Ready-built factory market on the up

|

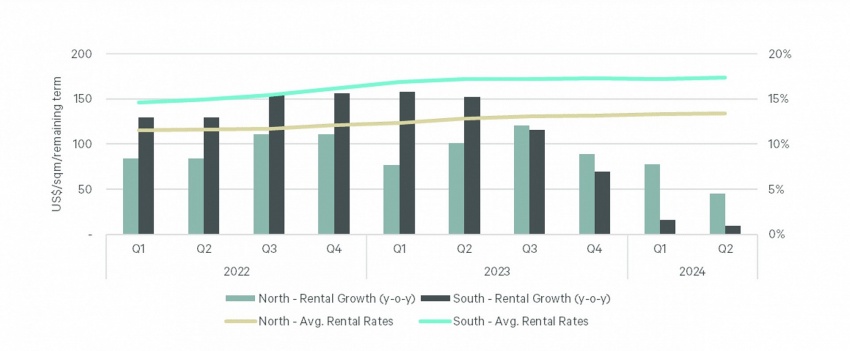

| Rental price of industrial land and its growth over recent years |

According to the last week's report of CBRE, a global commercial real estate services provider, for the industrial land market, industrial land prices in Tier 1 markets in the nNorth in the second quarter increased by 0.3 per cent on quarter and 4.5 per cent on-year, reaching an average of $134 per square metre.

Meanwhile, industrial land prices in Tier 1 markets in the South remained steady at $173 per sq.m per this quarter. This represents no change from the previous quarter and a modest 1 per cent increase on-year.

Dang Trong Duc, CEO of KTG Industrial, said that the industrial real estate market is struggling with some challenges due to increasing input costs

"Industrial park land prices have risen due to supply shortage, construction costs have been escalating due to supply chain disruptions after the pandemic, and interest rates have remained high," Duc said. "KTG Industrial is doing the efforts to remain competitive and attract investors by increasing rent prices reasonably, ensuring attractiveness for international manufacturers, who are looking for opportunities in Vietnam. KTG Industrial is also implementing many solutions to cope with input cost pressure, such as optimising the construction process, applying new technology and finding new cost-effective materials for our ready-built factories."

CBRE reported the absorption area in the first six months of 2024 reached over 220 hectares, helping the occupancy rate in the northern region to remain at 83 per cent, a slight increase compared to the same period last year.

In terms of demand, electronic manufacturers such as Victory Giant and Foxconn in Bac Ninh province continued to lead the northern market with significant transactions.

In the southern market, the occupancy rate is stable at 89 per cent and the absorption area is just over 259ha in the first half of 2024. Domestic and foreign manufacturers tend to expand into secondary markets such as Long An and Ba Ria - Vung Tau provinces, where industrial land banks are relatively abundant and rental prices are more competitive than other Tier 1 markets.

In the first six months of 2024, a series of large factories were commenced construction in both regions, exemplified by the Pandora factory in Binh Duong province, the Suntory Pepsico factory in Long An province, and the SK factory in the northern port city of Haiphong.

|

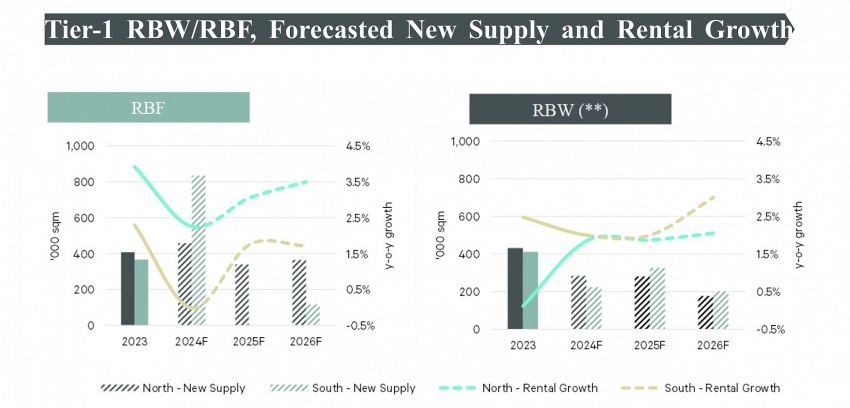

According to CBRE, for the ready-built warehouse (RBW) and factory (RBF) markets, in the first half of 2024, over 225,000sq.m of completed RBW and RBF were recorded in Tier 1 markets in the North, with factory space accounting for 95 per cent of the total area. The absorption area for RBF also exceeded that of RBW by more than four times. By the end of the second quarter of 2024, the occupancy rate for RBF reached 89 per cent, while RBW in the northern region maintained an occupancy rate of 79 per cent.

