Coffee chains set on physical growth

Vietnam’s beverage sector was set to end 2022 favourably with Q3 growth of 5.2 per cent, only 0.4 per cent lower than the average growth rate across Asia, according to a report on fast-moving consumer goods by Kantar Worldpanel.

Many businesses still failed to perform as expected, but other food and beverage (F&B) enterprises are enjoying success. Patricia Marques, general director of Starbucks Vietnam, is optimistic considering recent challenges and has strong expectations for the world-famous brand.

“We will open our 100th store in the second quarter of 2023, but that doesn’t mean we will stop there,” Marques said earlier in January.

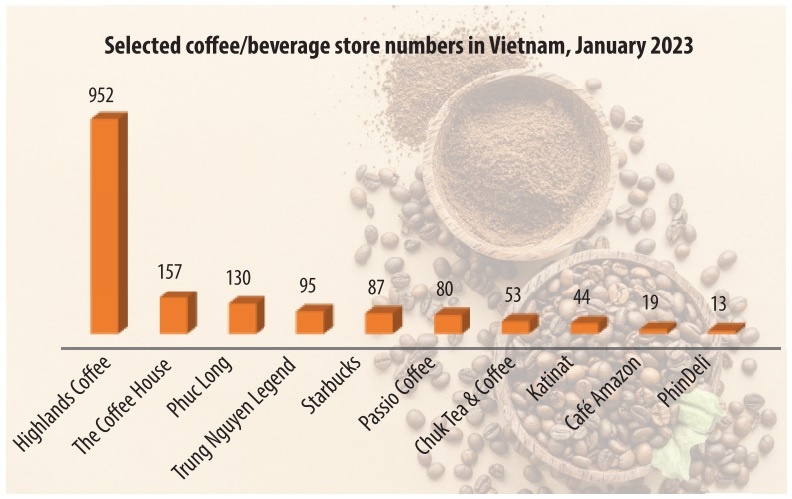

Starbucks has been present in Vietnam since opening its first store in Ho Chi Minh City in 2013. It owns 87 stores in eight cities with more than 800 employees and over 200 coffee masters. Ho Chi Minh City has the largest number of Starbucks stores at 50, with Hanoi boasting 24. There are other outlets in Haiphong, Hung Yen, Nha Trang, Danang, Hoi An, and Binh Duong.

Compared to other popular coffee brands in the market, Marques said that Starbucks is not participating in the race for numbers, but is instead focused on the customer experience. Currently, the brand is opening more stores with moderately sized areas for customers who are looking for take away. With the new model moving towards leanness, Starbucks Vietnam is seeking more space in new urban areas and local communities to expand its customer network. Binh Duong and Quy Nhon are potential destinations being targeted by the brand.

|

New player competition

However, despite the change in model, Starbucks has always felt that new locations must be in a community of stores and in an area where the brand can expand further.

“We don’t want to have one store in the middle of a city or town where there are no neighbours. We will continue to search for opportunities and open more stores, both in locations we know and in those we will discover,” Marques shared.

Starbucks is one of the few foreign brands that have a strong foothold in Vietnam, with the domestic coffee and beverage market still mainly a playground for home-grown enterprises.

According to research by Euromonitor, the value of the Vietnamese tea and coffee chain market is around $1.3 billion per year and has a projected compound annual growth rate of 8.65 per cent between 2021 and 2026. The long-term potential is bright, as the penetration rate of coffee and other beverage chains only meets 5 per cent of demand, with the rest belonging to independent stores.

In fact, the Vietnamese market has recorded the appearance of new brands such as Cheese Coffee, Phe La, Katinat, Phindeli, Café Amazon, and Chuk Tea & Coffee. Every brand aims to increase its market share and expand the number of new stores, but not all will be successful.

The PhinDeli coffee and beverage chain belonging to the Nova F&B ecosystem, a subsidiary of NovaGroup, wanted to develop 100 PhinDeli coffee shops and kiosks by the end of 2022. However, the brand only reached 20 new stores and was forced to close one in a central location in Ho Chi Minh City.

KIDO Group, which owns the beverage chain Chuk Tea & Coffee, also announced its full divestment in December after more than a year of investment. This chain owns more than 50 stores and kiosks in Vietnam.

Some other mid-range coffee and beverage chains are taking different directions. After the initial phase of accelerating new store openings with high expectations for growth, The Coffee House, Trung Nguyen Legend, and Café Amazon are showing signs of slowing down.

From 100 stores in 2019, the number of Trung Nguyen Legend stores has dipped to 95. Due to fierce competition in the market, owner Trung Nguyen Group has chosen to operate moderately and focus resources on e-commerce options.

The number of The Coffee House stores also decreased from 160 to 157 in 2022. This year, The Coffee House aims to revive its Signature luxury store brand after more than a year of forced closure.

Consumer spending drop

Meanwhile, Thailand’s Café Amazon chain announced plans to expand across different localities when it first entered Vietnam in 2020, but so far, it has only reached 15 stores. Café Amazon’s goal in 2023 is to still focus on developing in the south and add around 20 new stores.

The most prominent names in the mid-range coffee and beverage segment now belong to Phuc Long and Highlands Coffee, two brands that are constantly accelerating the process of opening new stores and showing no sign of stopping.

Since joining the consumer-retail ecosystem of Masan Group, Phuc Long has made a breakthrough and has the potential to become a dominant chain in the market.

The breakthrough point for Phuc Long tea and coffee was its two parallel business models that combine a flagship store chain and compact kiosks that are integrated into Masan’s WIN and WinMart+ multi-convenience stores. This solution has helped Phuc Long to quickly scale up while minimising the costs that are incurred with larger spaces. The chain currently owns 130 flagship stores and about 1,000 kiosks.

Highlands Coffee, the most prominent chain in the market with more than 500 stores, is continuing to expand. Most of its outlets are located in a central location, focusing on office buildings and residential areas. Despite increasing the price of drinks by around 18 per cent last year, the brand is still being received by many consumers.

According to forecasts from coffee info platform Allegra World Coffee Portal, the Vietnamese coffee chain will have a total of about 5,200 stores by 2025. The market will therefore become more competitive, especially this year at a time when consumers are cutting spending.

| Coffee chains shaking up habits and business tactics The United States and Vietnam, with the high consumer demand and fast-growing markets, are continuing to be promised lands for coffee and beverage brands on both sides. |

| Major coffee chains attempt to wade through price storm Beverage chains are struggling under the pressure of increasing selling prices due to sky-high costs of fuel and raw materials. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version