most economical sales methods and collecting revenue. Sales methods not only include finding the right website to sell on, other alternatives, including delivery services also need to be evaluated.

Customer service and support: Customers need a readily-available contact that can offer professional and quick response, attesting to real expertise. Remember: if you do not hold yourself a business, people will not see you as a business.

Startup dictionary

Below is a rudimentary glossary of terms associated with startups. While the list is (very) far from exhaustive, it could serve as a starting point for further, more in-depth research whereby readers may learn about the evolution of angel investors over the recent years and more technical dimensions of equity and convertible debt/notes. For a fuller list, click here.

Angel investors: accredited investors who inject capital for startups in exchange for ownership equity or convertible debt. In the US, angel investors need to have at least $1 million in the bank or an annual income of $200,000.

Bootstrapping: funding a company only by reinvesting profits

Business excubators: fee-based comprehensive suite of services from the beginning to the end that are, unlike free incubators and accelerators, available for any paying applicant

Business incubators: a company that helps new and startup companies develop by providing services, such as management training or office space.

Option pool: shares of stock reserved for employees of a private company. Option pools are a way of attracting talented employees to a startup company, as when the company goes public, the employees will be compensated with stock. Early-joining employees usually receive a greater percentage of the pool.

Venture capital fund: an investment fund that manages the money of investors who seek private equity stakes in startup and small- to medium-sized enterprises with strong growth potential. Generally characterised by high-risk, high-return investment decisions.

Startup/seed accelerators: fixed-term, cohort-based programmes, that include mentorship and educational components and culminate in a public pitch event or demo day

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Mobile Version

Mobile Version