VIB becomes first bank to launch online credit card issuance via VNeID

|

Pioneering credit card issuance via VNeID app

By leading the way in implementing credit card issuance on the VNeID app, VIB ensures a swift and convenient credit card application process for Vietnamese users and guarantees data security for both customers and banking operations.

Customers can gain access to official banking services, reducing risks associated with card fraud and black-market lending. Both the bank and its customers benefit from minimised risks linked to cybercrime by directly connecting to the Ministry of Public Security’s identification and authentication system, which shares information only with customer consent.

VNeID is becoming increasingly integrated into everyday life, serving the public efficiently, with nearly 1.9 million daily users. Adding the service of credit card issuance to the national database on population and integrating automatic verification and approval mechanisms directly on the VNeID app creates a strong foundation for VIB to deliver the best user experience and societal benefits.

Tuong Nguyen, head of VIB’s card business division, expressed confidence that online credit card issuance via VNeID will elevate citizens’ payment experiences. Customers with a level-2 VNeID account can easily apply for a credit card online in just seven simple steps, taking only 3-5 minutes, and receive the card within 15-30 minutes. This new process also enhances VIB’s card approval capability through three steps of data sharing.

|

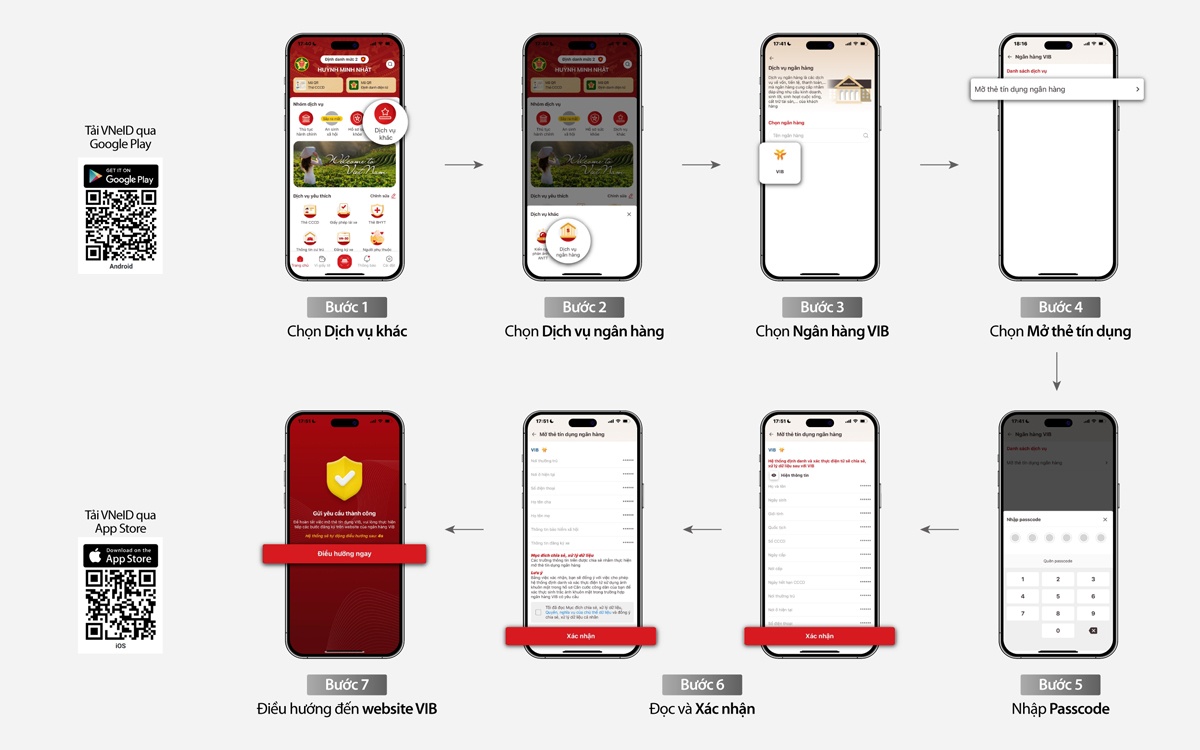

How to install VNeID and the 7 steps to apply for a VIB credit card

To apply for a VIB credit card through the VNeID app, customers need to install the app via the App Store or Google Play and activate a level-2 VNeID account. On the app, they can apply for a card through the following seven steps: Select Other Services > Select Banking Services > Choose VIB Bank > Select Credit Card Issuance > Enter Password > Read and Confirm > Redirect to VIB’s Website and Follow the Instructions. To complete the application, customers only need to consent to share their data on VNeID with VIB and register a card application.

