Modest bank growth projected this year

Vietcombank was the first bank with equity exceeding $4.26 billion by the end of 2021. In 2022, four more banks achieved this figure – Techcombank, Vietinbank, VPBank, and BIDV.

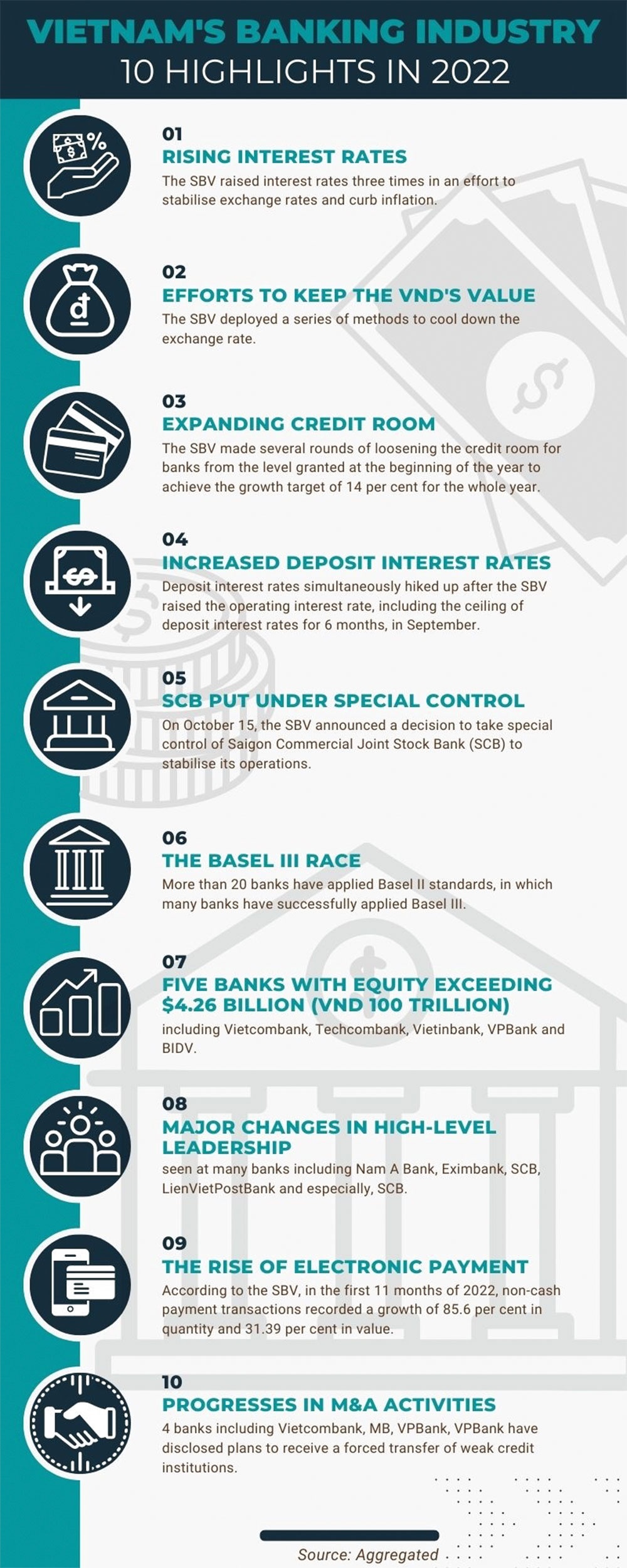

In 2022, the charter capital of many banks saw a significant increase, with some banks even recording a vast increase in charter capital. At the same time, banks continue to improve their capital adequacy ratio and apply international standards in risk management. More than 20 banks have applied Basel II standards. Notably, many banks have successfully applied Basel III with more stringent requirements, such as TPBank, ACB, VPBank, SeABank, NamABank, and OCB.

Some banks are also partially applying or piloting Basel III implementation, including VIB, HDBank, Techcombank, ABBank, MSB, and Sacombank.

