Foreign coffee chains take it slow and steady with expansion plans in Vietnam

Japanese coffee chain %Arabica, which has opened more than 150 stores in about 20 markets around the world, has suddenly cancelled its plans for a second store at Diamond Plaza in Ho Chi Minh City.

|

| Foreign coffee chains take it slow and steady with expansion plans in Vietnam, Source: doanhnhansaigon.vn |

Just over a week ago, the brand said it was looking for an independent, larger store front with plenty of space that would have a roastery in the heart of the new store.

“After all your feedback since opening our first store, we made the hard decision to sadly say goodbye to the announced Diamond Plaza store. We’re now focused on a bigger and better coffee experience for you,” %Arabica said.

The company opened its first brick-and-mortar coffee shop in Vietnam at the well-known “cafe apartment” building at 42 Nguyen Hue in February. Soon after, the brand embarked on the construction of a second store at Diamond Plaza, but before it could open, decided to change direction.

Vynce Nguyen, general manager of investor The Kho Group, said, “We are still very optimistic about the plan to open new stores in Hanoi, Hoi An, and Phu Quoc and will bring a new speciality coffee experience to consumers in Vietnam’s long-standing coffee market.”

According to Euromonitor, the value of the Vietnamese food and beverages (F&B) chain market is around $1.3 billion per year, but the penetration rate of foreign brands is only 5 per cent. Vietnam is one of the countries with the most beverage shops in the world, with up to 19,000, marginally fewer than the United States, China, and South Korea.

Despite possessing the advantage of being the world’s largest producer and exporter of robusta coffee, as well as being a large coffee and beverage consumption market, international chains continue to find it tough to expand here.

Mellower Coffee, a Chinese brand, announced the permanent closure of its operations in Ho Chi Minh City at the end of April. Mellower opened its first outlet in Ho Chi Minh City in 2019 and opened a second store in this city with drinks prices up to $10. Despite expanding rapidly in China and owning more than 50 stores worldwide, the brand failed in the Vietnamese market.

Gloria Jean’s Coffees, a chain from Australia, quietly left the Vietnamese market in 2017 after more than 10 years of joining. But only four years later, this brand once again returned to look for development opportunities with two stores in Ho Chi Minh City in 2021.

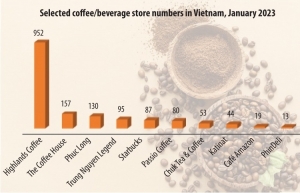

Meanwhile, some foreign coffee chains that are considered successful, such as Highlands Coffee and Starbucks, are also struggling to open more stores and find suitable a development direction.

Highlands Coffee, the market leader, decided to target the lower end of the market to seek new customers and sell cheap coffee for less than $1. It has also been locked in several rental disputes at major locations.

In 2021, two Highlands Coffee shops, in the Artemis building in Hanoi and the Pax Sky building in Ho Chi Minh City, were accused by landlords of not paying rent for many months with a total debt of more than $50,000.

Highlands Coffee currently has about 600 stores nationwide. According to the owner of Highlands Coffee chain, Jollibee Group, the coffee brand generated approximately $160.8 million in revenue in 2022, a record for the brand after many years of doing business in Vietnam.

Meanwhile, by late 2022, Starbucks had 87 outlets in the country despite entering the local market 10 years ago. Instead of opening outlets in prime locations, Starbucks had to close three large stores located in the heart of Hanoi and Ho Chi Minh City to switch to a small store model in new urban areas.

The coffee chain Café Amazon, despite receiving financial support from Thai groups PTT Oil and Retail Business and Central Group, is also hesitant to expand.

According to A-tathak Srinon, marketing director of Café Amazon Vietnam, the brand does not intend to move to the north but will continue to focus on the southern market.

“We have opened new stores while continuing research to understand the consumption behaviour of Vietnamese people more deeply. Our plan to expand the chain will depend on the specific needs of the market,” said Srinon.

In 2020, Café Amazon opened its first store in Vietnam at BigC Go! Shopping centre in the Mekong Delta province of Ben Tre. So far, the chain has 16 stores in the Ho Chi Minh City area and three more in Tra Vinh, My Tho, and Dong Nai.

According to a market report by iPOS last year, the total revenue of the F&B market reached nearly $25.6 billion in 2022, but only 5 per cent of the revenue belonged to chains. The report said that competition in the “sidewalk economy” and prices at F&B chains were still high compared to the average income of Vietnamese people.

Vietnam has over 1,500 coffee chain outlets, according to a 2022 report by Q&Me. The World Coffee Portal predicted that the country will have more than 5,200 coffee shops from different chains by 2025.

| Coffee chains shaking up habits and business tactics The United States and Vietnam, with the high consumer demand and fast-growing markets, are continuing to be promised lands for coffee and beverage brands on both sides. |

| Major coffee chains attempt to wade through price storm Beverage chains are struggling under the pressure of increasing selling prices due to sky-high costs of fuel and raw materials. |

| Coffee chains set on physical growth The journey of business growth and innovation is being boosted in Vietnam’s food and beverage market as businesses decide to close the door on a period of turmoil in search of breakthroughs this year. |

| Coffee chains ditching kiosk model Changes in operating patterns are taking place at many beverage chains as the number of kiosks begins to dwindle, making way for the return of flagship stores. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Rising consumption and travel fuel ‘Tet season’ stocks (February 11, 2026 | 11:43)

- Education as strategic capital: why Dwight School Hanoi represents a long-term investment in Vietnam’s future (February 10, 2026 | 19:00)

- Green logistics–the vital link in the global energy transition (February 09, 2026 | 19:35)

- Wages and Lunar New Year bonuses on the rise (February 09, 2026 | 17:47)

- Temporary relief for food imports as businesses urge overhaul of regulations (February 07, 2026 | 09:00)

- Opella and Long Chau join forces to enhance digestive and bone health (February 06, 2026 | 18:00)

- Vietnam-South Africa strategic partnership boosts business links (February 06, 2026 | 13:28)

- Sun PhuQuoc Airways secures AJW Group support for fleet operations (February 06, 2026 | 13:23)

- Pegasus Tech Ventures steps up Vietnam focus (February 05, 2026 | 17:25)

- The generics industry: unlocking new growth drivers (February 04, 2026 | 17:39)

Tag:

Tag:

Mobile Version

Mobile Version