VIB's profit exceeds $259 million with credit growth climbing 12 per cent

|

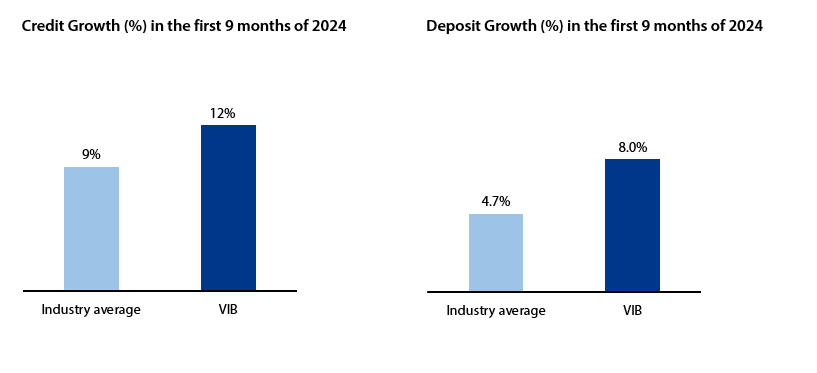

Credit and funding growth outperform industry average

As of September 30, VIB's total assets stood at VND445 trillion ($17.5 billion), a 9 per cent increase compared to the beginning of the year. Total credit reached over VND298 trillion ($11.7 billion), reflecting nearly 12 per cent growth, higher than the 9 per cent industry average.

In the third quarter alone, VIB's credit growth was close to 7 per cent, positioning VIB as one of the top-performing retail banks in terms of credit growth in the industry. Funding, for the first nine months of the year, grew by 8 per cent, nearly double the industry average, ensuring sufficient funding sources for credit activities.

|

Profit declines

In the first nine months of 2024, VIB achieved total revenue of VND15.3 trillion ($602 million), with net interest income down 9 per cent compared to the same period last year. VIB is focusing on high-quality customers with strong collateral. The bank offers competitive interest rates and maintains a strong net interest margin at 4 per cent.

|

On September 21, at the Government Standing Conference about the strategies to promote Vietnam’s socioeconomic development, chairman of the Board of Directors of VIB, Dang Khac Vy, stated that the bank has significantly reduced lending interest rates across all customer segments, stimulating both supply and demand, thereby supporting economic growth. Additionally, VIB’s leadership emphasised the importance of ensuring responsible and robust credit growth to maintain the healthy and sustainable development of the banking sector.

In the first nine months of 2024, VIB's non-interest income reached VND3.5 trillion ($137.8 million), an increase of 5 per cent, contributing 23 per cent to the bank's total revenue. Operating expenses increased by 13 per cent on-year, driven by investments in human resources, new branch openings, technology, digital banking, and marketing. The cost-to-income ratio temporarily rose to 36 per cent, but there has been improvement compared to the previous quarter, as cost-optimisation initiatives have been thoroughly implemented, and new branches are starting to operate efficiently.

VIB maintains a prudent policy, with provisioning standing at around VND3.23 trillion ($127.2 million) as of September 30, increasing 2 per cent on-year. Moreover, in the context of improving asset quality, provisioning in Q3 decreased by over 25 per cent on-year. Overall, VIB's pre-tax profit for the first nine months of the year reached VND6.6 trillion ($259 million), down 21 per cent compared to the same period last year. The return on equity stood at approximately 19 per cent.

Asset quality improvement, lowest concentration risk

VIB's category 2 loans have decreased by over VND4 trillion ($157.5 million), equivalent to a 27 per cent reduction, and the provisioning buffer has increased by 27 per cent compared to the beginning of the year. As of September 30, VIB’s non-performing loan ratio stood at 2.67 per cent.

Key management indicators are at the optimal levels, with the Basel II capital adequacy ratio at 11.5 per cent (regulatory requirement is above 8 per cent), the loan-to-deposit ratio at 75 per cent (regulatory cap is below 85 per cent), the short-term capital for medium and long-term loan ratio at 26 per cent (regulatory cap is below 30 per cent), and the net stable funding ratio under Basel III at 111 per cent (Basel III standard is above 100 per cent).

Building a reputable brand, superior innovative products, and leading reality TV programmes

In early October 2024, VIB was honoured by Enterprise Asia with the "Corporate Excellence Award 2024", recognising its outstanding retail banking solutions and products, modern digital banking applications, transparent corporate governance, and pioneering adoption of international standards. Additionally, VIB became the first bank in Vietnam to launch personalised card design services, supported by generative AI.

|

VIB continues to make a strong impression as a leading retail bank, reinforcing its goal of leading the card trend with the Anh Trai “Say Hi” programme. This show has garnered over 10 billion views across all platforms, and has had all of its episodes on Top YouTube Trending.

Responsibility and contribution to society

For more than 28 years, VIB has consistently contributed to community development through various economic and social activities, especially in terms of contributing to corporate tax and complying with international standards. VIB recently ranked among the top four private banks with the largest corporate tax contributions to the national budget.

In addition, VIB ranked 11th among private enterprises with the highest corporate tax contributions in 2023, totalling nearly VND3.3 trillion ($129.9 million).

In the first nine months of 2024, VIB contributed VND15 billion ($590,667) to a national programme to eliminate temporary and substandard housing, VND5 billion ($196,889) to support recovery efforts from Typhoon Yagi, and VND7 billion ($275,644) to fund student scholarships and various programmes aimed at honouring traditions and promoting cultural, educational, and social development.

| New VIB promotion to ease 'end-of-year' financial strain As consumers ramp up their expenditure ahead of the end-of-year festivities, VIB has launched a promotion to help its customers balance the family finances. |

| VIB becomes first bank to launch online credit card issuance via VNeID VIB has become the first bank to utilise information from an electronic identification and authentication system (VNeID) to issue credit cards online starting from October 17. |

| VIB launches Card Design On Demand powered by GenAI technology VIB announced on October 18 the official launch of its Card Design On Demand, powered by Generative AI (GenAI) technology from Fiza x Zalo AI. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- VIB named Best Customer Satisfaction Bank in Vietnam 2025 (December 26, 2025 | 16:40)

- Visa and Techcombank win AmCham’s 2025 ESG Tech Innovation Award for Eco Card (December 09, 2025 | 12:16)

- Visa brings tap-to-ride payments to Hanoi Metro Line 2A (December 05, 2025 | 17:35)

- Cross-border QR payments launched for Chinese tourists (December 03, 2025 | 19:12)

- VIB honoured by JP Morgan with 2025 US Dollar Clearing Elite Quality Recognition Award (December 02, 2025 | 17:04)

- Home Credit Vietnam brings financial literacy closer to women and students (November 20, 2025 | 11:25)

- MB partners with Visa, KOTRA to launch new MB Visa Hi BIZ card (November 20, 2025 | 11:24)

- VPBank upgrades core banking with Temenos and Systems Limited (November 14, 2025 | 17:54)

- CPO Home Credit shares how to build an AI-driven but human-centric workplace (October 30, 2025 | 09:56)

- VIB hits $267.4 million in pre-tax profit over first nine months (October 29, 2025 | 12:12)

Mobile Version

Mobile Version