Turbine leaders take choppy waters into account

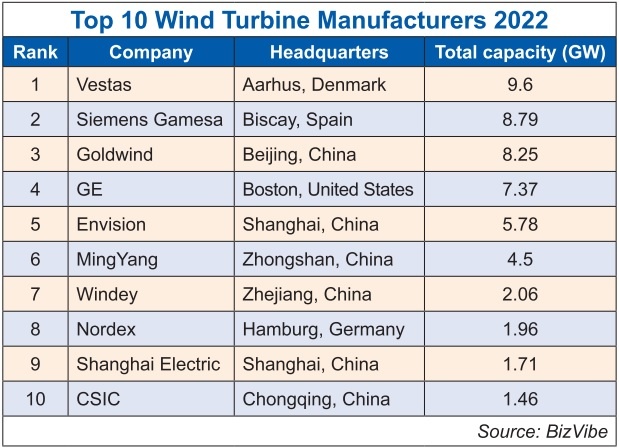

Danish turbine maker Vestas reported that it generated Q2 revenues of around $3.3 billion – a decrease of 7 per cent compared to the same period last year. It reported an interim loss of $183.5 million before special items in the second quarter this year, compared to an operating profit of $95 million for the same period in 2021.

|

The negative results were blamed on geopolitical uncertainty and supply chain disruptions that have caused costs to increase and an energy crisis.

The second biggest group in terms of energy capacity, Siemens Gamesa Renewable Energy, earlier this month delivered another cut to its earnings forecasts for 2022 due to the turbine maker’s declining outlook. It also cited inflation of energy, raw material, and logistics costs as the main factors, along with the unavailability of key wind turbine components, port congestion, and supply delays.

All these factors impacted manufacturing, project execution, and delivery according to Siemens Gamesa. Chinese producers, who are often able to undercut prices, were also noted as fierce competitors. Additionally, the corporation is battling a slump in the global market for wind energy.

According to the Global Wind Energy Council (GWEC) in April, wind energy is not growing nearly fast or widely enough to realise a secure and resilient global energy transition. At current rates of installation, GWEC Market Intelligence forecasts that by 2030, it will have less than two-thirds of the wind energy capacity required for a 1.5°C and net-zero pathway, effectively condemning the world to miss its climate goals.

The growth of renewable energy is expected to slow down for the first time in 10 years, according to the International Energy Agency (IEA) in June. The amount of money invested in clean energy is expected to increase, but as inflation soars and the price of energy, labour, components, raw materials, and freight rises, this investment will not be as profitable as it once was.

Vietnam is placed among the top five markets in Asia in new installations this decade, behind China (52GW), Taiwan (10.5GW), South Korea (7.9GW), and Japan (7.4GW), according to GWEC. However, this high-potential market lacks clear frameworks and price incentives thus far for offshore wind developments.

| Meeting seeks ways to tap offshore wind power The Vietnam Administration of Seas and Islands on July 22 held a hybrid consultation to seek advice on promoting the exploitation of offshore wind power. |

| UNDP roundtable to tackle energy transition financing On July 29, the "Finance and Governance Accelerators for a Just Energy Transition" roundtable hosted by Vietnam Investment Review in collaboration with the United Nations Development Programme (UNDP) in Vietnam will dig into policy options on financial development toward a just energy transition. |

| Renewable energy sources not fully tapped: experts The potential of renewable energy sources, especially wind and solar power, is one of the keys to Vietnam’s energy transformation towards carbon neutrality, but barriers stemming from the unresponsive transmission network and pricing mechanism is wasting the capacity of billions of kWh of electricity, according to experts. |

| Offshore wind future in balance for Vietnam The long-awaited Power Development Plan VIII is set to target the development of about 7GW of offshore wind power in Vietnam. However, both investors and localities are waiting for a clearer roadmap. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Efficient technology solutions key factors in energy transition (September 25, 2024 | 09:00)

- Sao Do Group gears towards energy savings (December 07, 2023 | 12:01)

- Vice President Vo Thi Anh Xuan visits Copenhagen Infrastructure Partners headquarters (November 23, 2023 | 10:37)

- A wind turbine tower collapses in China (November 20, 2023 | 19:36)

- Vietnam has massive potential for offshore wind energy (March 17, 2023 | 16:29)

- Rooftop solar event entices EPC contractors and investment funds (March 09, 2023 | 07:50)

- GreenYellow acquires 49.5MWp solar farm of French IPP Qair in Vietnam (November 25, 2022 | 08:00)

- Eaton contributes to Vietnam’s low-carbon economy (November 20, 2022 | 19:00)

- Proposals to promote Vietnam's energy transition (November 12, 2022 | 22:02)

- How intelligent lights make cities smarter, safer and greener (November 04, 2022 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version