Besides the growth in scale, banks’ development in customer base is significantly greater, with digital transformation being an indispensable factor. While in the past, it typically took a traditional bank 20-30 years to acquire a million customers or more, digital banks today grow in a much higher speed. An example would be Cake by VPbank, with 2.3 million customers within 20 months.

According to a report by the State Bank of Vietnam released in December, in the previous 11 months of 2022, non-cash payment transactions recorded a growth of 85.6 per cent in quantity and 31.39 per cent in value. Among this, transactions via mobile phone increased by 116.1 per cent and 92.3 per cent in quantity and value, respectively; transactions via QR code increased 182.5 per cent and 210.6 per cent respectively.

In 2022, Vietcombank, MB, HDBank, and VPBank have revealed their intentions or plans to receive a forced transfer of weak credit institutions. In which, in their April annual meeting of shareholders, Vietcombank and MB approved the plan to receive the compulsory transfer of weak banks.

By August, HDBank had also consulted shareholders and approved a plan to receive compulsory transfer.

Although VPBank has not announced a specific plan, at the annual meeting of shareholders, president Ngo Chi Dung also revealed a plan for a possible merger or acquisition.

In a newly-released strategic investment report for 2023, Rong Viet Securities Company (VDSC) believes that the banking industry will continue to weather the storm in the downtrend of real estate and a less positive outlook for import and export. According to the report, interest income growth of the banking industry will slow down due to the impact of credit growth along with a decrease in interest margin (NIM) in 2023. Credit growth is expected at 11 -12 per cent, lower than the target of 15.5-16 per cent for 2022.

Credit growth will vary among banks based on their specific advantages and level of economic support. In addition, with the negative outlook of the real estate market, credit demand is forecasted to be lower than in the past.

The decline in NIM also see a divergence among different groups, leading to the expected interest income growth below 11 per cent. Therefore, VDSC believes that interest income of banks will slow down in 2023.

Asset investment (including bonds) is also forecasted to decrease in size and profit margin, as the upcoming issuance volume may increase again compared to 2022 but still lower than the previous boom of 2019-2021, due to tight conditions. Elevated professional investor standards also make it difficult for banks to find buyers.

Growth in bancassurance income will continue to slow down, on the background of lower expected credit growth, reallocation of personal assets to high-interest savings channels, and market saturation. Some exceptions may be LienVietPostBank or HDBank, thanks to the recognition of exclusive fees and the collection of insurance premiums in the first year when signing new exclusive contracts for insurance distribution.

VDSC forecasts that the total operating income of the banking industry will grow modestly, in the context of decelerating lending activities, at 10 per cent on-year, when interest income growth is at 11 per cent. Likewise VNDirect Research’s latest report for 2023 also predicts the industry’s profit growth to decelerate and reach 10-11 per cent on-year in 2023-2024 (from 32 per cent in 2022) as credit growth usage slows, NIM shrinks, and credit costs rise.

However, the report assessed that the banking system has improved much more than before, and the banking sector remains the biggest beneficiary of Vietnam’s economic growth in the long term. “Given the current situation, we give priorities to banks that are able to defend against fluctuations such as VCB and ACB. However, once the storm is over, we have a preference for banks with low valuations, a solid capital buffer and a large proportion of real estate loans and corporate bonds in the credit portfolio, typically TCB and VPB.”

|

| Banking sector suffers difficulties in 2022 The State Bank (SBV) has looked back on the many difficulties for the sector in 2022, which relate to a number of areas, including credit, exchange rate, and liquidity. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Capital markets as pillar for Vietnam’s double-digit growth (February 27, 2026 | 17:30)

- Banks roll out God of Wealth Day promotions (February 26, 2026 | 17:10)

- VinaCapital launches Vietnam's first two strategic-beta ETFs (February 26, 2026 | 09:00)

- Banking sector targets double-digit growth (February 23, 2026 | 09:00)

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

Tag:

Tag:

Mobile Version

Mobile Version