Coffee chains ditching kiosk model

|

| Highlands Coffee, Phuc Long, The Coffee House, and others are reverting back to traditional stores |

Phuc Long, the top coffee chain in terms of scale in the Vietnamese market, is likely to see a landmark change later this year as Masan Group, which owns over half of its shares and has full control over its activities, decides on its future direction.

“Management is conducting a comprehensive review in Q1 of 2023 to determine a winning model before further scaling up,” said an annual business report published by Masan in early February.

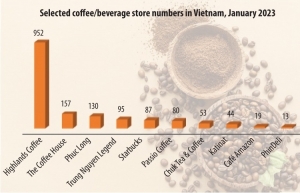

Phuc Long owns 906 stores as of mid-February, surpassing other well-known brands such as Highlands, Trung Nguyen, Starbucks, and The Coffee House, and it boasts the fastest growth rate in the entire market.

Before officially joining Masan’s ecosystem in May 2021, the brand only had 80 stores, but that number has skyrocketed since thanks to the integration of kiosks inside the Winmart supermarket chain and Winmart+ stores.

The strategy of focusing on developing small stores within the WinCommerce retail ecosystem helped the brand reduce cost burdens and increase profits during the pandemic, and also initiated the development of the kiosk model with the redirection of The Coffee House, Ong Bau, and Chuk Chuk brands.

However, Phuc Long since last summer has closed a number of inefficient kiosks, which reached 760 at its peak. The chain is now gradually returning to its traditional model by opening 44 more flagship stores in 2022 and is expected to continue to expand in 2023.

By the end of 2022, Phuc Long Heritage boasted 111 of these stores, doubling in number since it was acquired by Masan and closing the gap significantly with other food and beverage brands.

The new stores have resulted in marginal earnings before interest, taxes, depreciation, and amortisation (EBITDA). According to a financial report from Masan, Phuc Long achieved $68.6 million in revenue and $8.19 million in EBITDA in 2022, missed the target of $108-130 million set out, primarily due to the strong performance of flagship stores who delivered $48.3 million in revenue and $14.4 million in EBITDA.

“On a unit economics basis, flagship stores are estimated to deliver revenue per store twice that of the next industry player and a store EBITDA margin of 35 per cent, superior to that of the best-in-class globally,” said the report. “The outstanding unit economics combined with new store opening momentum provides Phuc Long Heritage with lots of confidence in the business to be the number one tea and coffee player in Vietnam within a few years, with international ambition to follow.”

Similar to Phuc Long, a number of other beverage chains are narrowing the kiosk model after a period of experimentation that did not achieve the expected results.

The Coffee House opened eight new kiosks but has ceased to continue in that direction. The first was opened in October 2021, and the company promised to bring customers a “convenient, safe, and modern experience based on technology”.

After a year of closure, the brand has reopened its flagship store in Ho Chi Minh City, bringing the total number of traditional stores to 154 as of this month.

The Chuk Chuk coffee and beverage chain, meanwhile, also took advantage of the new model when it was established in mid-2021. It set a goal to open up to 1,000 stores of all types by 2025. However, only 55 stores exist, nearly half of which are kiosks that mainly offer take-away.

In that time, KIDO Group, which owns over 60 per cent of Chuk Chuk, announced the withdrawal of capital. The company has yet to announce a new owner, but after name and concept changes, it has been rebranded to Chuk Tea & Coffee.

Elsewhere, Highlands Coffee has officially closed its kiosk model, in which kiosks were placed in front of their main stores for rush hour take-away. As of February, Highlands Coffee consists of just under 600 flagship stores in Vietnam.

According to some experts, kiosks seemed to become less popular because the choice of products was streamlined. Discounting delivery applications up to 25 per cent of order revenue was also the cause of profit erosion of the kiosk model, with no feasible way to increase the price of drinks higher than found in traditional stores.

Starbucks, meanwhile, had been focusing on spacious design to enhance the customer experience pre-2020. But in the last few years, the brand had a slight change in orientation with the opening of more moderate-sized stores.

Despite saying no to kiosks, Starbucks Vietnam’s current model is aimed at leanness, seeking more premises in new urban areas or in local communities to connect customers.

Starbucks Vietnam general manager Patricia Marques said the company will continue to open more stores as a priority goal in Vietnam this year and beyond.

| Restaurants, coffee chains in Vietnam switch to selling online delivery After HCM City decided to temporarily close restaurants and catering services with the capacity of more than 30 customers, they began selling online and delivering food. |

| Coffee chains shaking up habits and business tactics The United States and Vietnam, with the high consumer demand and fast-growing markets, are continuing to be promised lands for coffee and beverage brands on both sides. |

| Major coffee chains attempt to wade through price storm Beverage chains are struggling under the pressure of increasing selling prices due to sky-high costs of fuel and raw materials. |

| Coffee chains set on physical growth The journey of business growth and innovation is being boosted in Vietnam’s food and beverage market as businesses decide to close the door on a period of turmoil in search of breakthroughs this year. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version