Optimism abounds for more positive scenarios in macroeconomic forecasts

|

| Nguyen Minh Tuan, Founder of TOPI |

The risk of a world economic recession is reflected in the average GDP growth forecast of only 1.6-2.2 per cent, of which the US accounts for 0.5-1 per cent, the EU -0.5-0.2 per cent, and China 4-4.5 per cent.

After plenty of efforts by central banks inflation has cooled down, but is still high. The common global inflation forecast in 2023 is 6.5-6.6 per cent, which is in line with forecasts from the International Monetary Fund and the Organisation for Economic Co-operation and Development.

Optimistic banks assessed that in the second quarter of 2023, inflation would decrease, and those with more pessimistic views forecasted that the decline would take place by the end of 2023. Of course, along with inflation, tight monetary policy will affect world economic growth.

Accordingly, there are three scenarios for macroeconomic forecast in 2023. One is a negative scenario: persistent inflation and deep recession, with the following assumptions of geopolitical tensions escalating not only in Europe, but possibly appearing in Northeast Asia. There may be a higher unemployment rate and raw material price increases, many central banks could tighten their currency excessively, and in Europe the energy supply is worse.

The second is the base scenario, with moderate inflation and mild recession. It assumes that geopolitical tensions increase but do not escalate; the labour market weakens slightly and supply chain pressures continue to decrease; monetary policy impacts are delayed; and the US economy grows, albeit slowly. Meanwhile in Europe, the economy will improve by mid-2023 when the energy crisis begins to ease after the winter.

The third is a more positive scenario – inflation declines and the economy recovers, geopolitical tensions subside, the situation between Russia and Ukraine improves, and unemployment rates are kept low.

|

I lean towards the base scenario, and believe inflation is reaching its peak and will decline, and the economy will experience a slight recession.

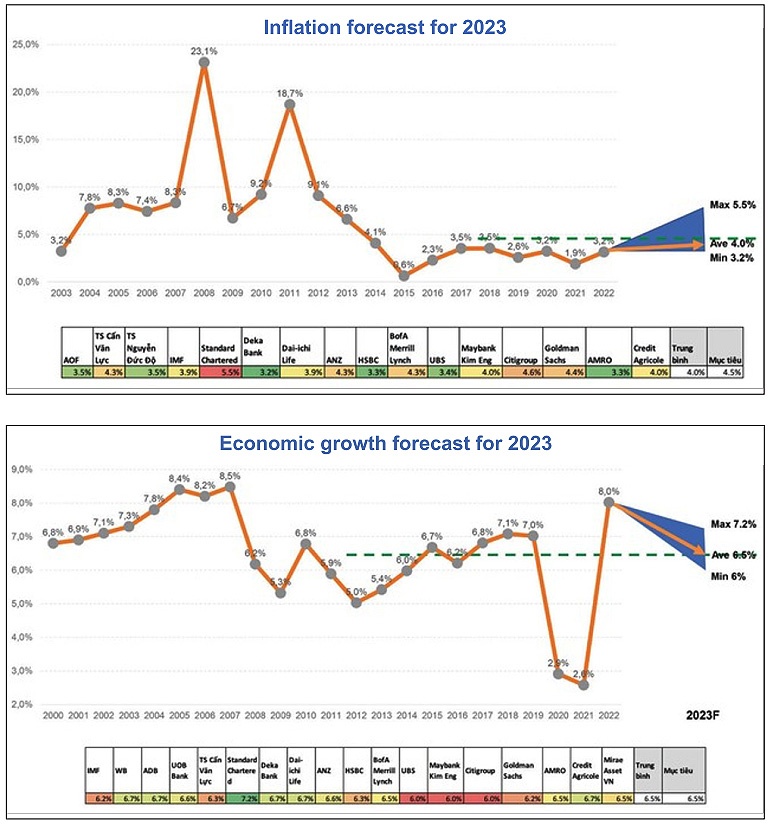

With an export-driven economy like Vietnam, the decline of major world markets will have a direct impact on economic growth, but inflation and exchange rate are expected to be less pressured. Vietnam targets economic growth in 2023 at 6.5 per cent. This is a lower level than pre-pandemic, demonstrating difficult factors in the economy.

According to statistics, the Purchasing Managers’ Index (PMI) continuously decreased in the last three months of 2022, to below 47 points. The index of industrial production in the fourth quarter of 2022 increased only 3 per cent, the lowest compared to the first three quarters of the year.

This decline does not only come from within the country, but also worldwide, causing exports to be affected. The global PMI has seen a decline since mid-2022 and is now slowly permeating as Vietnam’s economy has a lag, and this decline may last six months or so.

Meanwhile, the monetary policy does not have much room because the USD interest rate is anchored at a high level (5 per cent per year), so it is difficult for the State Bank of Vietnam (SBV) to lower interest rates because this leads to exchange rate pressure and the burden will be shifted to fiscal policy.

Regarding the fiscal policy, public investment can be the driving force for economic growth in 2023. As for inflation, the target for 2023 is to control it at no more than 4.5 per cent. In fact, inflation is not under much pressure and it will be difficult to exceed the target.

Inflation is affected by three main groups of indicators: food, transportation, and housing and construction materials. The ground price in 2022 has not yet penetrated into food prices, so from 2023 it will penetrate more, putting pressure on food prices, even though the prices of input materials have cooled down.

But in the transportation group, oil prices are expected to be stable in the range of $85-90 per barrel. Meanwhile, rents are unlikely to increase as sharply as in 2022.

As for the exchange rate, from mid-2022, there was a stressful situation, causing the SBV to sell nearly $30 billion, equivalent to one-quarter of the total foreign exchange reserves, to stabilise. However, the overall balance was only a net outflow of about $25 billion abroad.

The SBV has raised the operating interest rate and the VND interest rate level has been raised, reducing the need for foreign currency hoarding. The exchange rate has recently decreased and so it is forecasted that 2023 will be favourable.

With this macroeconomic picture at home and abroad, our view on investment in 2023 is inclined to a cautious scenario. However, investors may still stumble upon strong opportunities in the first half of the year.

| Macroeconomic stability helps push stock market development: official Macroeconomic stability will be a good foundation for developing the stock market, Deputy Minister of Finance Nguyen Duc Chi said at the Government’s regular press conference on October 29 in Hanoi. |

| Next year's economic hardships to become more visible The issue of macroeconomic stability remains arduous, but this is the mission that the Vietnamese economy must pursue. |

| IMF commends Vietnam’s macro-economic stabilisation policies Deputy Managing Director of the International Monetary Fund (IMF) Antoinette Sayeh has lauded Vietnam for its high economic growth and controlled inflation over the past years despite global uncertainties. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Tag:

Tag:

Mobile Version

Mobile Version