VIB will approve applications within 15-30 minutes, provided customers meet basic requirements such as being at least 20 years old, having a salaried income, paying social insurance, or being a third- or fourth-year university student, alongside other conditions as per legal and VIB’s internal regulations.

Speaking on becoming the first bank to implement online credit card issuance via VNeID, Tuong Nguyen emphasised that this is a strong testament to VIB’s pioneering efforts in card technology over the past six years. VIB currently leads the card trend in several key indicators: the number of cards issued, total spending through cards, and high recognition from reputable international organisations.

|

VIB credit cards gaining popularity

As of the end of September 2024, VIB had 800,000 cards in circulation, nine times more than six years ago. From 2018 to 2023, customer spending through VIB credit cards grew more than 11-fold, reaching a total spending milestone of $4 billion in 2023, making it one of the top Mastercard market leaders in Vietnam. VIB has also received numerous awards, such as “The First Bank to Apply AR Technology to Credit Cards in Vietnam” from Visa and “Breakthrough in Credit Card Digitisation” from Mastercard.

Leveraging its technological edge, VIB has developed and restructured an innovative, multi-functional credit card ecosystem with many perks, meeting even the smallest needs of different customer segments. This includes cashback/rewards up to 15 per cent (Online Plus 2in1, Super Card, Cash Back, Rewards Unlimited, LazCard), unlimited miles accumulation for travel (Travel Elite, Premier Boundless), and family spending rewards (Family Link), or cards allowing 100 per cent limit cash withdrawal with free fees and interest (Financial Free). Additionally, VIB constantly enhances its card products and services, offering personalised user experiences in feature customisation (cashback/rewards; spending categories), services (choosing statement date, minimum payment amount, automatic debt deduction, transaction limit), and more recently, personalised card designs via AI technology.

“At every user touchpoint, VIB incorporates advanced technologies, superior product features, and a wide range of perks. With this new touchpoint VNeID, we aim to further bridge the gap with the digital citizen generation, enhancing the connection experience with VIB’s 10 current credit card products,” the VIB representative emphasised.

| VIB the most 'viral' bank on social media The summer media race became more vibrant among banks in June, with a 29 per cent increase in engagement and participation in discussions across social networking sites compared with the previous month. |

| VIB programme offers zero interest, zero fees, and more With VIB’s “Buy now, pay later” programme, credit cardholders can enjoy 0 per cent interest, zero fees, and up to 40 per cent off five popular spending categories. |

| New VIB promotion to ease 'end-of-year' financial strain As consumers ramp up their expenditure ahead of the end-of-year festivities, VIB has launched a promotion to help its customers balance the family finances. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Citi sharpens its focus on institutional banking (February 09, 2026 | 19:58)

- SSC steps up engagement with FTSE Russell on market reforms (February 09, 2026 | 17:33)

- IFC considers $50m trade finance guarantee facility for Nam A Bank (February 09, 2026 | 17:28)

- Hoa Phat Agricultural Development debuts shares on HSX (February 06, 2026 | 14:00)

- Vietcap’s VAD 2026 draws strong global investor turnout (February 06, 2026 | 13:30)

- New rules ease foreign access to Vietnam equities (February 05, 2026 | 17:29)

- 0.1 per cent tax proposed on each transfer of digital assets (February 05, 2026 | 17:27)

- Ministry of Finance tightens policy delivery at start of year (February 05, 2026 | 17:26)

- Vietnam steps up market reforms as FTSE Russell reviews upgrade progress (February 05, 2026 | 17:20)

- 2025 profits mixed amid strong energy and farming results (February 05, 2026 | 17:18)

Mobile Version

Mobile Version