The rental prices for RBF were recorded at $4.9 per sq.m per month, representing an on-year increase of 1.9 per cent. For the RBW segment, rents decreased by 1 per cent on-year, staying at $4.6 per sq.m per month. The electronics, semiconductor, furniture, and logistics sectors were the leading tenants driving the demand for RBW and RBF in the northern region in the first half of this year.

After a period of strong growth, in the first half of 2024, the RBW market saw no new supply, occupancy surged 9 per cent to 63 per cent due to major deals in Ho Chi Minh City and Long An. Conversely, the RBF market experienced a significant influx of new space (over 371,000sq.m) in Binh Duong and Dong Nai provinces, leading to a slight dip in occupancy (5 per cent) to a healthy 81 per cent.

Duc from KTG Industrial said, "The RBW demand grows slowly due to the weak domestic consumer market and incomplete transportation infrastructure in neighbouring provinces of Hanoi and Ho Chi Minh City."

"RBF maintains its growth momentum thanks to the China+1 supply chain shift effect and the strong recovery of Vietnam's manufacturing industry, which is driven by 10 per cent on year growth of the manufacturing industry, 15 per cent growth of export turnover in Q2, the highest purchasing managers' index in the past two years, and large foreign investment in processing and manufacturing industry," he added.

Regarding average rental prices, rental prices for RBW/RBF in the southern market remained stable compared to the previous quarter, reaching $4.5 and $4.9 per sq.m per month, with a growth rate of 2 per cent on year for RBW and 1 per cent on year for RBF, according to CBRE. High-tech and renewable energy manufacturers, and e-commerce companies, are major tenants driving demand for RBW and RBF space in the south.

In the next three years, industrial land rental prices are expected to increase by 5-8 per cent annually in the north and by 3-7 per cent in the south. Meanwhile, the rental prices for RBW/RBF are forecasted to have a slight increase of 1-4 per cent annually, with the segment of RBF experiencing a higher rate of price growth in the next three years.

An Nguyen, senior director of CBRE Vietnam said, "With the development of transportation infrastructure, the industrial real estate market is expanding into new areas such as Tier 2 markets or bordered economic zones. In addition, the expansion of existing investors and the entry of new investors into the market are making the industrial real estate landscape more vibrant."

| DEEP C Industrial Zones remain a reliable investment location The DEEP C Industrial Zones (IZ) complex – based in Haiphong city and Quang Ninh province – initiated 21 new projects last year with a total capital value of $970 million, including those for vehicle manufacturing and component production for the renewable energy industry. |

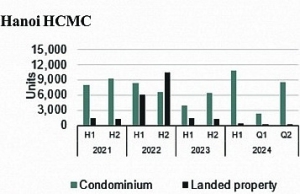

| Hanoi condo supply hits highest peak since 2020 Abundant new supply during the second quarter was matched with a strong buying momentum in Hanoi's condominium market, as total sold units in the first half of 2024 alone already surpassed the full-year sales figures for 2023. |

| Capital flows strongly into industrial real estate As the economy is still facing difficulties, industrial real estate has become one of the most attractive sectors for investors. |

| KTG Industrial breaks ground on Nhon Trach 2 project phase 3 On April 5, Viteccons and KTG Industrial managed by Boustead & KTG Industrial Management Co. Ltd., organised the groundbreaking ceremony for the "proposed ready-built factories (Rbf) development of Phase 3 on the 13-hectare land of NT2 project" located in the Nhon Trach 2 - Nhon Phu Industrial Park, Hiep Phuoc commune, Nhon Trach district, Dong Nai province. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Sembcorp Development secures licence for VSIP in Khanh Hoa (December 31, 2025 | 18:54)

- Prodezi Long An advances towards integrated eco-centric industrial park model (December 26, 2025 | 11:16)

- Amata to develop $185 million Amata City Phu Tho (December 23, 2025 | 17:49)

- Work starts on Nhat Ban – Haiphong Industrial Zone Phase 2 (December 19, 2025 | 16:43)

- Becamex – Binh Phuoc drives sustainable industrial growth (November 28, 2025 | 15:22)

- South Korean investors seek clarity on IP lease extensions (November 24, 2025 | 17:48)

- CEO shares insights on Phu My 3 IP’s journey to green industrial growth (November 17, 2025 | 11:53)

- Business leaders give their views on ESG compliance in industrial parks (November 15, 2025 | 09:00)

- Industrial parks pivot to sustainable models amid rising ESG demands (November 14, 2025 | 11:00)

- Amata plans industrial park in Ho Chi Minh City (November 04, 2025 | 15:49)

Tag:

Tag:

Mobile Version

Mobile Version