Vietnamese banks perform well with brand value growth of 31.3 per cent

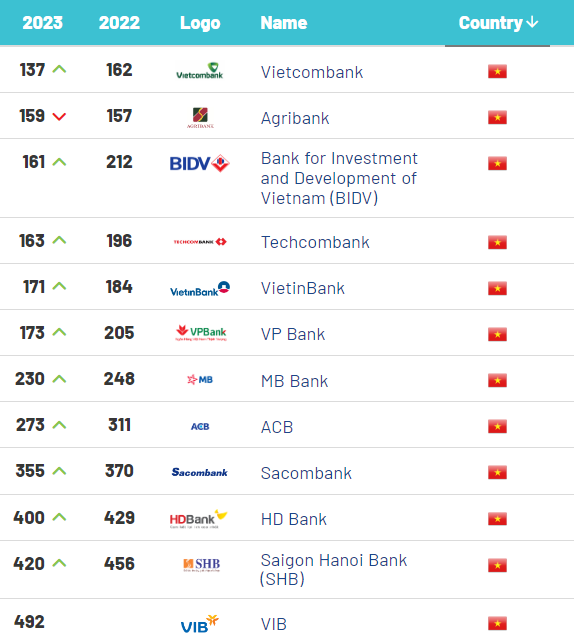

Almost all the 12 Vietnamese banking brands listed in the rankings improved their positions, with Vietnam’s second most valuable banking brand Agribank (brand value up 1.7 per cent to $1.4 billion) recording a mere drop of two places and VIB making its first ranking appearance by posting a brand value increase of 14 per cent to $181 million.

Brand Finance’s research indicated that recovered revenue and revenue forecasts were important drivers of the impressive growth. Overall, Vietnamese banking brands recorded improved business performances in 2022, underpinned by the nation’s strong credit growth of nearly 13 per cent, as well as remarkable economic recovery that is reflected by a GDP growth of 8 per cent – its fastest in 25 years.

Alex Haigh, managing director of the Asia Pacific of Brand Finance commented, "Vietnamese banking brands are rapidly adopting digital banking as a primary business and becoming leaders in this space regionally. For instance, Techcombank (brand value up 46.7 per cent to $1.4 billion), the second-fastest growing Vietnamese banking brand in our study, is embracing digital banking, which has resulted in significant growth of its retail banking unit. Combined with Vietnam’s economic miracle, we note that Vietnam’s banks are well poised to be some of the best performing this year."

"We believe that Vietnam's banks are ready for consolidation in the next few years – given that the nation has many brands relative to its scale – to leverage efficiencies and bolster their strength. If this proceeds, it is important that these brands play a central role in the process and that the resulting combined entities identify the individual brands that will deliver maximum value," he added.

|

In addition, findings outlined in Brand Finance’s Banking 500 2023 report support the global prevalence of digital banks as the value of digital banking brands grew from $795.6 million in 2022 to $1.61 billion in 2023 – an increase of 102.6 per cent or $816.3 million.

Digital banking brands such as Tymebank and Discovery Bank in South Africa, Nubank in Brazil, and Maya Bank in the Philippines are disrupting the industry, having garnered high scores in Brand Finance’s innovation and sustainability metrics – two key drivers of customer choice.

Declan Ahern, director of Brand Finance said, "Banking brands across the globe have continued to recover well post-pandemic. There has been an improvement in digital banking services, government stimulus measures have been relatively successful, and the rise of mobile banking and online platforms have contributed to the sector’s positive performance. Accelerated by the strict global lockdowns, banking and fintech brands have innovated to create user-friendly, application-based banking services that have led to an increase in customer satisfaction and acquisition."

| The future of commercial banking The commercial banking sector is rapidly evolving through digitalisation. Nguyen Ngoc Hoang, director and digital innovation lead for KPMG in Vietnam, looks at what the future of the commercial banking landscape looks like, and what commercial banks should do to stay competitive. |

| Neobanking: a trend-setting model for the digital revolution With the achievements of Industry 4.0, digital transformation has become a strong movement in all sectors in recent years. Finance-banking is one of the sectors prioritised in digital transformation since it is one of the backbones playing a vital role in the national economy, as stated in the National Digital Transformation Programme towards 2025, with an orientation to 2030. |

| Financial institutions’ role in lending to domestic banks The Vietnamese banking system has had to contend with a myriad of internal and external factors in 2022. Andrew Jeffries, country director of the Asian Development Bank in Vietnam, told VIR’s Hong Dung about the current liquidity situation and explained how businesses can access loans from major financial institutions. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Banking sector targets double-digit growth (February 23, 2026 | 09:00)

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

Tag:

Tag:

Mobile Version

Mobile Version