Advanced search

Search Results: 2,237 results for keyword "banks".

Cross-border funds required to advance banking expansion

24-02-2023 08:00

A slew of Vietnamese banks and securities firms are searching for international financing sources in an effort to expand operations.

Real estate bailout “perilous” for system

23-02-2023 17:13

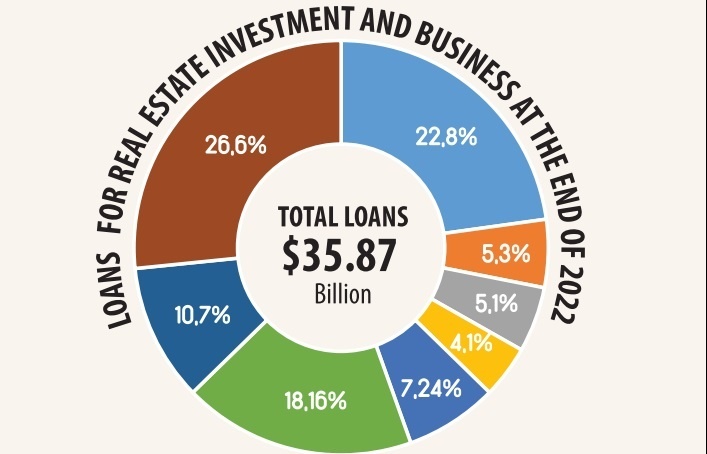

As more than $52 billion is due to banks and bondholders from real estate corporations, not to mention the requirement for additional loans, experts say a purge in the real estate market is unavoidable.

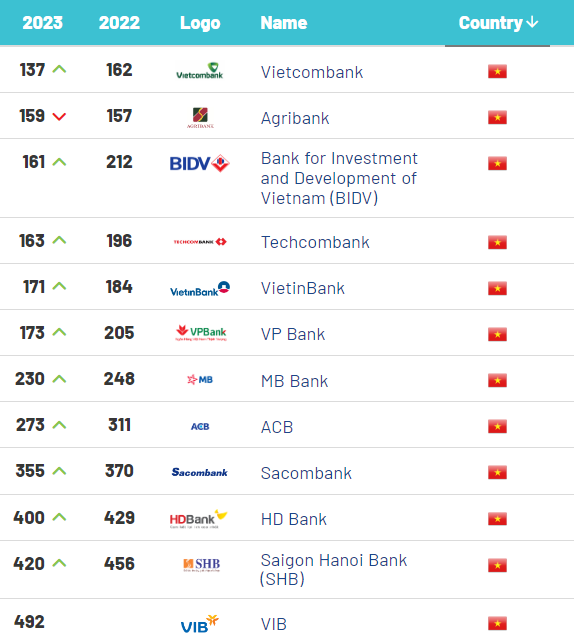

Vietnamese banks perform well with brand value growth of 31.3 per cent

23-02-2023 10:32

Vietnamese banking brands have posted an overall growth of 31.3 per cent in brand value, amounting over $2 billion compared to their 2022 positions. This is according to Brand Finance’s Banking 500 2023 report, which ranks the world’s top 500 most valuable and strongest brands in the banking industry.

FOL hikes and merger plans on the cards

16-02-2023 19:00

Mergers and acquisitions in Vietnam’s banking sector are anticipated to be more vibrant as more lenders look to increase the foreign ownership limit and enhance their footprint in weak banks’ restructuring process.

High interest rates compound business woes

13-02-2023 08:00

Businesses face mounting hardships due to the spike in interest rates, leading to shrinking results and significantly diminished production, as banks are called upon to show more sympathy to businesses.

Banks urged to reduce costs to cope with NIM drops

09-02-2023 15:26

To ensure net interest margin (NIM), banks are often choosing to raise output interest rates for borrowers but reduce the ability to fulfill debt obligations, while the central bank has also requested cuts in admin and expenses.

Rising bad debt threat looms large

09-02-2023 12:33

Despite a bright business outlook, non-performing loans are causing significant concerns to banks amid a challenging environment in both the domestic and global market, according to industry experts.

Banks bolster financial strength via M&As and capital hikes

09-02-2023 12:17

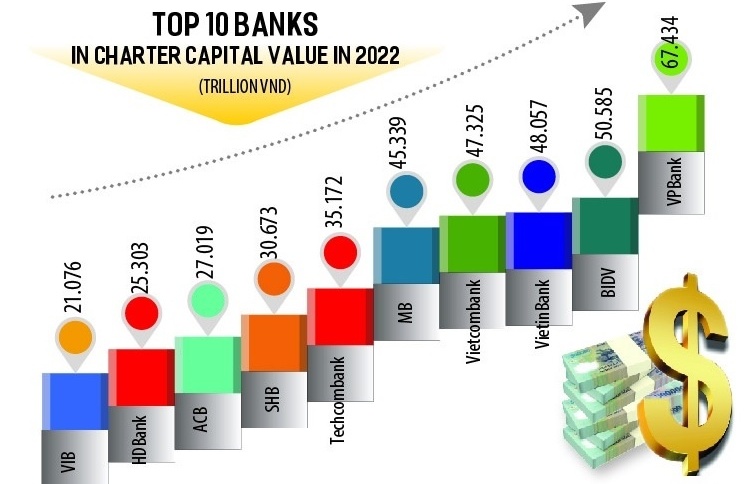

Since the start of the year, several banks have been busy with mergers and acquisitions (M&A) and capital hike ventures to bolster financial health and keep up with ever-increasing development needs.

Bad debts continue to soar at commercial banks

06-02-2023 12:21

The rate of bad debt is rising at commercial banks and is expected to increase further amid real estate market woes.

Optimism abounds for more positive scenarios in macroeconomic forecasts

06-02-2023 12:14

In 20 reports from major investment banks in the world on 2023’s outlook, inflation and recession were mentioned with high frequency. However, investment opportunities in Vietnam may still appear in the first quarter.

Gauging efficient investment channels for the year

06-02-2023 11:55

Looking back on 2022, right from the outset of the year, the economy rebooted strongly, reflected in economic growth data and banks’ lending practice. Yet by the end of the year, there were signs growth slowing due to the impacts from external and internal factors on the economy.

Expanded credit probable for January

17-01-2023 11:11

The State Bank of Vietnam (SBV) will likely provide commercial banks with more credit room in January, according to economists.

Lenders elevate charter capital moves

16-01-2023 15:44

There have been positive signals of increased charter capital activities at commercial banks in recent weeks, especially those with state capital.

Modest bank growth projected this year

16-01-2023 15:30

Last year saw major changes in the banking industry, with total assets of the commercial bank group growing strongly, and most banks entering the race to diversify services. In 2023, challenges lie ahead in the context of a downturn in the real estate cycle and a less positive outlook for exports.

Banks anticipate upward momentum in 2023

12-01-2023 14:22

Bank profit is anticipated to be stellar in Q4/2022, with the financial announcement season to take place after the Lunar New Year holiday, providing a catalyst for the industry to advance.

Mobile Version

Mobile Version