Real estate bailout “perilous” for system

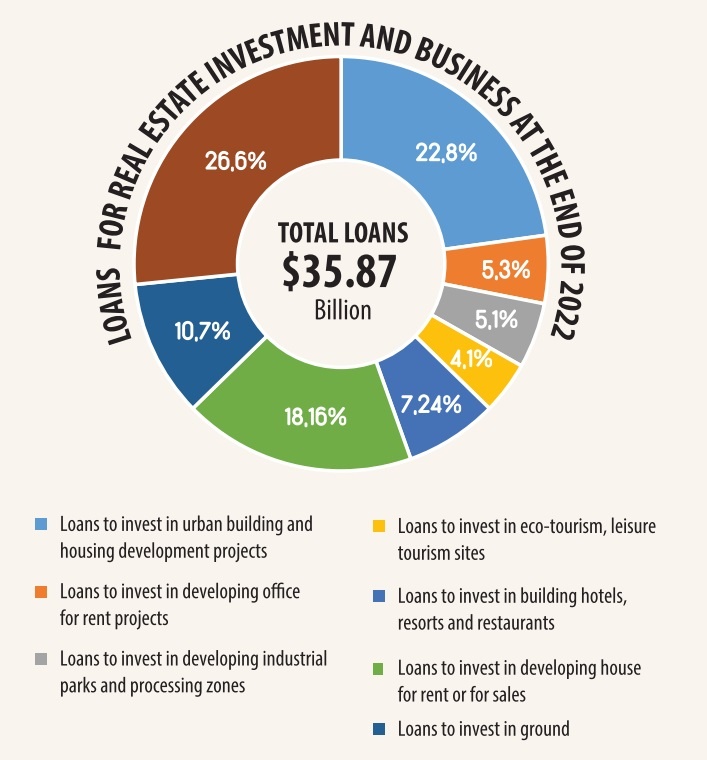

According to the Credit Department for Economic Sectors under the State Bank of Vietnam (SBV), the outstanding credit amount for commercial real estate in 2022 was close to $35 billion, with urban building and housing development projects receiving the most concern. According to the Hanoi Stock Exchange, at the end of 2022, the outstanding individual bonds of real estate companies totalled around $17.7 billion. Consequently, real estate enterprises are borrowing up to $52.5 billion through credit and bonds.

|

Since the second half of last year, insiders noted, cash flow has been trapped in banks and people, no longer flowing to enterprises, and the other two capital mobilisation channels, namely securities and bonds, are onerous, resulting in a widespread capital deficit.

In the context of stalled capital flows, real estate enterprises are expecting banks to bail them out. Nevertheless, during a real estate credit conference organised by the SBV at the beginning of February, a number of suggestions from real estate enterprises on debt restructuring and lowering credit access criteria were vetoed due to system security concerns.

Associate Dinh Trong Thinh, an economist, told VIR that requesting banks to engage in the bailout of real estate enterprises is perilous for the whole system. “A bank is also a firm that must adhere to risk management regulations in order to safeguard its interests, shareholders, and depositors,” Thinh said.

Dr. Le Xuan Nghia, a member of the National Advisory Council for Monetary Policies, added that credit has a significant influence on the real estate market’s revival, but it cannot be simply poured. “Companies with solid, robust initiatives must be classified. Banks will only favour certain projects when allocating cash,” Nghia stated.

Currently, credit is considered the tonic for the real estate market. However, it is all but guaranteed that access to funding for real estate enterprises is to remain very challenging. At BIDV, Vietcombank, and VietinBank, real estate loans account for up to 18-20 per cent of the total; however, 80-90 per cent are focused on people purchasing homes, concentrating on actual housing requirements.

In order to improve risk management, banks that have increased corporate lending in recent years, such as Techcombank, prefer to limit lending to these clients. Because they are being pursued, it will also be challenging for the group of banks recognised for their tight links with other real estate businesses to expand their lending for backyard development.

The SBV said that in the near future, it would intensify inspections and audits of banks that amass loans for enterprises, corporations, and homeowners’ backyard projects. In order for credit to save the real estate market, according to economic analysts, firms must reorganise the sector with an emphasis on low-cost commercial housing developments that meet actual housing demands.

This market sector has a high capacity for consumption, and it is typically simple to get a feasible loan. In order to achieve this, local governments must expedite the elimination of legal processes and licence new projects.

According to Thinh, real estate businesses have only the following options in the near future to avoid default: steeply reducing real estate prices, bringing house prices to an adequate point to induce cash flow from buyers; joint ventures and associations to find additional funding sources; and reducing prices of initiatives that have not yet begun or are struggling.

“Until then, firms must accept reality, be willing to sell assets cheaply to meet debt repayment commitments, have investment cash, preserve their reputation, and sit tight for time to restore it,” Thinh added.

Thinh added that it is vital to consider modifying Decree No.65/2022/ND-CP comprehensively, and not in the direction of a 1-2 year grace period as the Ministry of Finance recently advocated.

“This decree’s requirements are overly stringent, making life tough for both investors and issuers. A grace period of 1-2 years makes little sense, given that the market will remain challenging for longer than a few years and investors’ trust cannot be quickly restored,” Thinh said.

| Management agencies, businesses, and buyers must work together to solve the problems in the real estate market, said Prime Minister Pham Minh Chinh at a national conference in Hanoi last Friday. “It is important to be aware of the problem and have a solution, and it must be based on the principle of harmonising benefits and sharing risks between the state, people, and businesses,” PM Chinh said. Going into detail, the PM asked state management agencies to review their mechanisms, policies, and laws, and strengthen supervision. The banking and finance side must also take measures to unclog credit sources such as bonds and securities. |

| How predictable can 2023 become for real estate? Some experts continue to be sceptical about the possibility of the real estate market entering a calm period and freezing liquidity at this moment. |

| Together for a long-term partnership Despite market swings, foreign investment capital continued to flood heavily into several categories of Vietnamese real estate in 2022. Mergers and acquisitions (M&As) in the real estate industry have been particularly attractive due to the existence of a number of loaded giants. |

| Industrial real estate faces up to pressures Although it was one of the rare segments to see positive growth in 2022, industrial real estate is forecast to suffer this year due to global macroeconomic uncertainties. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version